Answered step by step

Verified Expert Solution

Question

1 Approved Answer

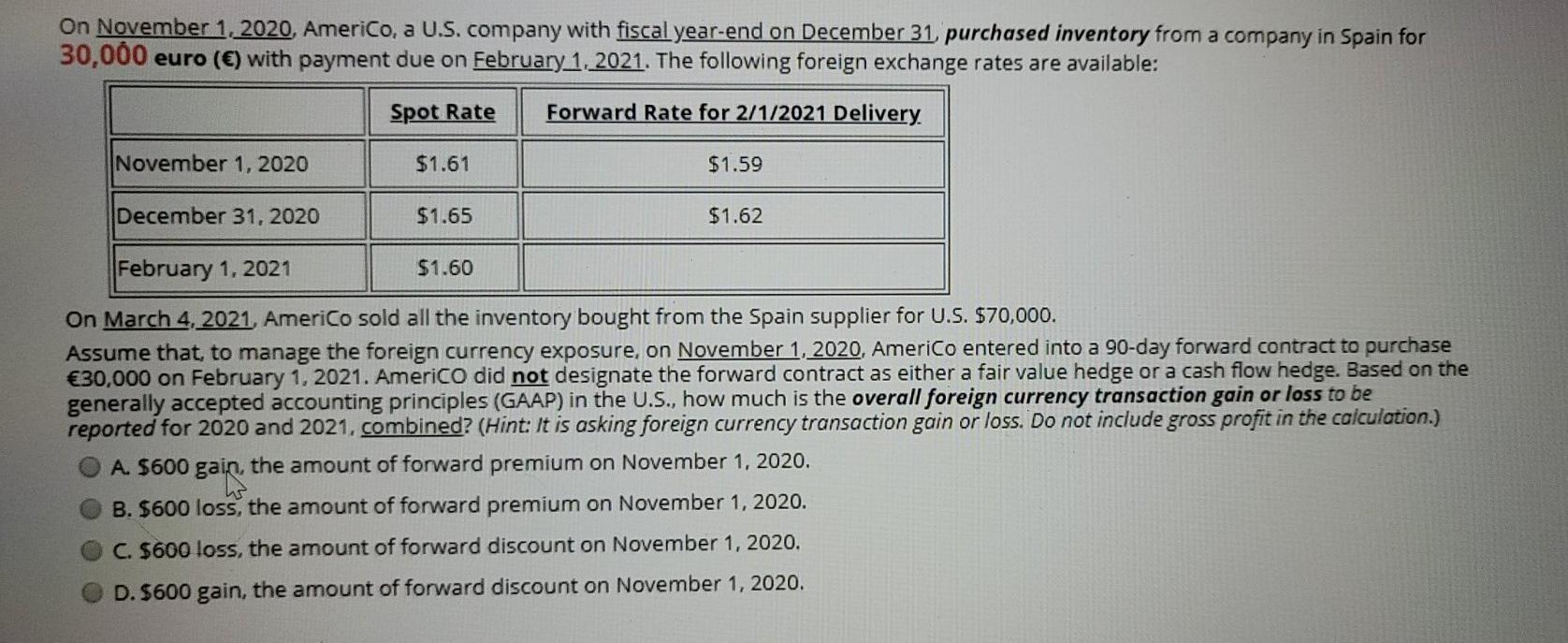

On November 1, 2020, Americo, a U.S. company with fiscal year-end on December 31 purchased inventory from a company in Spain for 30,000 euro ()

On November 1, 2020, Americo, a U.S. company with fiscal year-end on December 31 purchased inventory from a company in Spain for 30,000 euro () with payment due on February 1, 2021. The following foreign exchange rates are available: Spot Rate Forward Rate for 2/1/2021 Delivery November 1, 2020 $1.61 $1.59 December 31, 2020 $1.65 $1.62 February 1, 2021 $1.60 On March 4, 2021. AmeriCo sold all the inventory bought from the Spain supplier for U.S. $70,000. Assume that, to manage the foreign currency exposure, on November 1, 2020, Americo entered into a 90-day forward contract to purchase 30,000 on February 1, 2021. Americo did not designate the forward contract as either a fair value hedge or a cash flow hedge. Based on the generally accepted accounting principles (GAAP) in the U.S., how much is the overall foreign currency transaction gain or loss to be reported for 2020 and 2021, combined? (Hint: It is asking foreign currency transaction gain or loss. Do not include gross profit in the calculation.) A. $600 gain, the amount of forward premium on November 1, 2020. B. $600 loss, the amount of forward premium on November 1, 2020. C. $600 loss, the amount of forward discount on November 1, 2020. D. $600 gain, the amount of forward discount on November 1, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started