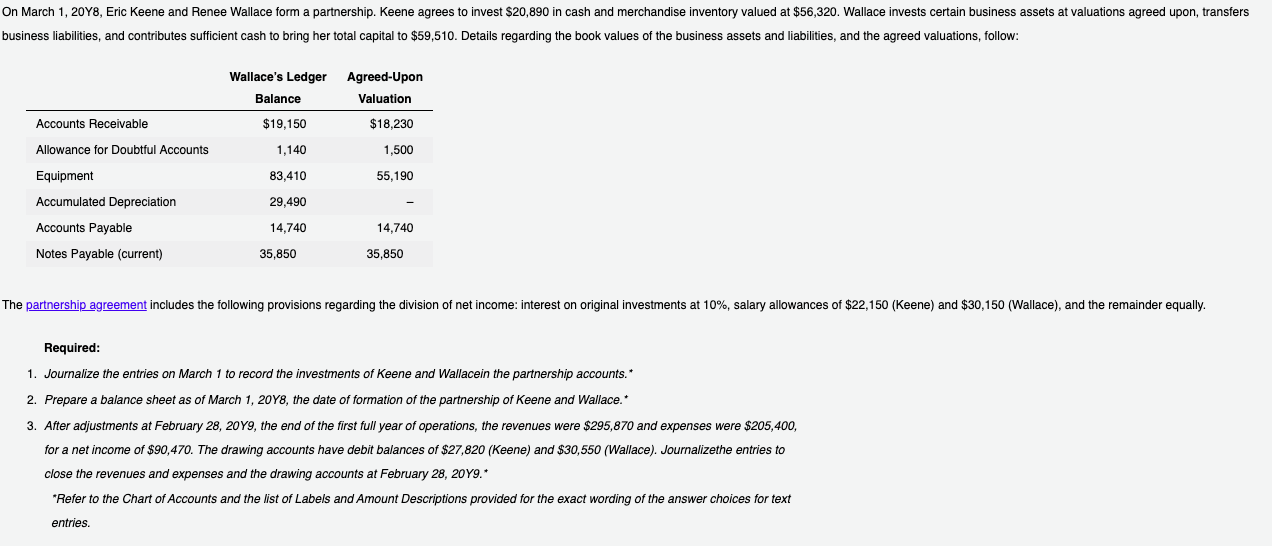

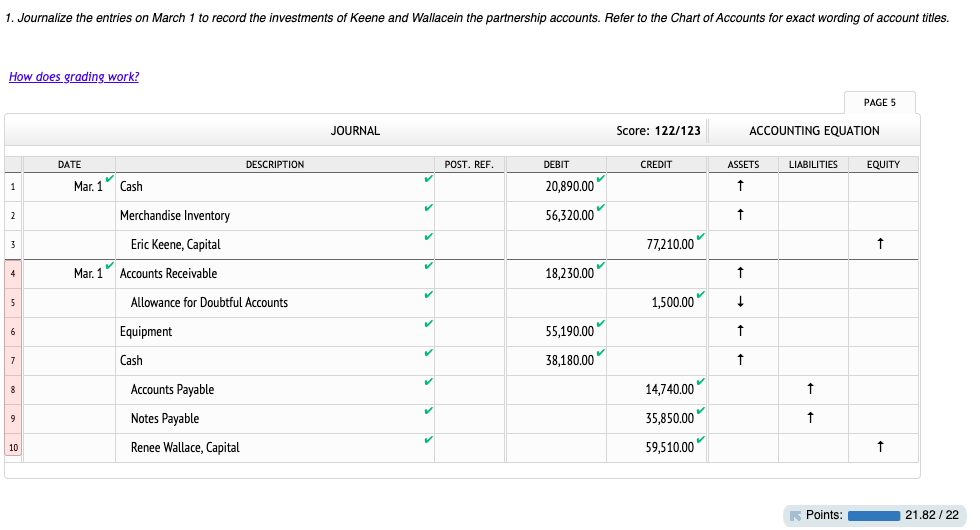

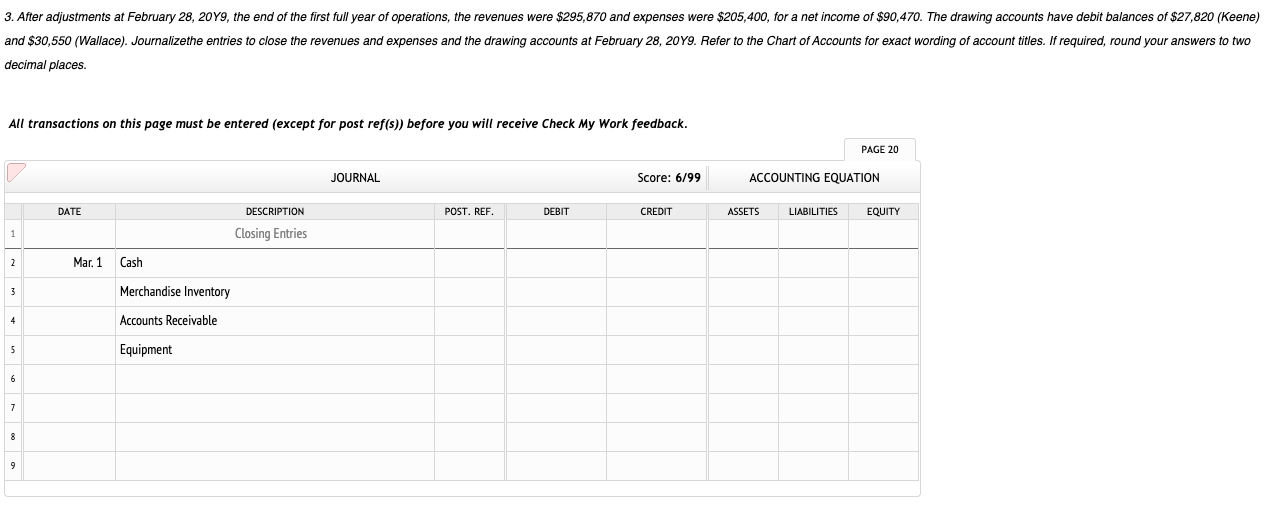

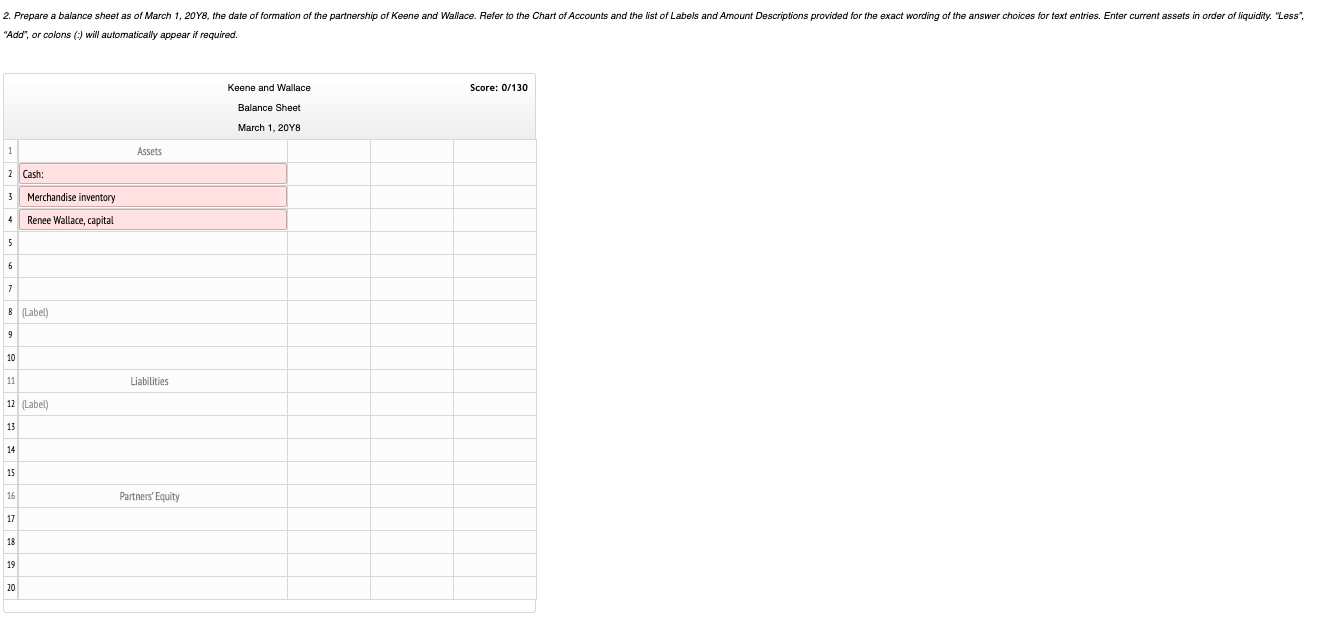

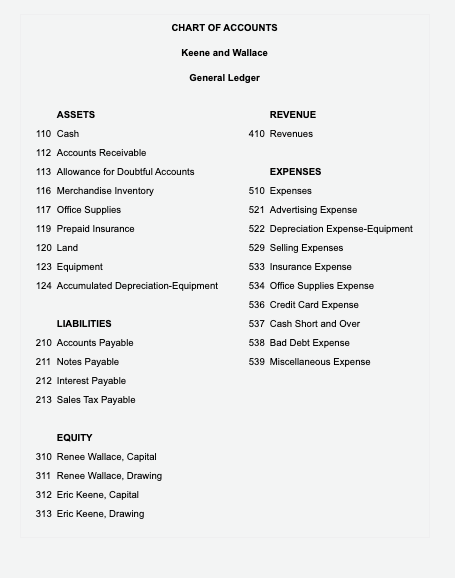

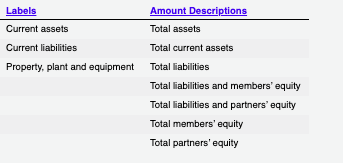

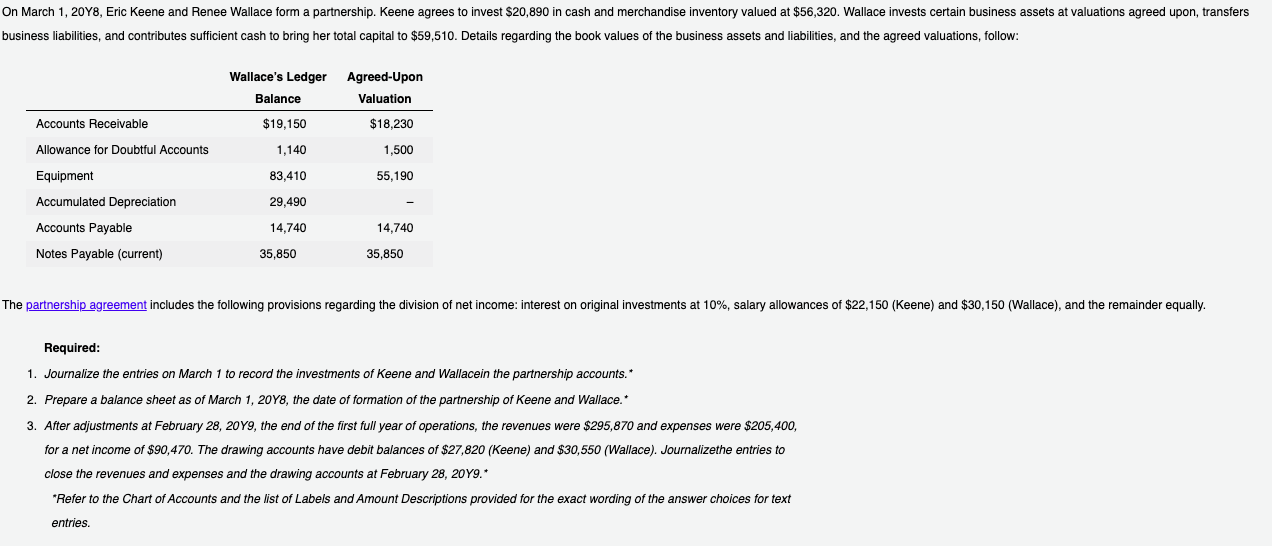

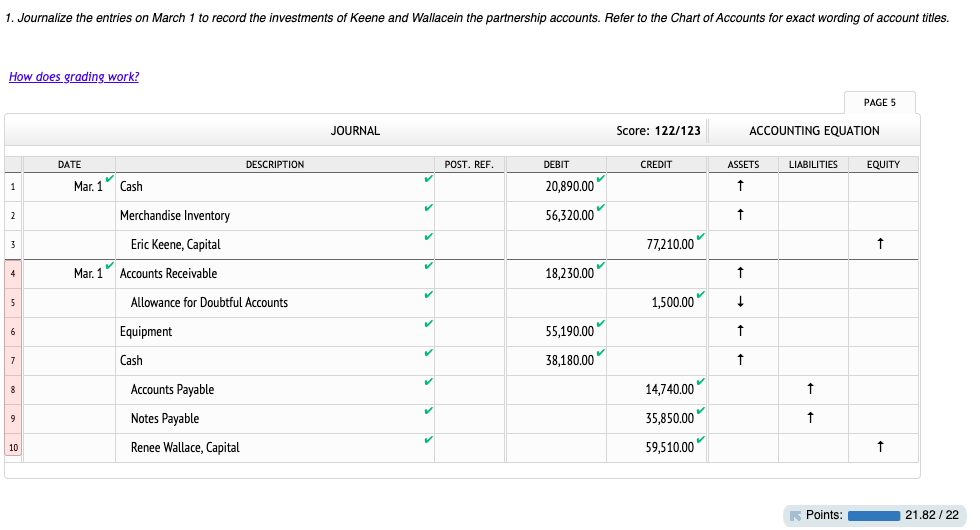

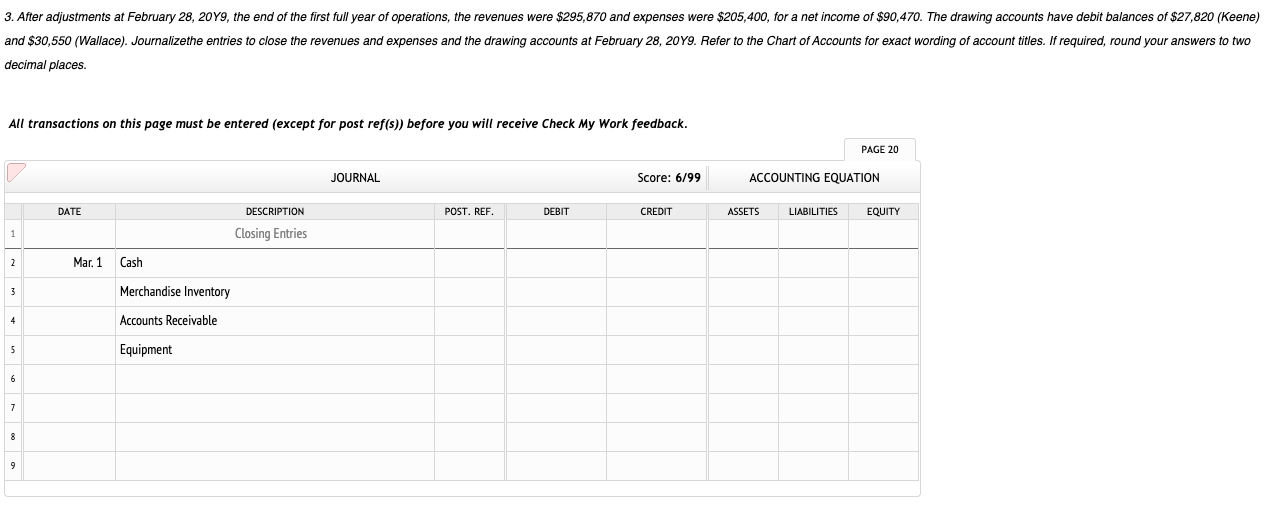

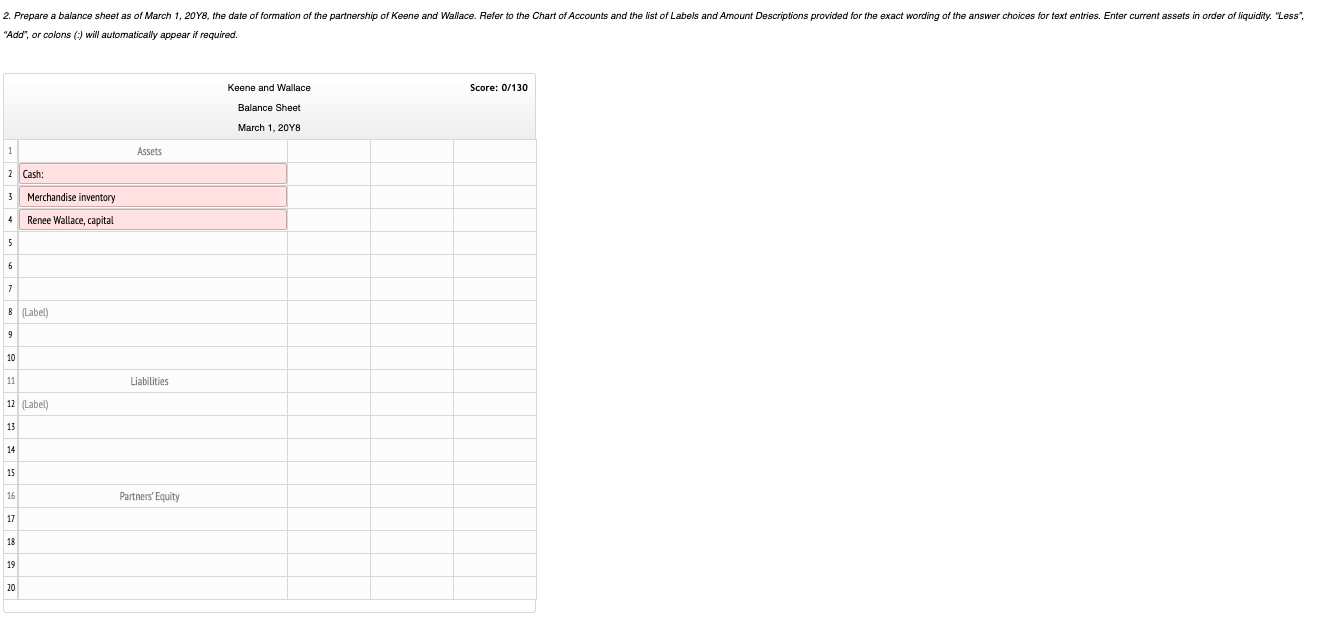

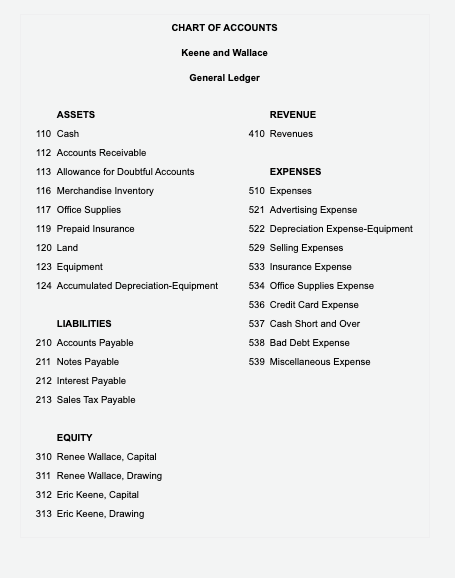

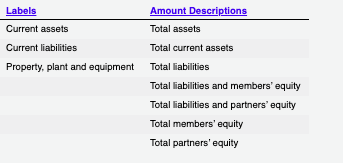

On March 1, 20Y8, Eric Keene and Renee Wallace form a partnership. Keene agrees to invest $20,890 in cash and merchandise inventory valued at $56,320. Wallace invests certain business assets at valuations agreed upon, transfers business liabilities, and contributes sufficient cash to bring her total