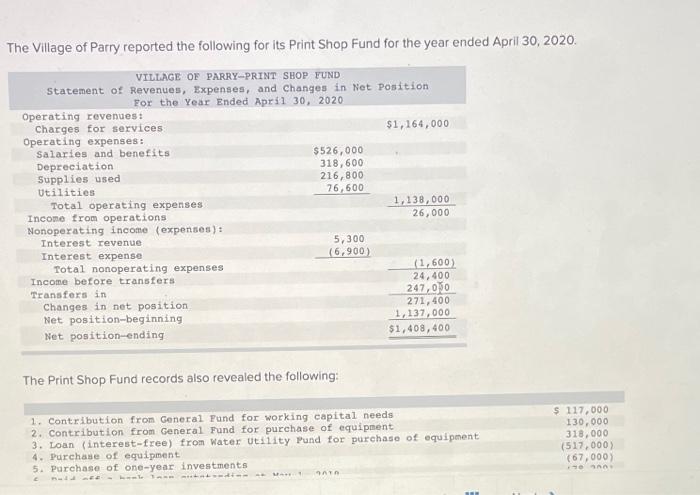

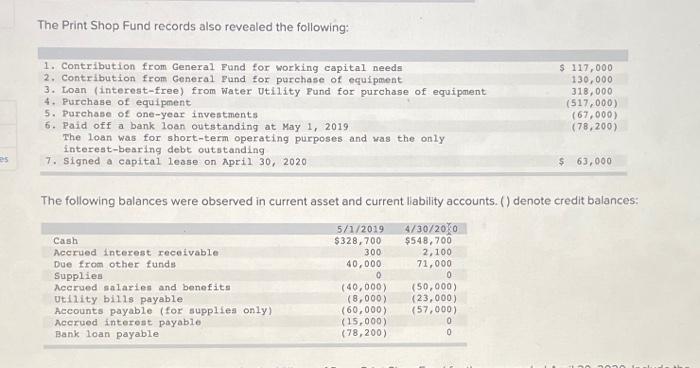

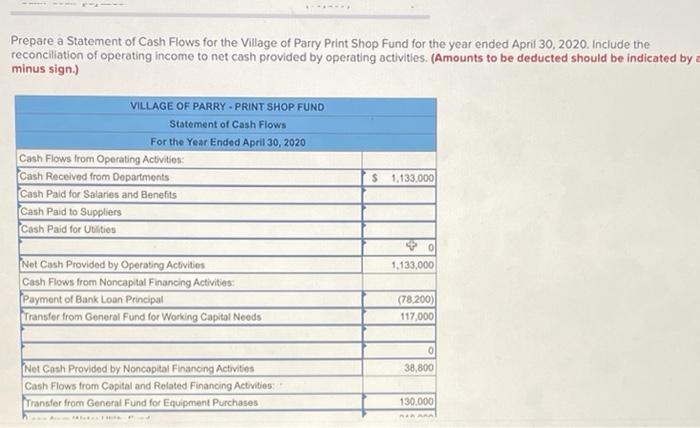

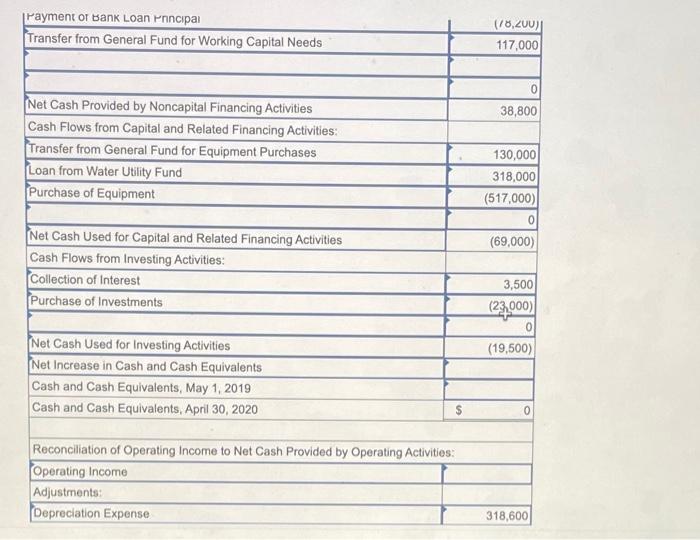

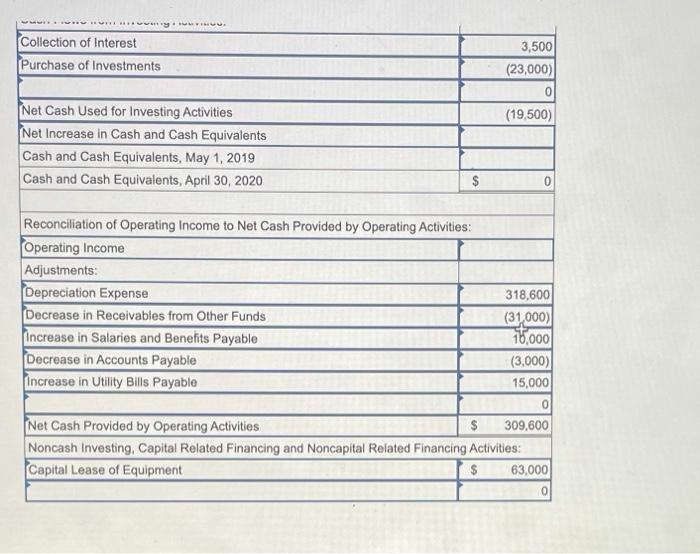

The Village of Parry reported the following for its Print Shop Fund for the year ended April 30, 2020. VILLAGE OF PARRY-PRINT SHOP FUND Statement of Revenues, Expenses, and changes in Net Position For the Year Ended April 30, 2020 Operating revenues : Charges for services $1,164,000 Operating expenses: Salaries and benefits $526,000 Depreciation 318,600 Supplies used 216,800 Utilities 76,600 Total operating expenses 1,138,000 Income from operations 26,000 Nonoperating income expenses) : Interest revenue 5,300 Interest expense (6,900) Total nonoperating expenses (1.600) Income before transfers 24,400 Transfers in 247,00 Changes in pet position 271,400 Net position-beginning 1,137,000 Net position-ending $1,408,400 The Print Shop Fund records also revealed the following: 1. Contribution from General Pund for working capital needs 2. Contribution from General Fund for purchase of equipment 3. Loan (interest-free) from Water Utility Pund for purchase of equipment 4. Purchase of equipment 5. Purchase of one-year investments $ 117,000 130,000 318,000 (517,000) (67, 000) AT The Print Shop Fund records also revealed the following: 1. Contribution from General Pund for working capital needs 2. Contribution from General Pund for purchase of equipment 3. Loan (interest-free) from Water utility Pund for purchase of equipment 4. Purchase of equipment 5. Purchase of one-year investments 6. Paid off a bank loan outstanding at May 1, 2019 The loan was for short-term operating purposes and was the only interest-bearing debt outstanding 7. Signed a capital lease on April 30, 2020 $ 117,000 130,000 318,000 (517,000) (67,000) (78,200) $ 63,000 The following balances were observed in current asset and current liability accounts.() denote credit balances: 5/1/2019 4/30/2020 Cash $328,700 $548, 700 Accrued interest receivable 300 2,100 Due from other funds 40,000 71,000 Supplies 0 0 Accrued salaries and benefits (40,000) (50,000) Utility bills payable (8,000) (23,000) Accounts payable (for supplies only) (60,000) (57,000) Accrued interest payable (15,000) Bank loan payable (78,200) 0 0 Prepare a statement of Cash Flows for the Village of Parry Print