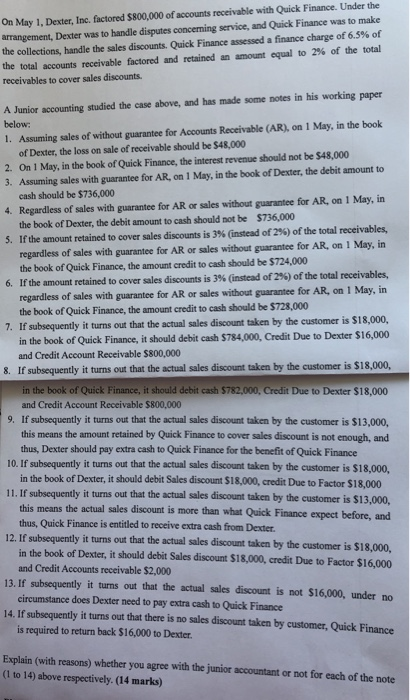

On May 1, Dexter, Inc. factored S800,000 of accounts receivable with Quick Finance. Under the arrangement, Dexter was to handle disputes concerming service, and Quick Finance was to make the collections, handle the sales discounts. Quick Finance assessed a finance charge of 6.5% of the total accounts receivable factored and retained an amount equal to 2% of the total receivables to cover sales discounts. A Junior accounting studied the case above, and has made some notes in his working paper 1. Assuming sales of without guarantee for Accounts Receivable (AR), on 1 May, in the book of Dexter, the loss on sale of receivable should be $48,000 2. On 1 May, in the book of Quick Finance, the interest revenue should not be $48,000 3. Assuming sales with guarantee for AR, on 1 May, in the book of Dexter, the debit amount to cash should be $736,000 below: 4. Regardless of sales with guarantee for AR or sales without guarantee for AR, on 1 May, in the book of Dexter, the debit amount to cash should not be $736,000 5. If the amount retained to cover sales discounts is 3% (instead of 2%) of the total receivables, regardless of sales with guarantee for AR or sales without guarantee for AR, on 1 May, in the book of Quick Finance, the amount credit to cash should be $724,000 6. If the amount retained to cover sales discounts is 3% (instead of 2%) of the total receivables, regardless of sales with guarantee for AR or sales without guarantee for AR, on 1 May, in the book of Quick Finance, the amount credit to cash should be $728,000 7. If subsequently it turns out that the actual sales discount taken by the customer is $18,000, in the book of Quick Finance, it should debit cash $784,000, Credit Due to Dexter $16,000 and Credit Account Receivable $800,000 8. If subsequently it turns out that the actual sales discount taken by the customer is $18,000, in the book of Quick Finance, it should debit cash $782,000, Credit Due to Dexter $18,000 and Credit Account Receivable $800,000 9. If subsequently it turns out that the actual sales discount taken by the customer is $13,000, this means the amount retained by Quick Finance to cover sales discount is not enough, thus, Dexter should pay extra cash to Quick Finance for the benefit of Quick Finance 10. If subsequently it turns out that the actual sales discount taken by the customer is $18,000, in the book of Dexter, it should debit Sales discount $18,000, credit Due to Factor $18,000 11. If subsequently it turns out that the actual sales discount taken by the customer is $13,000, this means the actual sales discount is more than what Quick Finance expect before, and thus, Quick Finance is entitled to receive extra cash from Dexter. 12. If subsequently it turns out that the actual sales discount taken by the customer is $18,000. in the book of Dexter, it should debit Sales discount $18,000, credit Due to Factor $16.000 and Credit Accounts receivable $2,000 13. If subsequently it turns out that the actual sales discount is not $16,000, under no circumstance does Dexter need to pay extra cash to Quick Finance 14. If subsequently it turns out that there is no sales discount taken by customer, Quick Finance is required to return back $16,000 to Dexter. Explain (with reasons) whether you agree with the junior accountant or not for each of the note (1 to 14) above respectively. (14 marks)