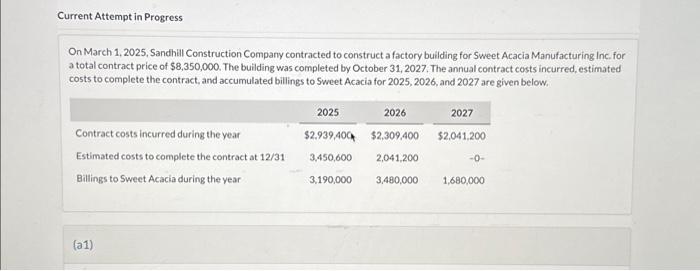

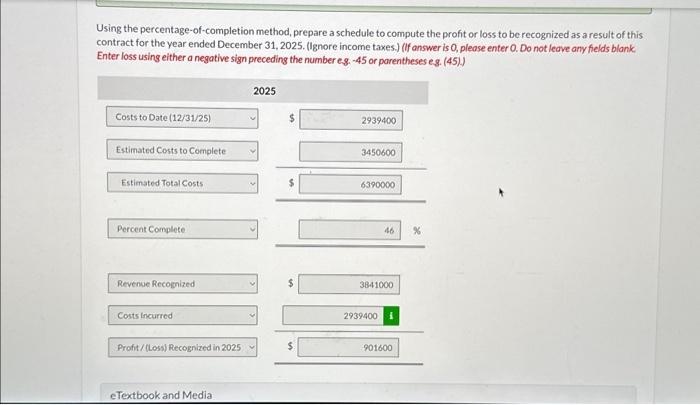

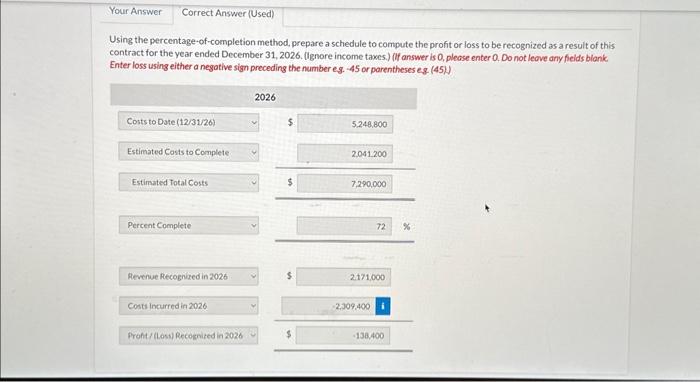

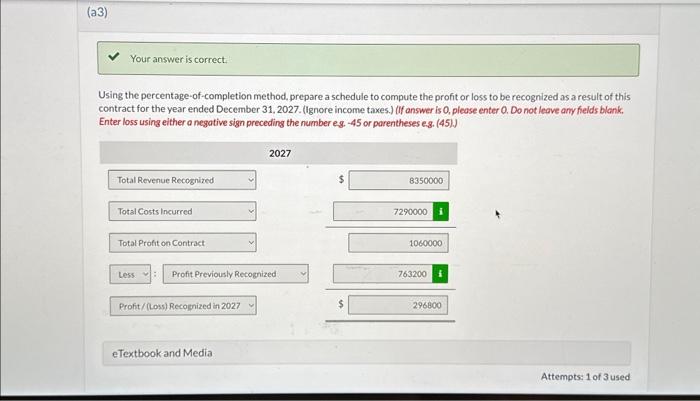

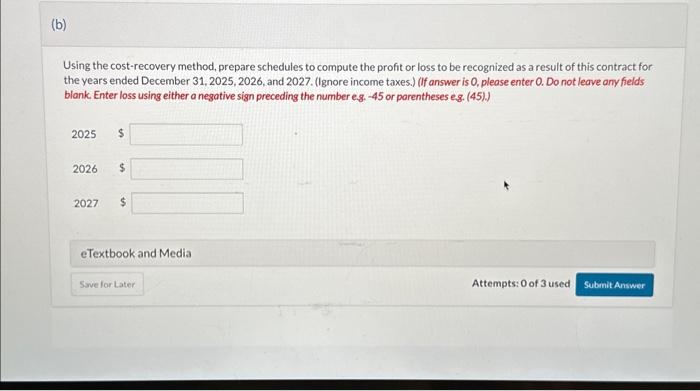

On March 1, 2025, Sandhill Construction Company contracted to construct a factory building for Sweet Acacia Manufacturing Inc. for a total contract price of $8,350,000. The building was completed by October 31,2027 . The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Sweet Acacia for 2025, 2026, and 2027 are given below. Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2025. (Ignore income taxes) (If answer is 0 , pleose enter 0 . Do not leave any fields blank. Enter loss using either a negative sign preceding the number eg. -45 or parentheses eg. (45). Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2026. (lgnore income taxes.) (If answer is 0 , please enter 0 . Do not leove any fields biank Enter loss using either a negotive sign preceding the number eg. 45 or parentheses eg ( 45) ) Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2027. (Ignore income taxes.) (If answer is 0 , pleose enter 0 . Do not leave amy fields biank, Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Using the cost-recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.) (If answer is 0 , please enter 0 . Do not leave any fields blank. Enter loss using either a negative sign preceding the number e.g. -45 or parentheses eg. (45)).) 2025$2026$2027$ On March 1, 2025, Sandhill Construction Company contracted to construct a factory building for Sweet Acacia Manufacturing Inc. for a total contract price of $8,350,000. The building was completed by October 31,2027 . The annual contract costs incurred, estimated costs to complete the contract, and accumulated billings to Sweet Acacia for 2025, 2026, and 2027 are given below. Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2025. (Ignore income taxes) (If answer is 0 , pleose enter 0 . Do not leave any fields blank. Enter loss using either a negative sign preceding the number eg. -45 or parentheses eg. (45). Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2026. (lgnore income taxes.) (If answer is 0 , please enter 0 . Do not leove any fields biank Enter loss using either a negotive sign preceding the number eg. 45 or parentheses eg ( 45) ) Using the percentage-of-completion method, prepare a schedule to compute the profit or loss to be recognized as a result of this contract for the year ended December 31, 2027. (Ignore income taxes.) (If answer is 0 , pleose enter 0 . Do not leave amy fields biank, Enter loss using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Using the cost-recovery method, prepare schedules to compute the profit or loss to be recognized as a result of this contract for the years ended December 31, 2025, 2026, and 2027. (Ignore income taxes.) (If answer is 0 , please enter 0 . Do not leave any fields blank. Enter loss using either a negative sign preceding the number e.g. -45 or parentheses eg. (45)).) 2025$2026$2027$