Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 1, ABC Holdings purchased land and three buildings for $1,200,000. The plan was to use Building 1 as an office and to

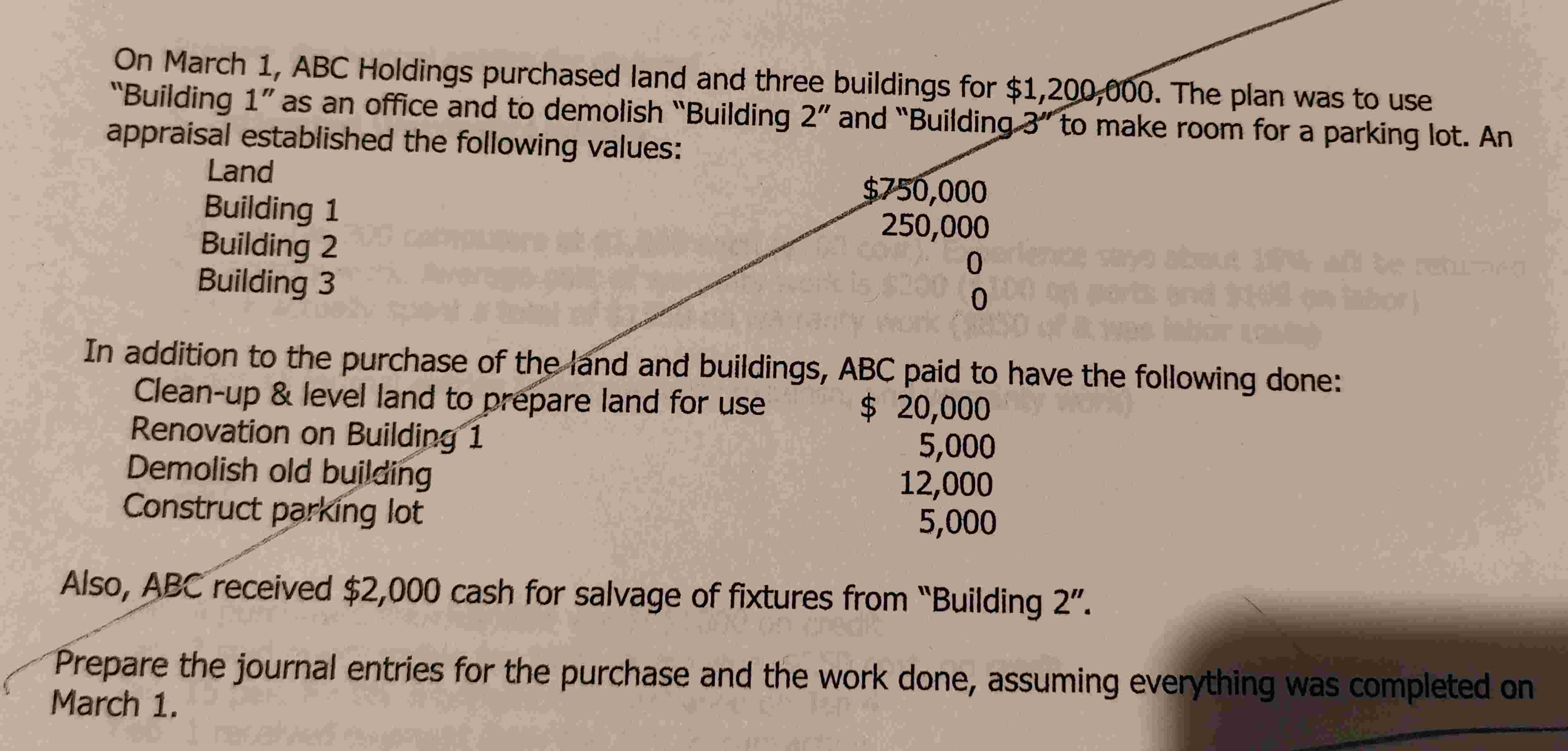

On March 1, ABC Holdings purchased land and three buildings for $1,200,000. The plan was to use "Building 1" as an office and to demolish "Building 2" and "Building 3" to make room for a parking lot. An appraisal established the following values: Land Building 1 Building 2300 can Building 3 $750,000 250,000 0 ut 10% ai be returned 15,$200 ity work (2 0 100 on morts and $1 on tabor So 50 of 8 was labor In addition to the purchase of the land and buildings, ABC paid to have the following done: Clean-up & level land to prepare land for use Renovation on Building 1 Demolish old building Construct parking lot $ 20,000 5,000 12,000 5,000 Also, ABC received $2,000 cash for salvage of fixtures from "Building 2". Prepare the journal entries for the purchase and the work done, assuming everything was completed on March 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the journal entries for the purchase and the work done by ABC Holdings lets break it down ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started