Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On March 31, 2021, Lafarge Manufacturing had $330,000 Dr in Accounts Receivable, and $8,770 Cr. in Allowance for Doubtful Accounts. During April, the following

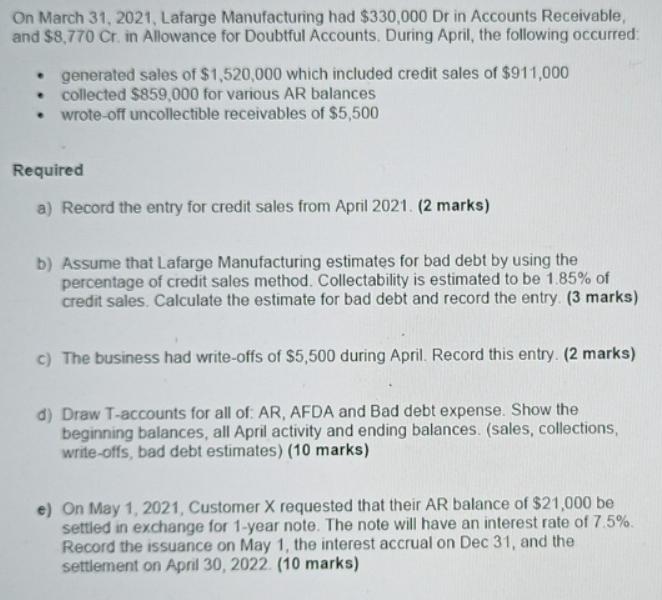

On March 31, 2021, Lafarge Manufacturing had $330,000 Dr in Accounts Receivable, and $8,770 Cr. in Allowance for Doubtful Accounts. During April, the following occurred: generated sales of $1,520,000 which included credit sales of $911,000 . collected $859,000 for various AR balances wrote-off uncollectible receivables of $5,500 . Required a) Record the entry for credit sales from April 2021. (2 marks) b) Assume that Lafarge Manufacturing estimates for bad debt by using the percentage of credit sales method. Collectability is estimated to be 1.85% of credit sales. Calculate the estimate for bad debt and record the entry. (3 marks) c) The business had write-offs of $5,500 during April. Record this entry. (2 marks) d) Draw T-accounts for all of: AR, AFDA and Bad debt expense. Show the beginning balances, all April activity and ending balances. (sales, collections, write-offs, bad debt estimates) (10 marks) e) On May 1, 2021, Customer X requested that their AR balance of $21,000 be settled in exchange for 1-year note. The note will have an interest rate of 7.5%. Record the issuance on May 1, the interest accrual on Dec 31, and the settlement on April 30, 2022. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To record the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started