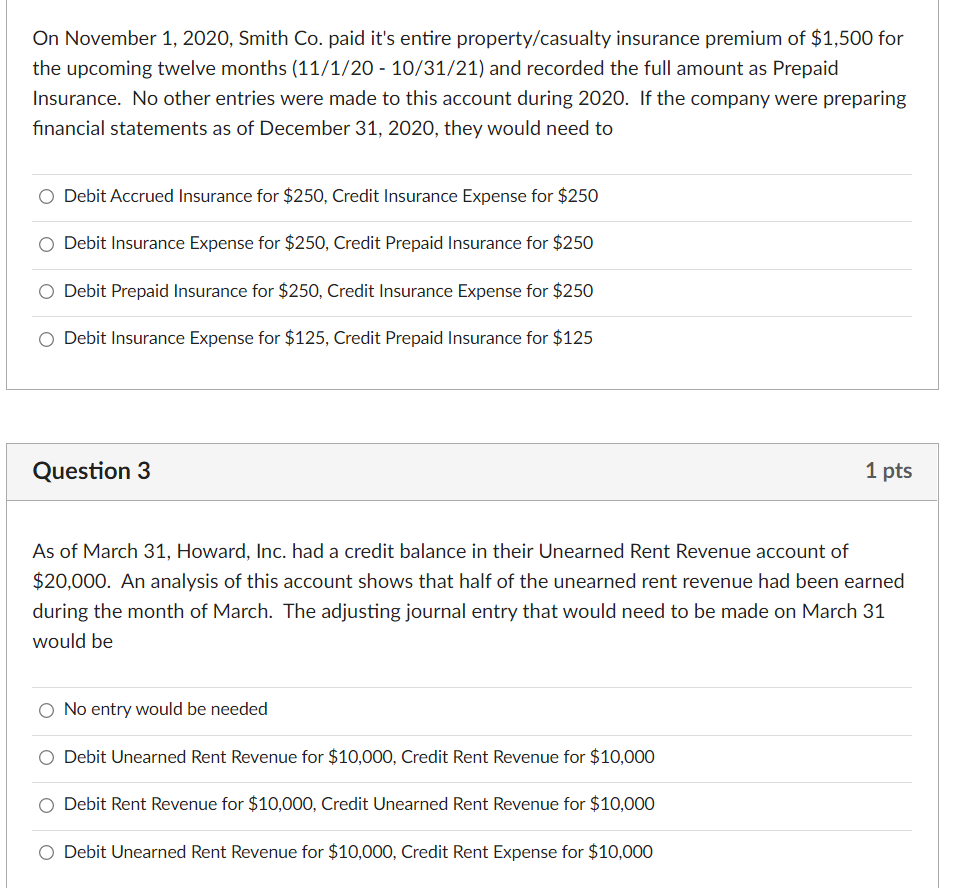

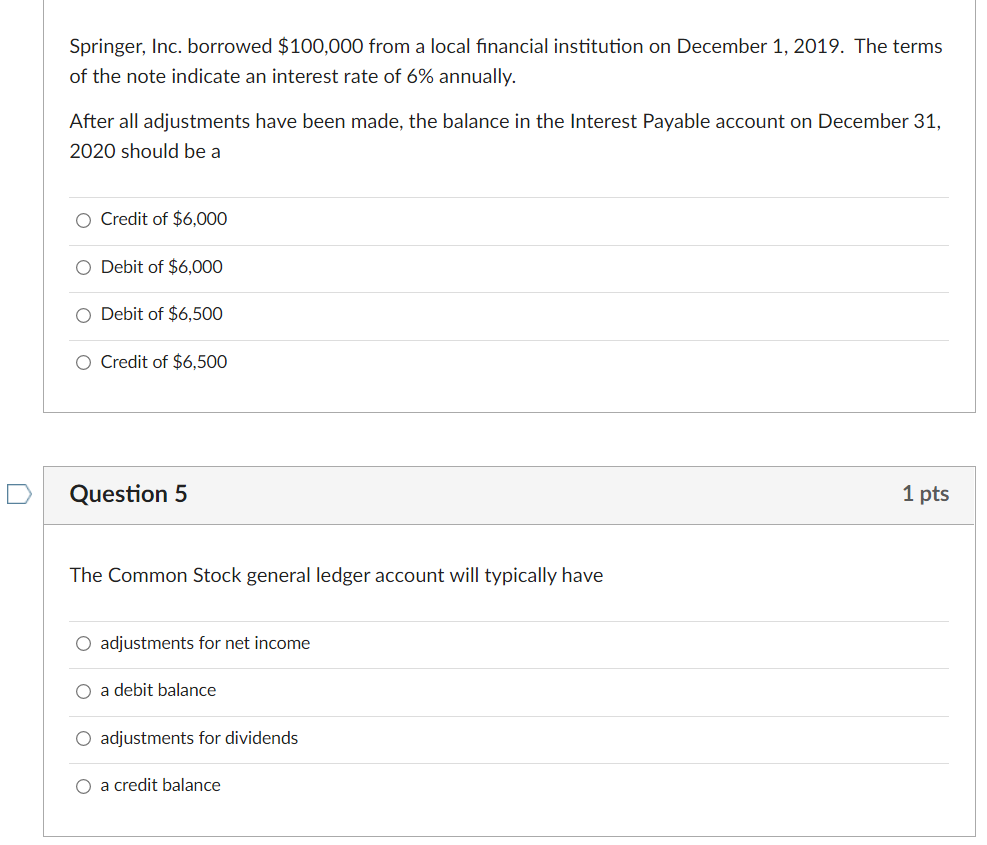

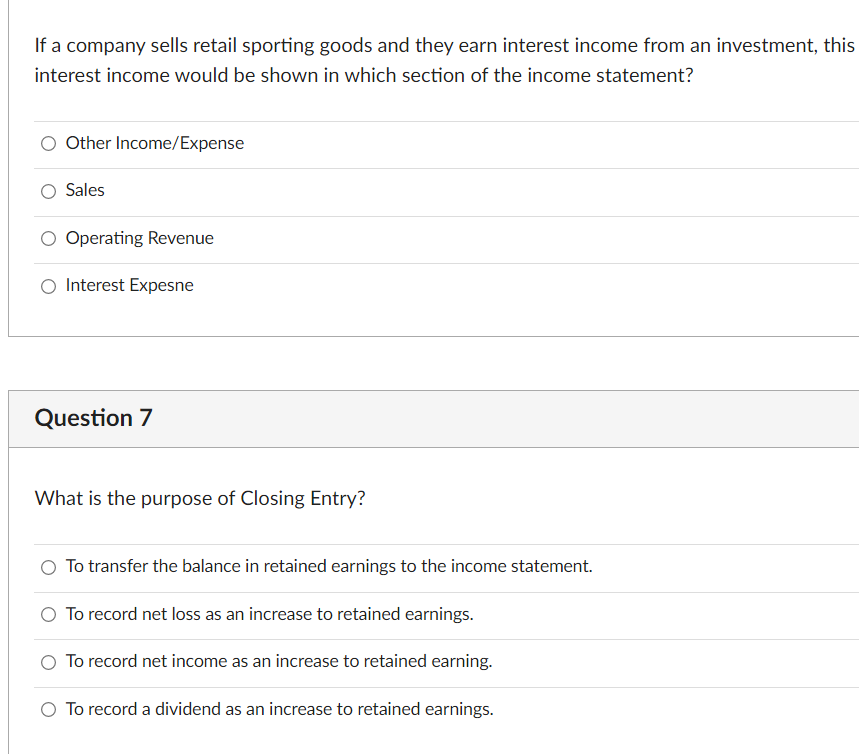

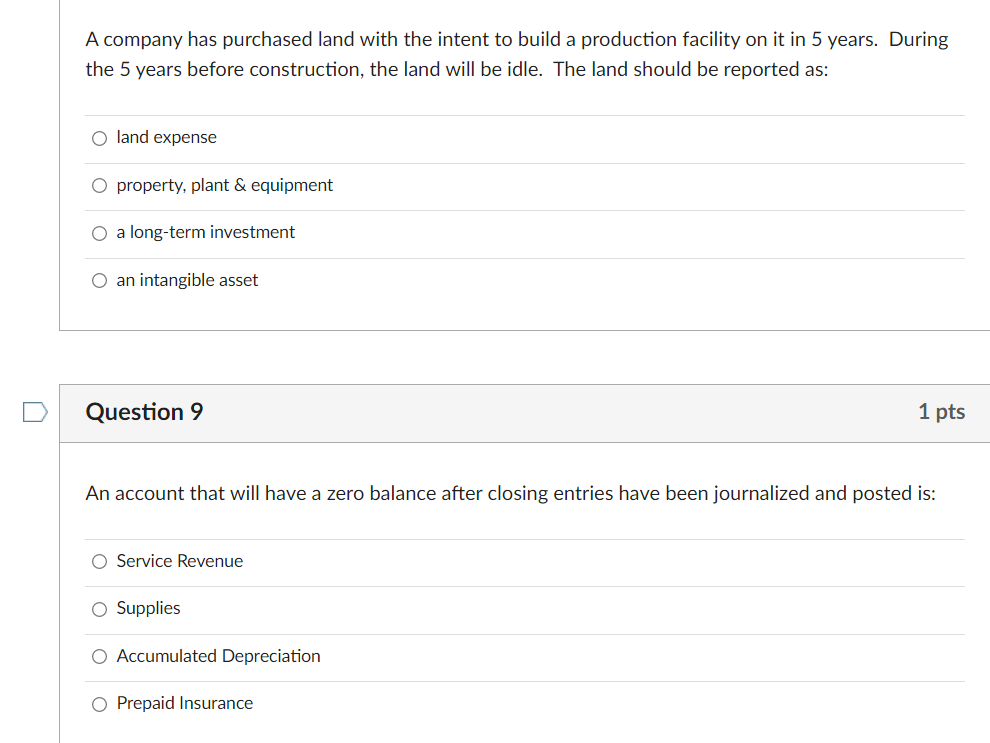

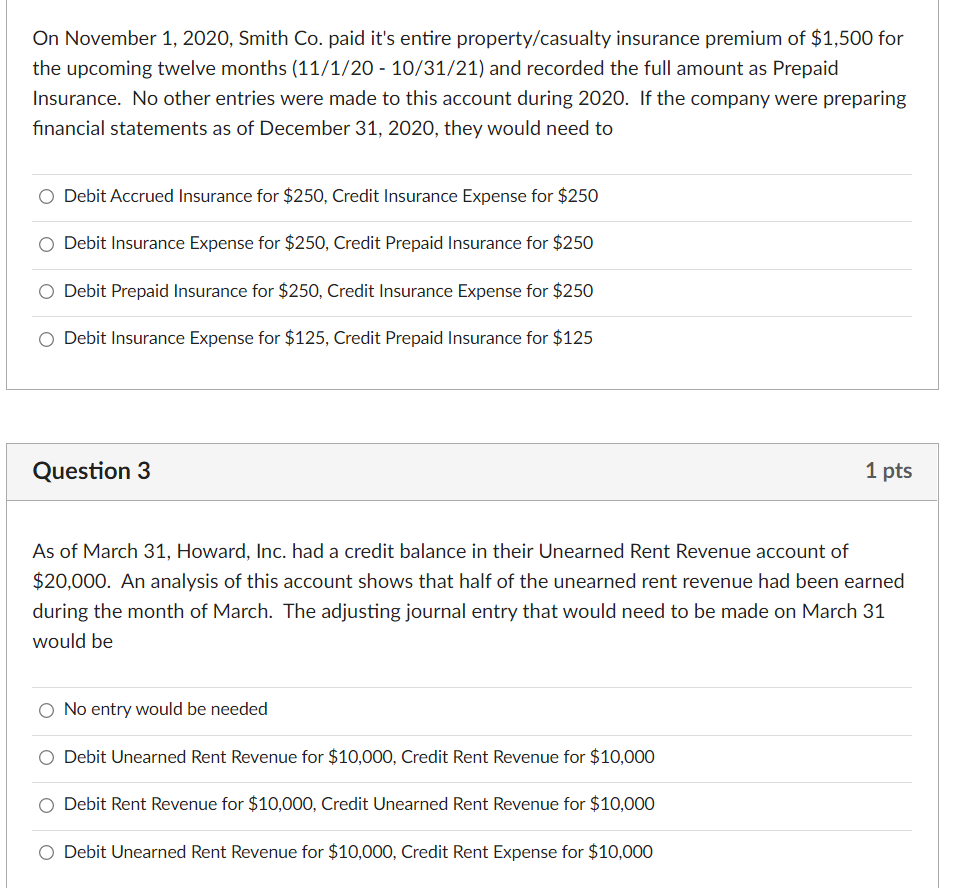

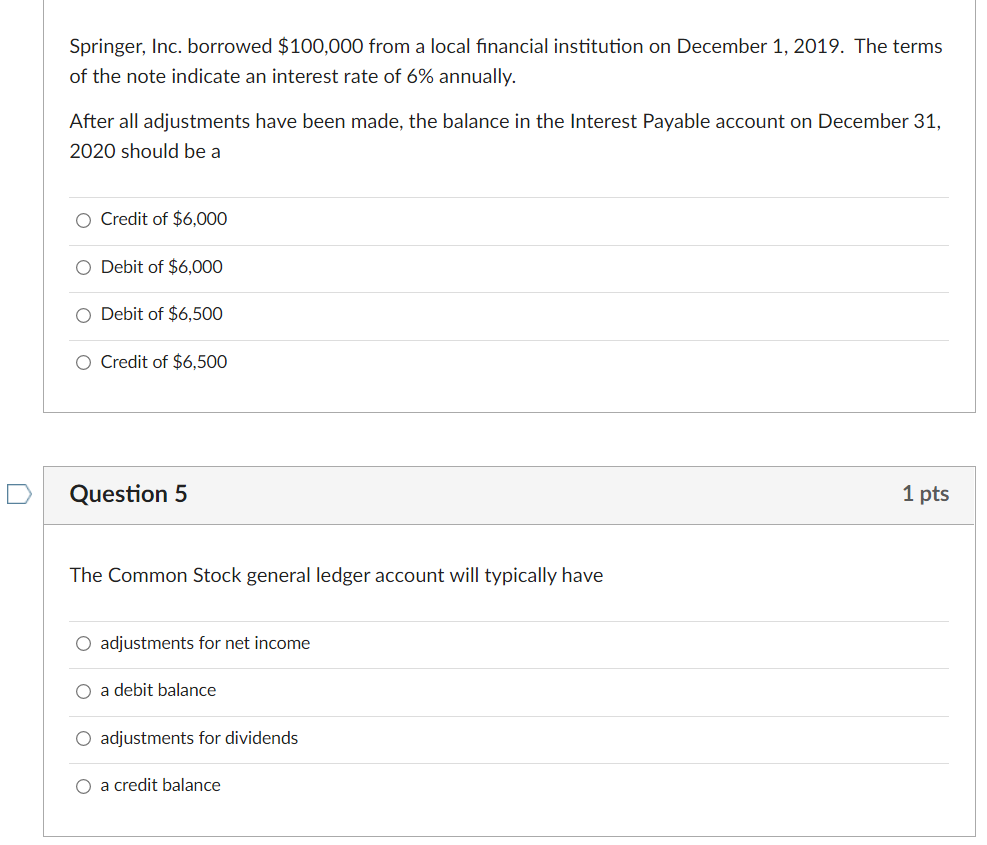

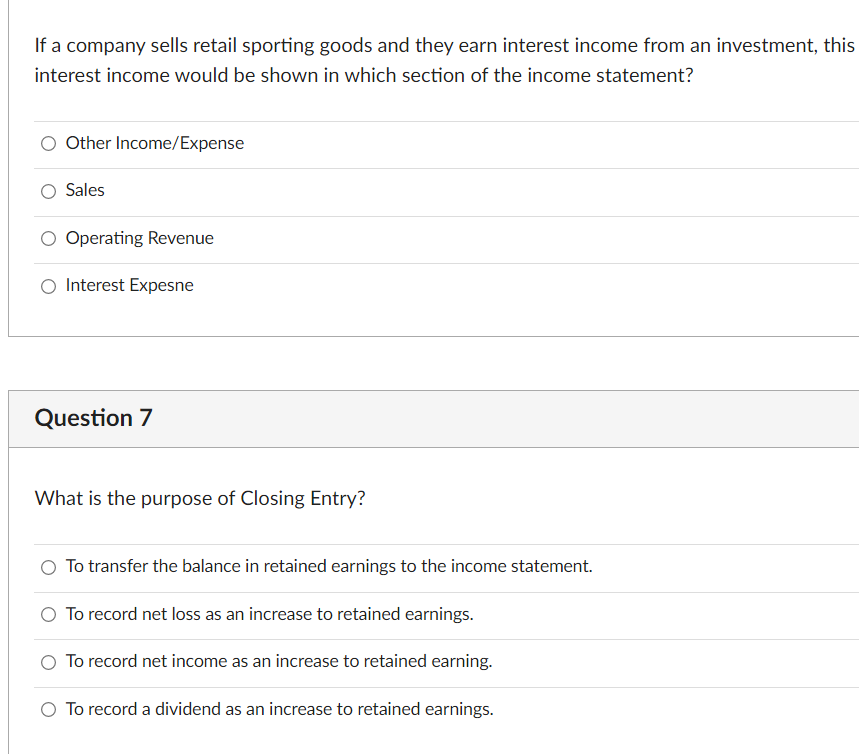

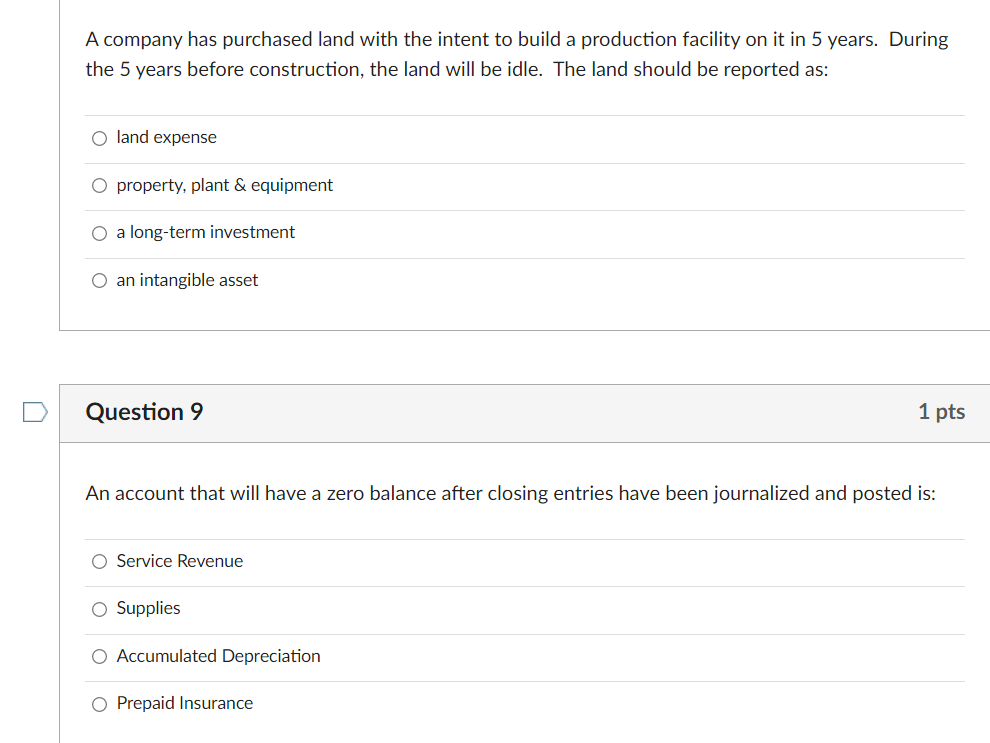

On November 1, 2020, Smith Co. paid it's entire property/casualty insurance premium of $1,500 for the upcoming twelve months (11/1/2010/31/21) and recorded the full amount as Prepaid Insurance. No other entries were made to this account during 2020. If the