Answered step by step

Verified Expert Solution

Question

1 Approved Answer

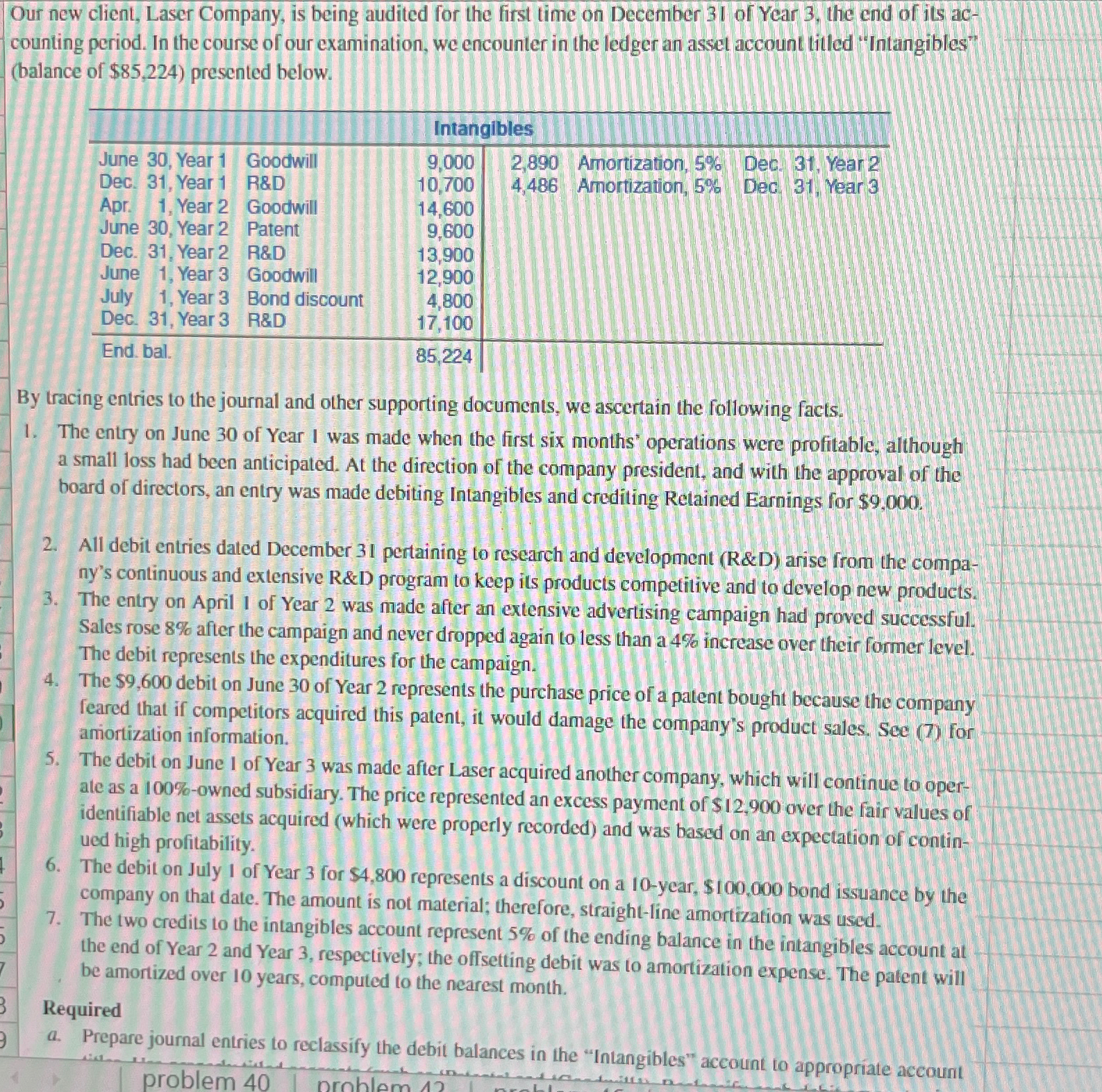

Our new client, Laser Company, is being audited for the first time on December 31 of Year 3, the end of its ac- counting

Our new client, Laser Company, is being audited for the first time on December 31 of Year 3, the end of its ac- counting period. In the course of our examination, we encounter in the ledger an asset account titled "Intangibles" (balance of $85,224) presented below. Intangibles June 30, Year 1 Goodwill 9,000 Dec. 31, Year 1 R&D 10,700 2,890 Amortization, 5% Dec. 31, Year 2 4,486 Amortization, 5% Dec 31, Year 3 Apr. 1, Year 2 Goodwill 14,600 June 30, Year 2 Patent 9,600 Dec. 31, Year 2 R&D 13,900 June 1, Year 3 Goodwill 12,900 July 1, Year 3 Dec. 31, Year 3 Bond discount R&D 4,800 17,100 End. bal. 85,224 5 5 7 B 9 By tracing entries to the journal and other supporting documents, we ascertain the following facts. 1. The entry on June 30 of Year I was made when the first six months' operations were profitable, although a small loss had been anticipated. At the direction of the company president, and with the approval of the board of directors, an entry was made debiting Intangibles and crediting Retained Earnings for $9,000. 2. All debit entries dated December 31 pertaining to research and development (R&D) arise from the compa- ny's continuous and extensive R&D program to keep its products competitive and to develop new products. 3. The entry on April 1 of Year 2 was made after an extensive advertising campaign had proved successful. Sales rose 8% after the campaign and never dropped again to less than a 4% increase over their former level. The debit represents the expenditures for the campaign. 4. The $9,600 debit on June 30 of Year 2 represents the purchase price of a patent bought because the company feared that if competitors acquired this patent, it would damage the company's product sales. See (7) for amortization information. 5. The debit on June 1 of Year 3 was made after Laser acquired another company, which will continue to oper- ale as a 100%-owned subsidiary. The price represented an excess payment of $12,900 over the fair values of identifiable net assets acquired (which were properly recorded) and was based on an expectation of contin- ued high profitability. 6. The debit on July 1 of Year 3 for $4,800 represents a discount on a 10-year, $100,000 bond issuance by the company on that date. The amount is not material; therefore, straight-line amortization was used. 7. The two credits to the intangibles account represent 5% of the ending balance in the intangibles account at the end of Year 2 and Year 3, respectively; the offsetting debit was to amortization expense. The patent will be amortized over 10 years, computed to the nearest month. Required 1 a. Prepare journal entries to reclassify the debit balances in the "Intangibles" account to appropriate account problem 42 problem 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started