Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1 2023, Blossom Winery Ltd. purchased a five-hectare commercial vineyard for $1,049,050. The total purchase price was based on appraised market values

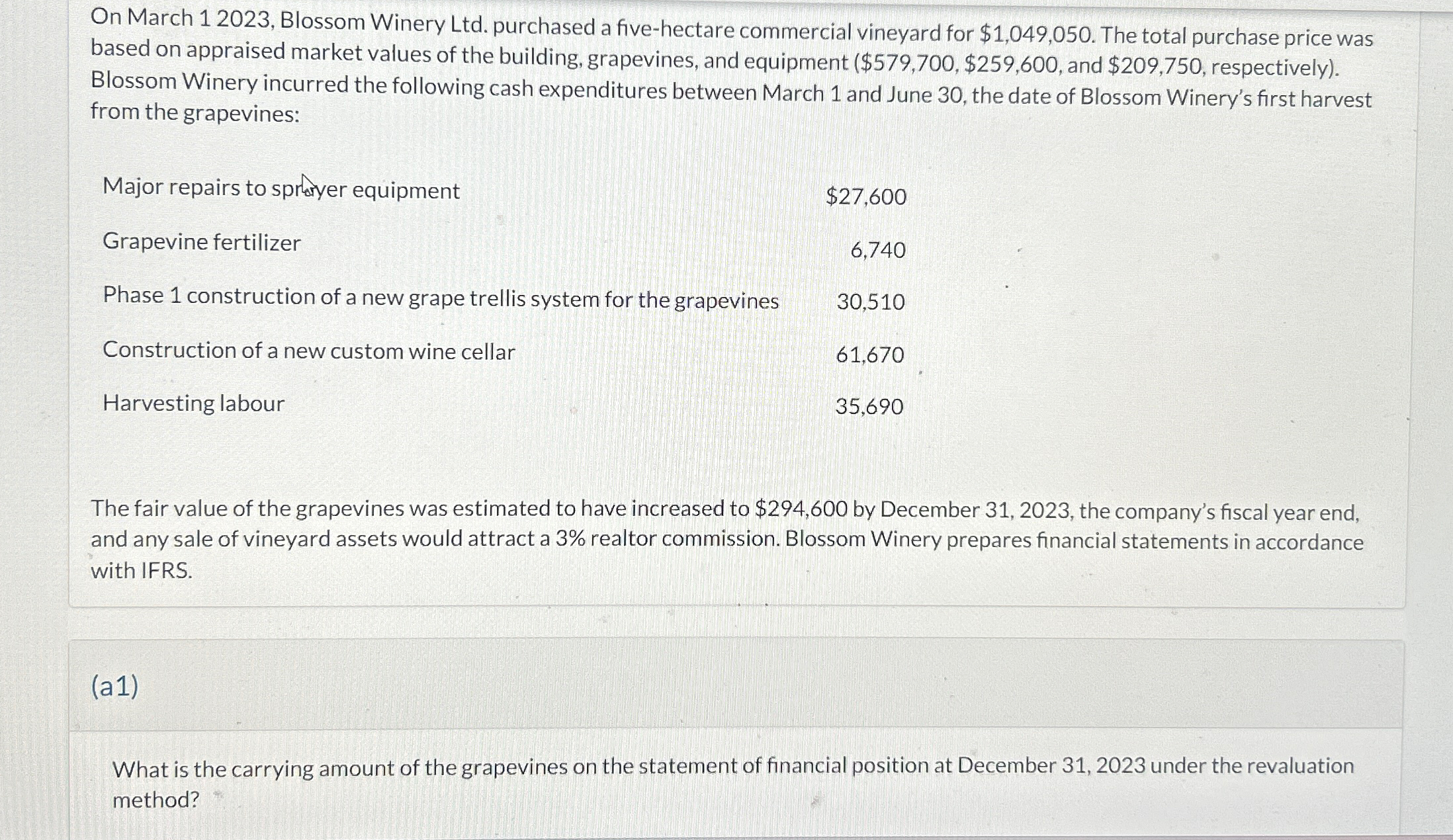

On March 1 2023, Blossom Winery Ltd. purchased a five-hectare commercial vineyard for $1,049,050. The total purchase price was based on appraised market values of the building, grapevines, and equipment ($579,700, $259,600, and $209,750, respectively). Blossom Winery incurred the following cash expenditures between March 1 and June 30, the date of Blossom Winery's first harvest from the grapevines: Major repairs to sprayer equipment $27,600 Grapevine fertilizer 6,740 Phase 1 construction of a new grape trellis system for the grapevines 30,510 Construction of a new custom wine cellar 61,670 Harvesting labour 35,690 The fair value of the grapevines was estimated to have increased to $294,600 by December 31, 2023, the company's fiscal year end, and any sale of vineyard assets would attract a 3% realtor commission. Blossom Winery prepares financial statements in accordance with IFRS. (a1) What is the carrying amount of the grapevines on the statement of financial position at December 31, 2023 under the revaluation method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Under the revaluation method the carrying amount of the grapevines on the statement of financial po...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e914a9e87b_954542.pdf

180 KBs PDF File

663e914a9e87b_954542.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started