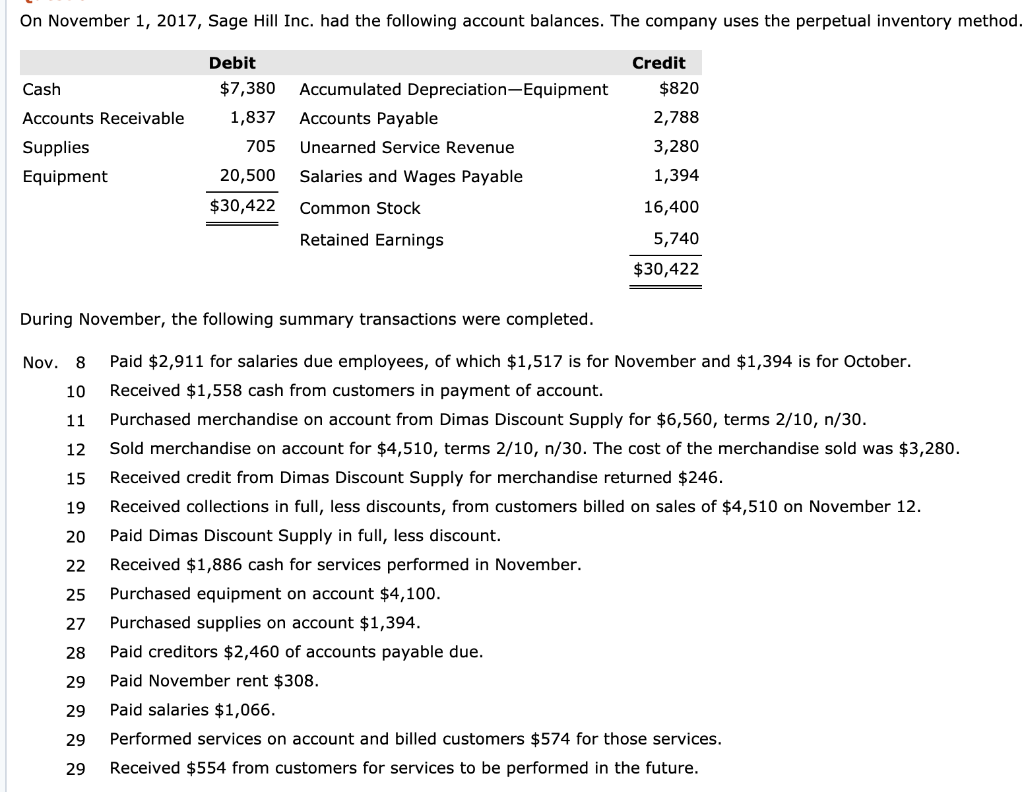

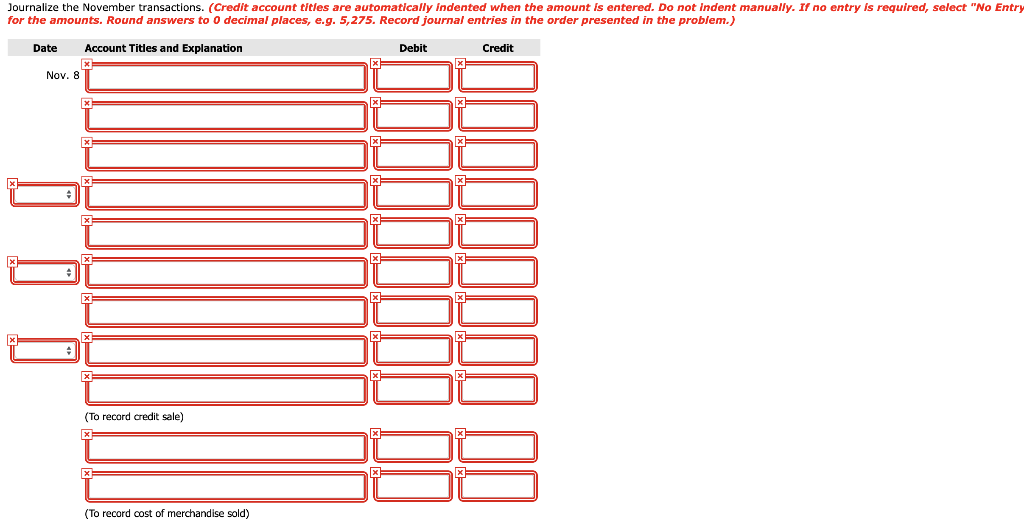

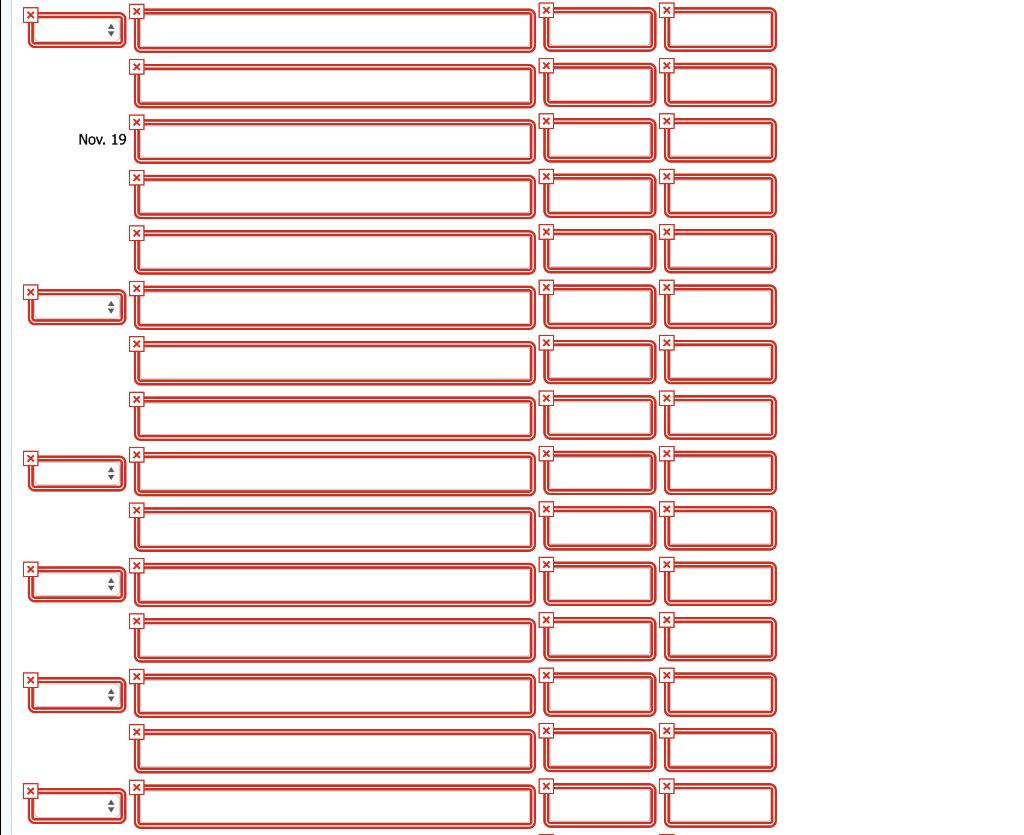

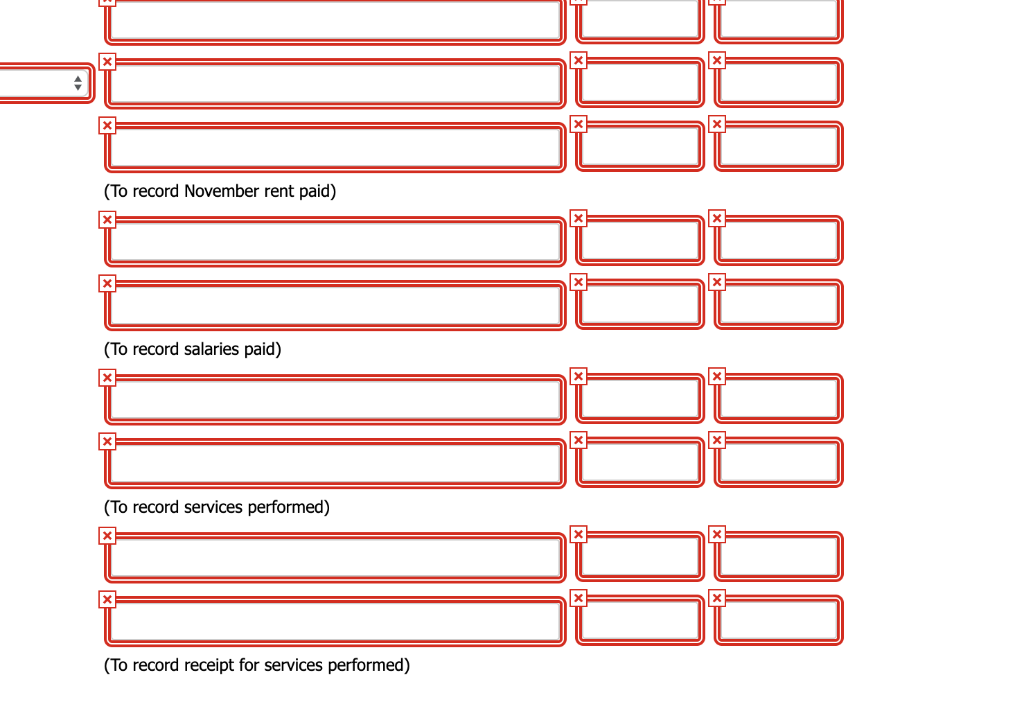

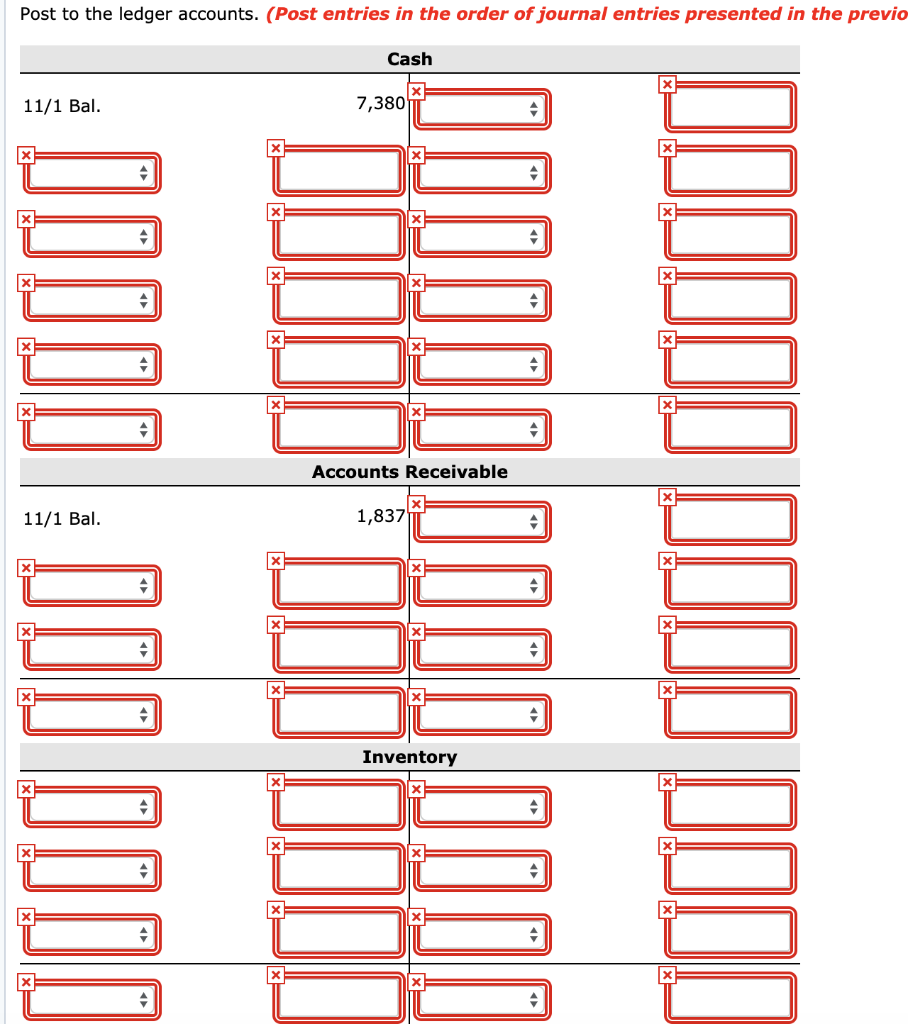

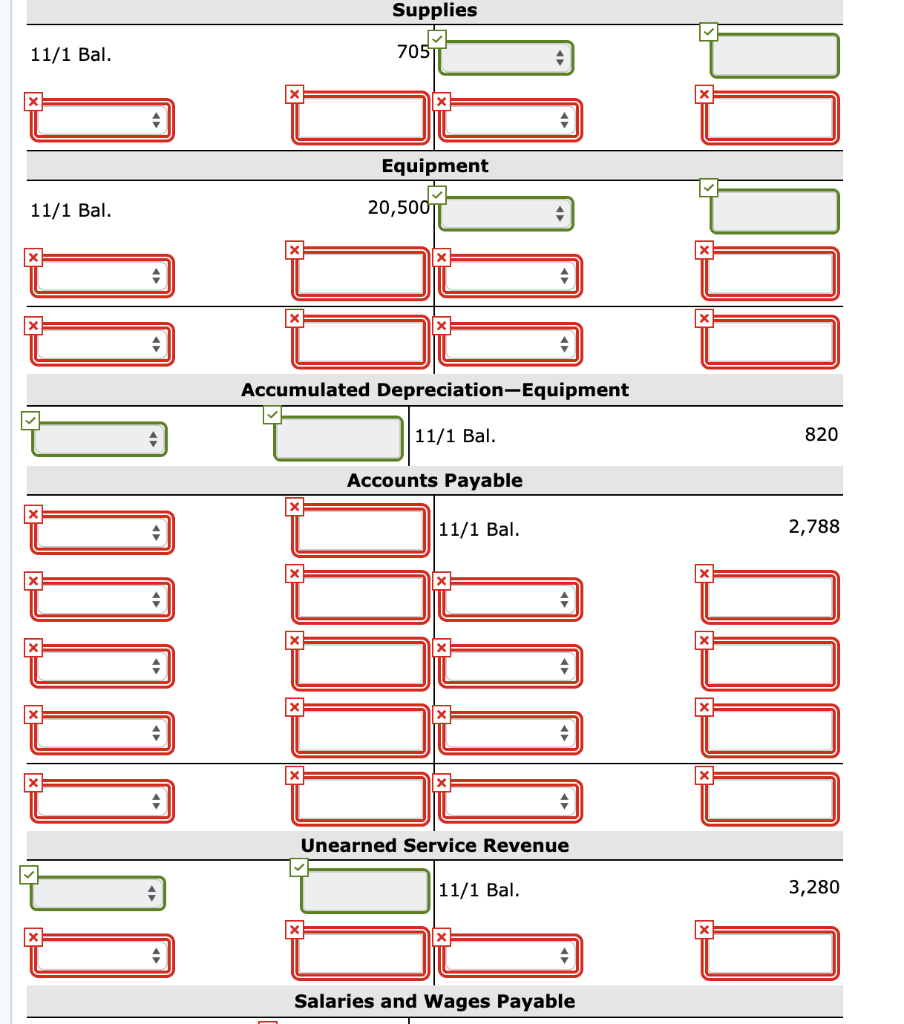

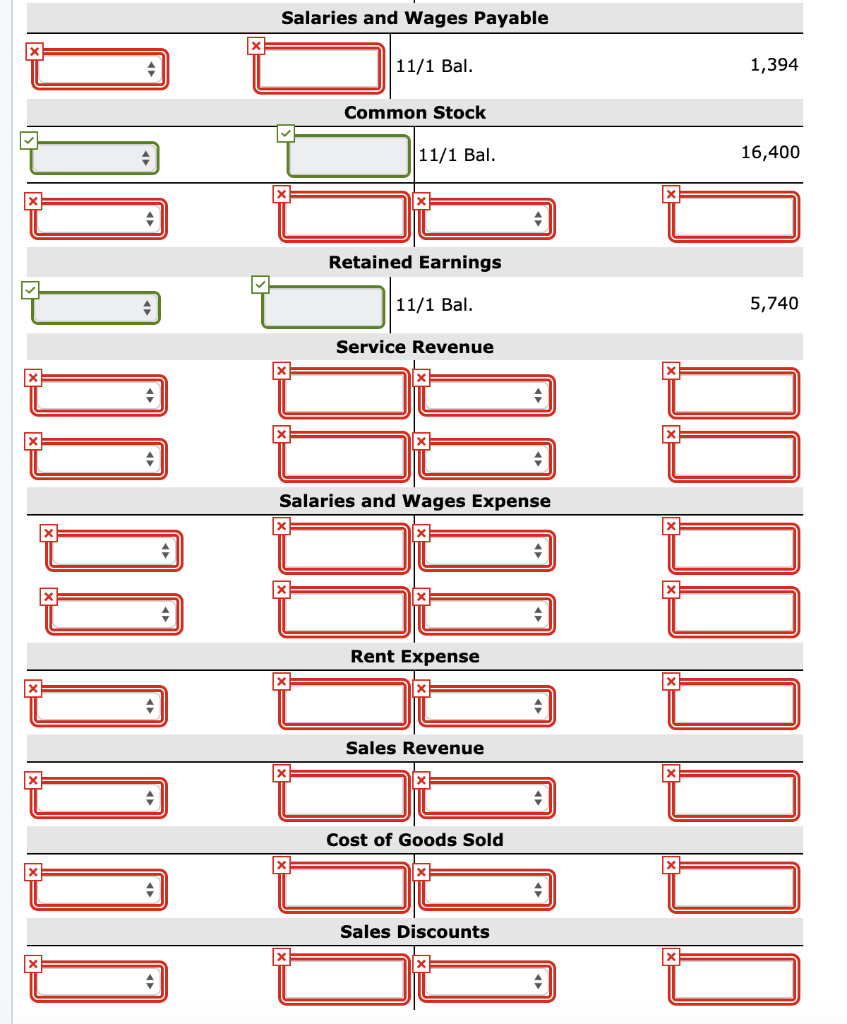

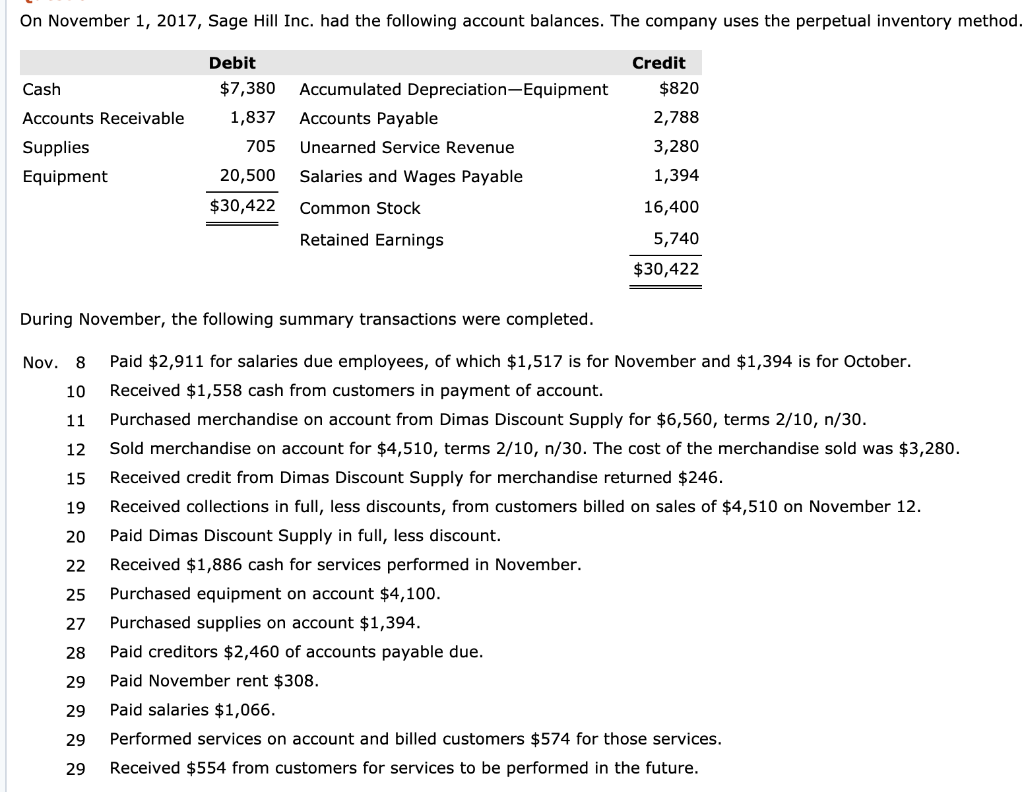

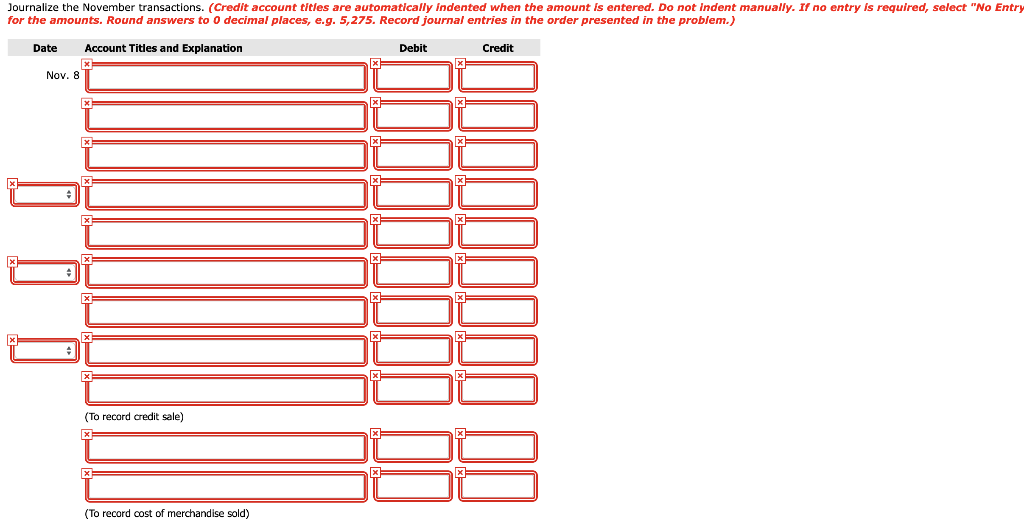