company were preparing financial statements as of December 31, 2020, they would need to Debit Accrued Insurance for $250, Credit Insurance Expense for $250 Debit Insurance Expense for $250, Credit Prepaid Insurance for $250 Debit Prepaid Insurance for $250, Credit Insurance Expense for $250 Debit Insurance Expense for $125, Credit Prepaid Insurance for $125 Question 3 1 pts As of March 31, Howard, Inc. had a credit balance in their Unearned Rent Revenue account of $20,000. An analysis of this account shows that half of the unearned rent revenue had been earned during the month of March. The adjusting journal entry that would need to be made on March 31 would be No entry would be needed Debit Unearned Rent Revenue for $10,000, Credit Rent Revenue for $10,000 Debit Rent Revenue for $10,000, Credit Unearned Rent Revenue for $10,000 Debit Unearned Rent Revenue for $10,000, Credit Rent Expense for $10,000 Springer, Inc. borrowed $100,000 from a local financial institution on December 1, 2019. The terms of the note indicate an interest rate of 6% annually. After all adjustments have been made, the balance in the Interest Payable account on December 31, 2020 should be a Credit of $6,000 Debit of $6,000 Debit of $6,500 Credit of $6,500 Question 5 The Common Stock general ledger account will typically have adjustments for net income a debit balance adjustments for dividends a credit balance If a company sells retail sporting goods and they earn interest income from an investment, this interest income would be shown in which section of the income statement? Other Income/Expense Sales Operating Revenue Interest Expesne Question 7 What is the purpose of Closing Entry? To transfer the balance in retained earnings to the income statement. To record net loss as an increase to retained earnings. To record net income as an increase to retained earning. To record a dividend as an increase to retained earnings. A company has purchased land with the intent to build a production facility on it in 5 years. During the 5 years before construction, the land will be idle. The land should be reported as: land expense property, plant \& equipment a long-term investment an intangible asset Question 9 1 pts An account that will have a zero balance after closing entries have been journalized and posted is: Service Revenue Supplies Accumulated Depreciation Prepaid Insurance