Question

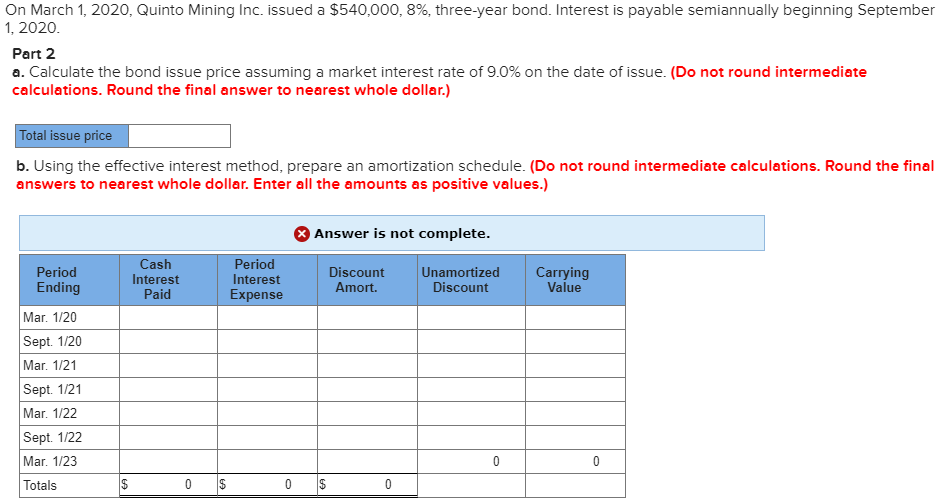

On March 1, 2020, Quinto Mining Inc. issued a $540,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. Part 2 a. Calculate

On March 1, 2020, Quinto Mining Inc. issued a $540,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020.

Part 2 a. Calculate the bond issue price assuming a market interest rate of 9.0% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.) (You'll need this answer when starting part of b., because it's the carrying value on March 1/2020)

b. Using the effective interest method, prepare an amortization schedule. Make sure to fill in all columns and rows below with the calculated amounts $ (Cash Interest Paid, Period Interest Expense, Discount Amortization, Unamortized Discount, and Carrying Value).(Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.)

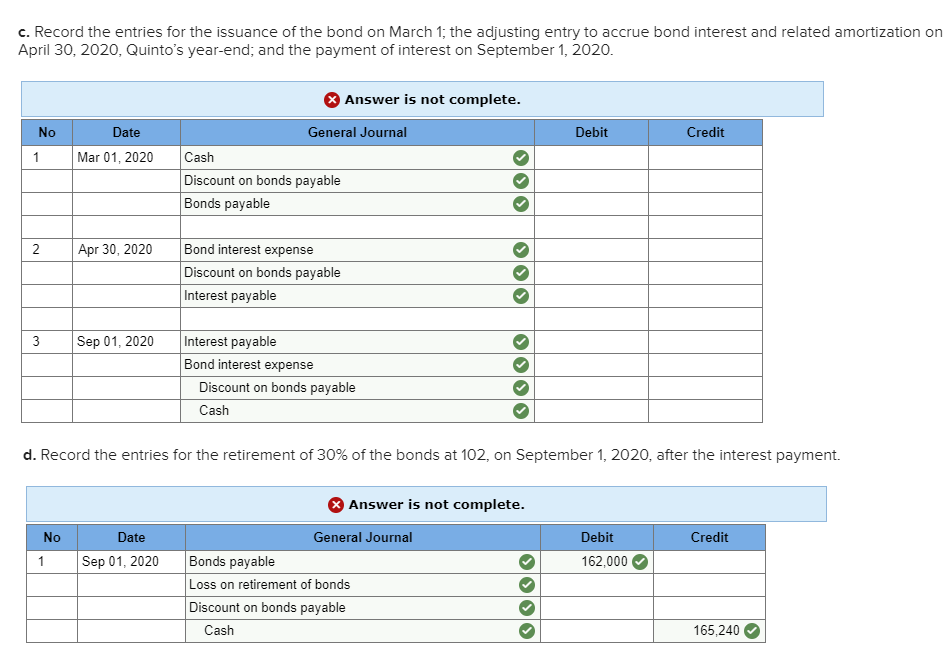

c. Record the entries for the issuance of the bond on March 1; the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quintos year-end; and the payment of interest on September 1, 2020. (The number of accounts here are sufficient and their names are correct so when you reach c., please calculate and identify the amounts $ for each of these accounts)

d. Record the entries for the retirement of 30% of the bonds at 102, on September 1, 2020, after the interest payment. (The number of accounts here are also sufficient and their names are correct so when you reach d., please calculate and identify the remaining amounts $ for these last 2 accounts: Loss on retirement of bonds, and discount on bonds payable)

On March 1, 2020, Quinto Mining Inc. issued a $540,000, 8%, three-year bond. Interest is payable semiannually beginning September 1, 2020. Part 2 a. Calculate the bond issue price assuming a market interest rate of 9.0% on the date of issue. (Do not round intermediate calculations. Round the final answer to nearest whole dollar.) Total issue price b. Using the effective interest method, prepare an amortization schedule. (Do not round intermediate calculations. Round the final answers to nearest whole dollar. Enter all the amounts as positive values.) Answer is not complete. Period Ending Period Cash Interest Paid interest Period Interest Expense Discount Amort. Unamortized Discount Carrying Value Mar. 1/20 Sept. 1/20 Mar. 1/21 Sept. 1/21 Mar. 1/22 Sept. 1/22 Mar. 1/23 Totals $ 0 $ 0 $ 0 c. Record the entries for the issuance of the bond on March 1; the adjusting entry to accrue bond interest and related amortization on April 30, 2020, Quinto's year-end, and the payment of interest on September 1, 2020. Answer is not complete. Debit Credit No 1 Date Mar 01, 2020 General Journal Cash Discount on bonds payable Bonds payable 2 Apr 30, 2020 Bond interest expense Discount on bonds payable Interest payable OOO OOO OOO Sep 01, 2020 Interest payable Bond interest expense Discount on bonds payable Cash d. Record the entries for the retirement of 30% of the bonds at 102, on September 1, 2020, after the interest payment. Answer is not complete. Credit No 1 Date Sep 01, 2020 Debit 162,000 General Journal Bonds payable Loss on retirement of bonds Discount on bonds payable Cash 165,240

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started