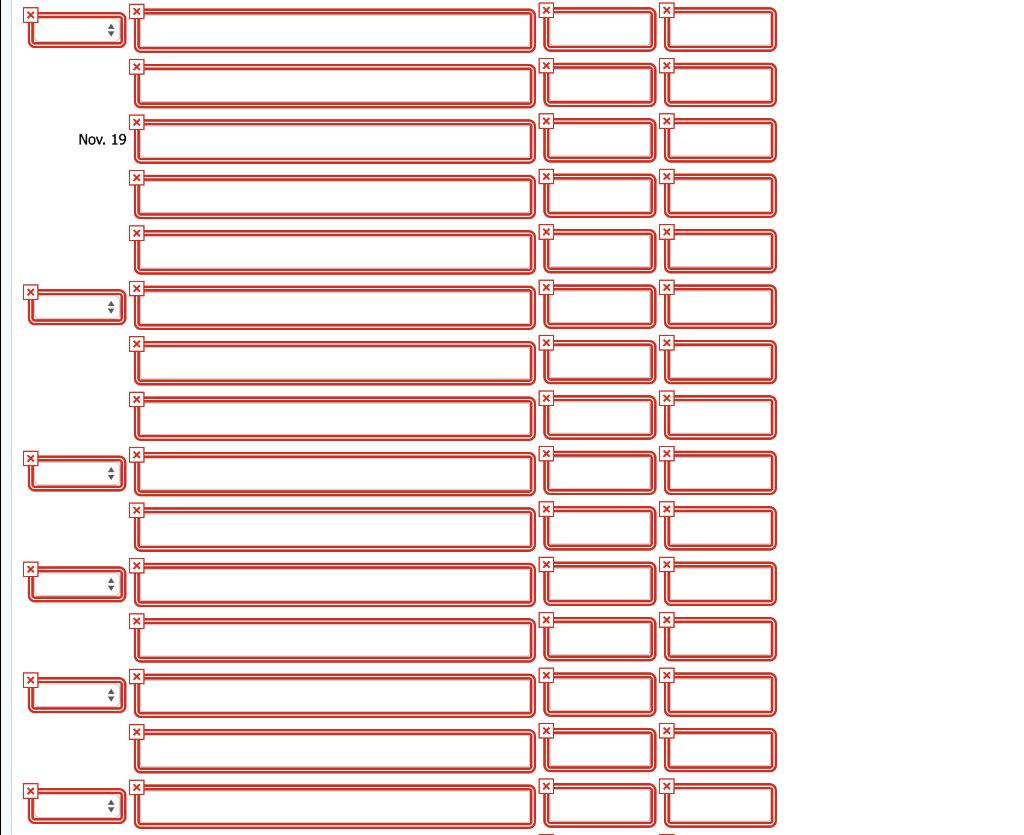

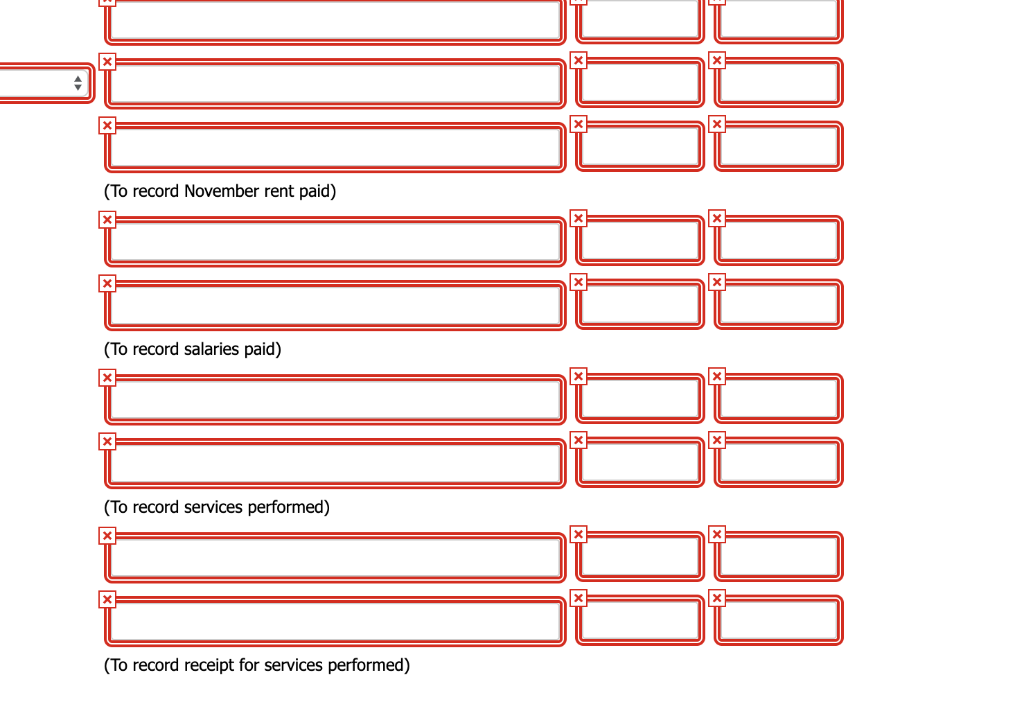

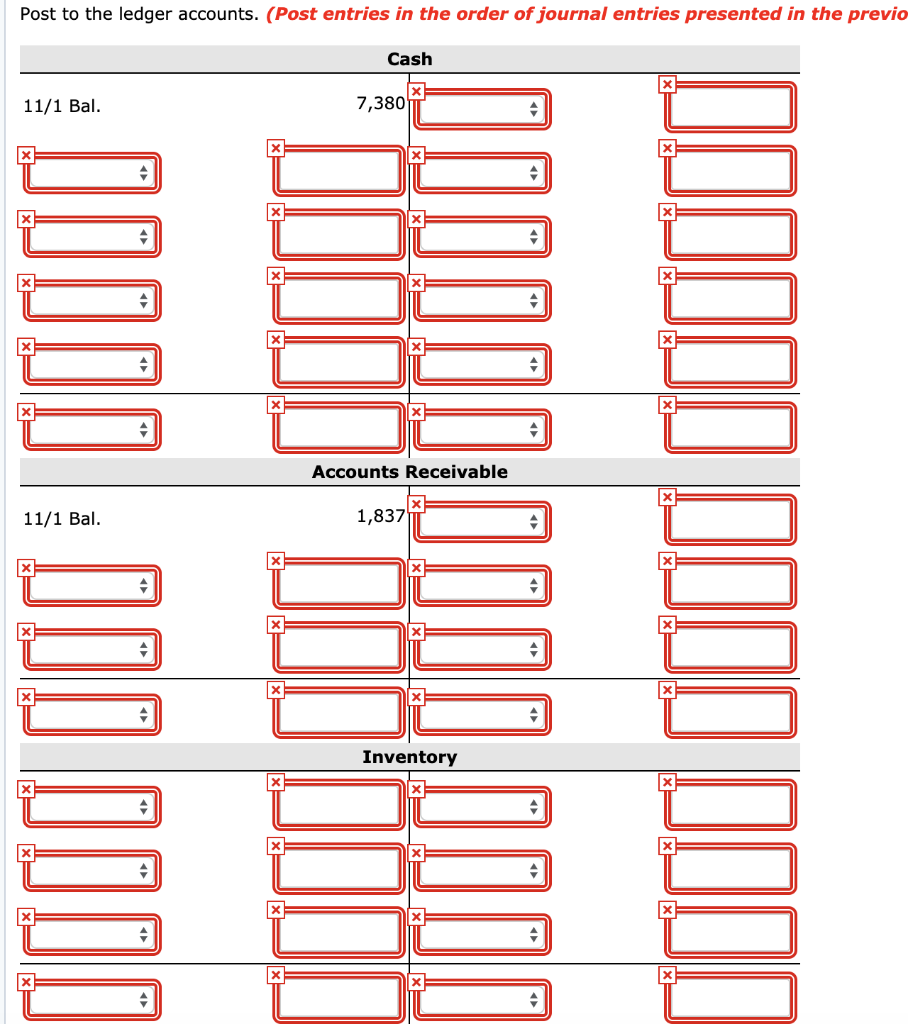

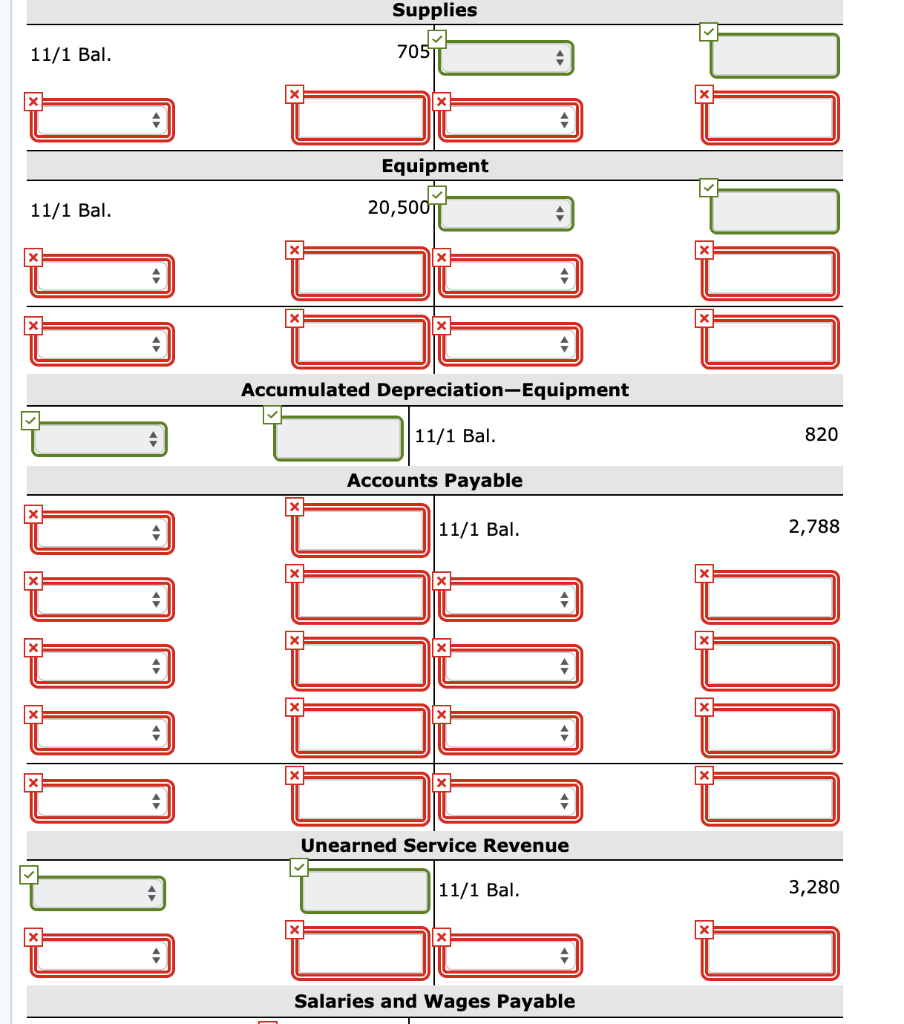

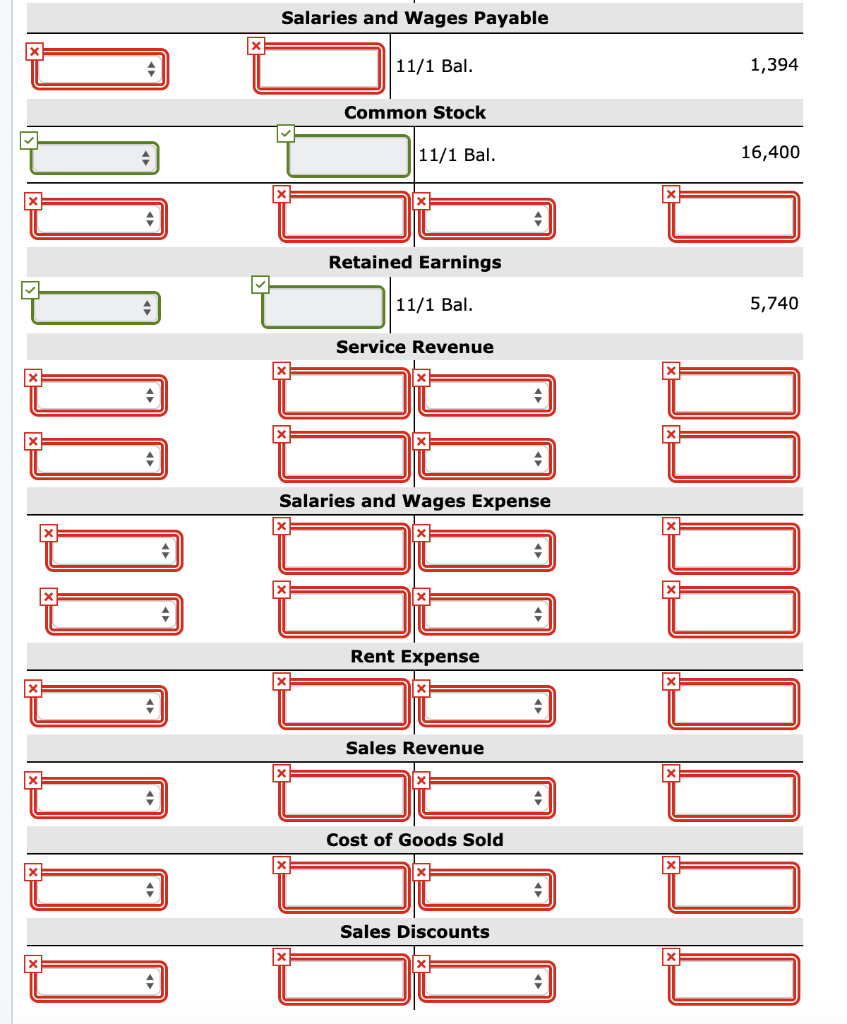

On November 1, 2017, Sage Hill Inc. had the following account balances. The company uses the perpetual inventory method. Debit Credit $7,380 $820 Cash Accumulated