capital to $59,510. Details regarding the book values of the business assets and liabilities, and the agreed valuations, follow: Wallace's Ledger Balance $19,150 Agreed-Upon Valuation Accounts Receivable $18,230 Allowance for Doubtful Accounts 1,140 1,500 55,190 Equipment 83,410 Accumulated Depreciation 29,490 Accounts Payable 14,740 14,740 35,850 Notes Payable (current) 35,850 The partnership agreement includes the following provisions regarding the division of net income: interest on original investments at 10%, salary allowances of $22,150 (Keene) and $30,150 (Wallace), and the remainder equally. Required: 1. Journalize the entries on March 1 to record the investments of Keene and Wallacein the partnership accounts.* 2. Prepare a balance sheet as of March 1, 20Y8, the date of formation of the partnership of Keene and Wallace.* 3. After adjustments at February 28, 2099, the end of the first full year of operations, the revenues were $295,870 and expenses were $205,400, for a net income of $90,470. The drawing accounts have debit balances of $27,820 (Keene) and $30,550 (Wallace). Journalizethe entries to close the revenues and expenses and the drawing accounts at February 28, 2049.* "Refer to the Chart of Accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. 1. Journalize the entries on March 1 to record the investments of Keene and Wallacein the partnership accounts. Refer to the Chart of Accounts for exact wording of account titles. How does grading work? PAGE 5 JOURNAL Score: 122/123 ACCOUNTING EQUATION POST. REF. CREDIT ASSETS LIABILITIES EQUITY DEBIT 20,890.00 56,320.00 DATE