Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, 2025, DN, a publicly traded company, issued 10-year $5,000,000 bonds with a coupon rate of 5% and semi-annual interest payments on

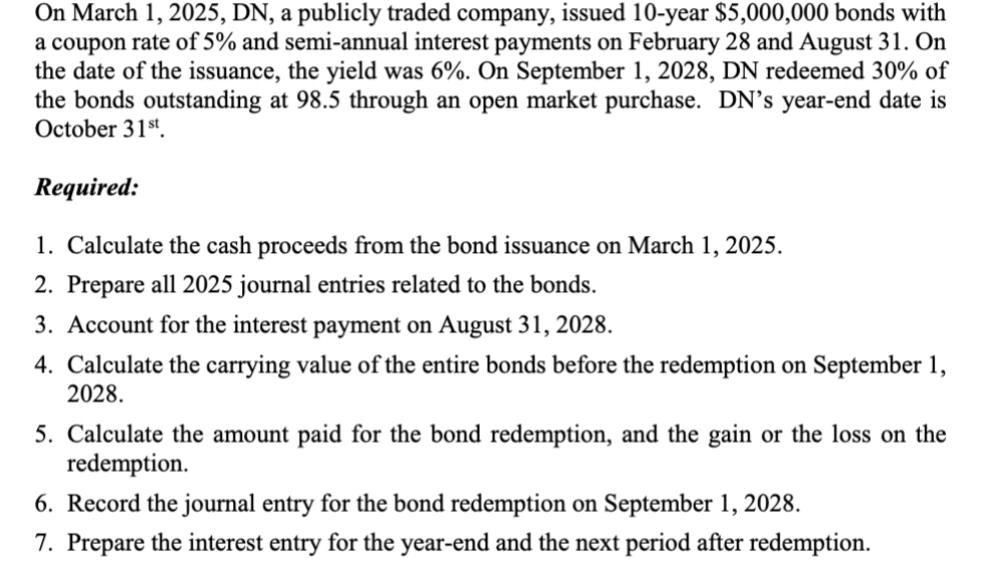

On March 1, 2025, DN, a publicly traded company, issued 10-year $5,000,000 bonds with a coupon rate of 5% and semi-annual interest payments on February 28 and August 31. On the date of the issuance, the yield was 6%. On September 1, 2028, DN redeemed 30% of the bonds outstanding at 98.5 through an open market purchase. DN's year-end date is October 31st. Required: 1. Calculate the cash proceeds from the bond issuance on March 1, 2025. 2. Prepare all 2025 journal entries related to the bonds. 3. Account for the interest payment on August 31, 2028. 4. Calculate the carrying value of the entire bonds before the redemption on September 1, 2028. 5. Calculate the amount paid for the bond redemption, and the gain or the loss on the redemption. 6. Record the journal entry for the bond redemption on September 1, 2028. 7. Prepare the interest entry for the year-end and the next period after redemption.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started