Shop Fund for the year ended April 30, 2020. Include the reconciliation of operating income to net cash provided by operating activities. (Amounts to be deducted should be indicated by minus sign.) VILLAGE OF PARRY - PRINT SHOP FUND Statement of Cash Flows For the Year Ended April 30, 2020 Cash Flows from Operating Activities: Cash Received from Departments Cash Paid for Salanes and Benefits Cash Paid to Suppliers Cash Paid for Ulities $ 1.133.000 0 1,133,000 (Net Cash Provided by Operating Activities Cash Flows from Noncapital Financing Activities: Payment of Bank Loan Principal Transfer from General Fund for Working Capital Needs (78,200) 117,000 0 38,800 Net Cash Provided by Noncapital Financing Activities Cash Flows from Capital and Related Financing Activities Transfer from General Fund for Equipment Purchases 130.000 Payment or Bank Loan Poncipal Transfer from General Fund for Working Capital Needs (18,20021 117,000 0 38,800 Net Cash Provided by Noncapital Financing Activities Cash Flows from Capital and Related Financing Activities: Transfer from General Fund for Equipment Purchases Loan from Water Utility Fund Purchase of Equipment 130,000 318,000 (517,000) (69,000) Net Cash Used for Capital and Related Financing Activities Cash Flows from Investing Activities: Collection of Interest Purchase of Investments 3,500 (23.000) 0 (19,500) Net Cash Used for Investing Activities Net Increase in Cash and Cash Equivalents Cash and Cash Equivalents, May 1, 2019 Cash and Cash Equivalents, April 30, 2020 Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating Income Adjustments: Depreciation Expense 318,600 UMUM Collection of Interest Purchase of Investments 3,500 (23,000) 0 (19,500) Net Cash Used for Investing Activities Net Increase in Cash and Cash Equivalents Cash and Cash Equivalents, May 1, 2019 Cash and Cash Equivalents, April 30, 2020 $ 0 Reconciliation of Operating Income to Net Cash Provided by Operating Activities: Operating Income Adjustments: Depreciation Expense Decrease in Receivables from Other Funds Increase in Salaries and Benefits Payable Decrease in Accounts Payable Increase in Utility Bills Payable 318,600 (31,000) 16,000 (3,000) 15,000 0 Net Cash Provided by Operating Activities $ 309,600 Noncash Investing, Capital Related Financing and Noncapital Related Financing Activities: Capital Lease of Equipment $ 63,000 0