DESCRIPTION Mar. 1 Cash Merchandise Inventory Eric Keene, Capital Mar. 1' Accounts Receivable Allowance for Doubtful Accounts Equipment 77,210.00 18,230.00 1,500.00 55,190.00 Cash 38,180.00 Accounts Payable Notes Payable Renee Wallace, Capital 14,740.00 35,850.00 59,510.00 Points: 21.82 / 22 3. After adjustments at February 28, 2099, the end of the first full year of operations, the revenues were $295,870 and expenses were $205,400, for a net income of $90,470. The drawing accounts have debit balances of $27,820 (Keene) and $30,550 (Wallace). Journalizethe entries to close the revenues and expenses and the drawing accounts at February 28, 2049. Refer to the Chart of Accounts for exact wording of account titles. If required, round your answers to two decimal places. All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback. PAGE 20 JOURNAL Score: 6/99 ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Closing Entries Mar. 1 Cash Merchandise Inventory Accounts Receivable Equipment 2. Prepare a balance sheet as of March 1, 2048, the date of formation of the partnership of Keene and Wallace. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. Enter current assets in order of liquidity. "Less", "Add", or colons (-) will automatically appear if required. Keene and Wallace Score: 0/130 Balance Sheet March 1, 2048 Assets 2 Cash: Merchandise inventory Renee Wallace, capital (Label) Liabilities (Label) Partners' Equity CHART OF ACCOUNTS Keene and Wallace General Ledger ASSETS REVENUE 410 Revenues 110 Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 116 Merchandise Inventory 117 Office Supplies 119 Prepaid Insurance 120 Land 123 Equipment 124 Accumulated Depreciation-Equipment EXPENSES 510 Expenses 521 Advertising Expense 522 Depreciation Expense-Equipment 529 Selling Expenses 533 Insurance Expense 534 Office Supplies Expense 536 Credit Card Expense 537 Cash Short and Over 538 Bad Debt Expense 539 Miscellaneous Expense LIABILITIES 210 Accounts Payable 211 Notes Payable 212 Interest Payable 213 Sales Tax Payable EQUITY 310 Renee Wallace, Capital 311 Renee Wallace, Drawing 312 Eric Keene, Capital 313 Eric Keene, Drawing Amount Descriptions Total assets Labels Current assets Current liabilities Property, plant and equipment Total current assets Total liabilities Total liabilities and members' equity Total liabilities and partners' equity Total members' equity Total partners' equity