Depreciation-Equipment 1,837 2,788 Accounts Receivable Accounts Payable 705 Unearned Service Revenue 3,280 Supplies 20,500 Salaries and Wages Payable 1,394 Equipment $30,422 16,400 Common Stock Retained Earnings 5,740 $30,422 During November, the following summary transactions were completed Paid $2,911 for salaries due employees, of which $1,517 is for November and $1,394 is for October Nov. 8 Received $1,558 cash from customers in payment of account. 10 Purchased merchandise on account from Dimas Discount Supply for $6,560, terms 2/10, n/30. 11 Sold merchandise on account for $4,510, terms 2/10, n/30. The cost of the merchandise sold was $3,280 12 Received credit from Dimas Discount Supply for merchandise returned $246 15 Received collections in full, less discounts, from customers billed on sales of $4,510 on November 12. 19 Paid Dimas Discount Supply in full, less discount. 20 Received $1,886 cash for services performed in November 22 Purchased equipment on account $4,100. 25 Purchased supplies on account $1,394. 27 Paid creditors $2,460 of accounts payable due. 28 Paid November rent $308. 29 Paid salaries $1,066. 29 Performed services on account and billed customers $574 for those services. 29 Received $554 from customers for services to be performed in the future. 29 Journalize the November transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.) Credit Date Account Titles and Explanation Debit x Nov. 8 (To record credit sale) (To record cost of merchandise sold) X Nov. 19 x (To record November rent paid) (To record salaries paid) (To record services performed) (To record receipt for services performed) Post to the ledger accounts. (Post entries in the order of journal entries presented in the previo Cash 7,380 11/1 Bal X Accounts Receivable 1,837 11/1 Bal Inventory X DOD00D000000 Supplies 705T 11/1 Bal X Equipment 20,500T 11/1 Bal X X Accumulated Depreciation-Equipment 820 11/1 Bal Accounts Payable 2,788 11/1 Bal Unearned Service Revenue 3,280 11/1 Bal Salaries and Wages Payable Salaries and Wages Payable 11/1 Bal 1,394 Common Stock 16,400 11/1 Bal Retained Earnings 5,740 11/1 Bal Service Revenue Salaries and Wages Expense Rent Expense Sales Revenue Cost of Goods Sold Sales Discounts x