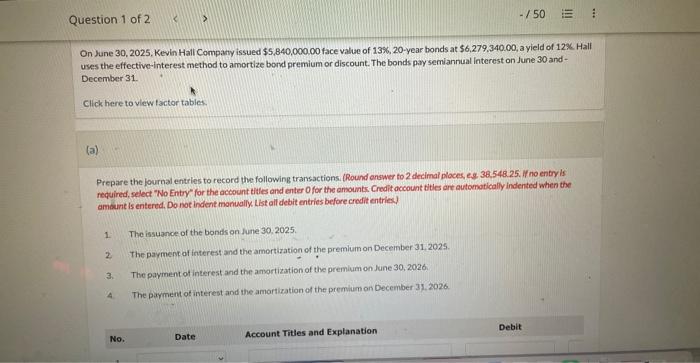

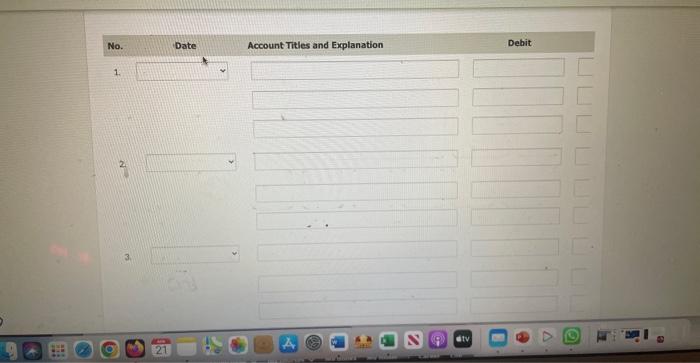

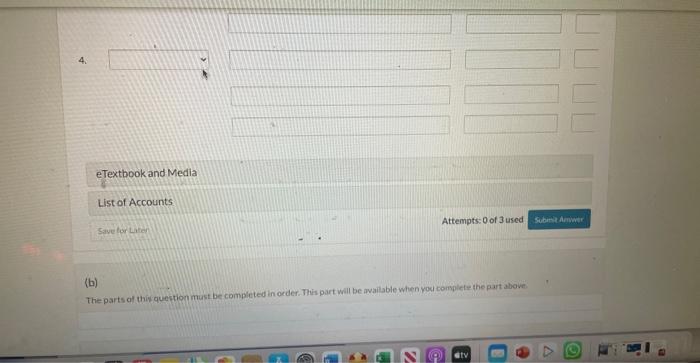

On June 30, 2025. Kevin Hall Company issued $5,840,000.00 face value of 13%,20-year bonds at $6,279,340,00, a yield of 12%. Hall uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31 Cllck here to vlew tactor tables. (a) Prepare the journal entries to record the following transactions. (Round enswer to 2 decimal ploces, e.g. 38.548.25. .f no entry is required, select "No Entry" for the account tites and enter O for the anounts. Credit account tities are automotically indented when the ambunt is entered, Do not indent monually List all debit entries before credit entries) 1. The issuance of the bonds on June 30.2025. 2. The payment of interest and the amortization of the premlum on Decenber 31,2025 . 3. The payment of interest and the amortization of the premlum on June 30,2026 4. The payment of interest and the amartization of the premium on December 31,2026 . (3. (b) The parts of this quection must be completed in ocder. This part will be awailable when you complete the part above On June 30, 2025. Kevin Hall Company issued $5,840,000.00 face value of 13%,20-year bonds at $6,279,340,00, a yield of 12%. Hall uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest on June 30 and December 31 Cllck here to vlew tactor tables. (a) Prepare the journal entries to record the following transactions. (Round enswer to 2 decimal ploces, e.g. 38.548.25. .f no entry is required, select "No Entry" for the account tites and enter O for the anounts. Credit account tities are automotically indented when the ambunt is entered, Do not indent monually List all debit entries before credit entries) 1. The issuance of the bonds on June 30.2025. 2. The payment of interest and the amortization of the premlum on Decenber 31,2025 . 3. The payment of interest and the amortization of the premlum on June 30,2026 4. The payment of interest and the amartization of the premium on December 31,2026 . (3. (b) The parts of this quection must be completed in ocder. This part will be awailable when you complete the part above