Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On October 15 an investor opens a position to sell 4000 troy ounces of gold on December with the Chicago mercantile exchange when the Futures

On October 15 an investor opens a position to sell 4000 troy ounces of gold on December

with the Chicago mercantile exchange when the Futures price is $1802 per ounce. The

initial margin requirements are $10000 per contract. On July 31 the investor closes the

position when the Futures price is $1820. (Futures are contracts traded in exchanges

and are standardized given the terms established in the exchange.)

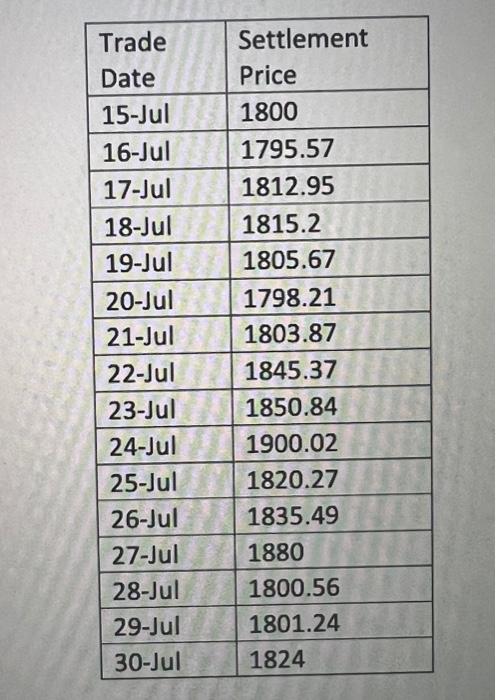

A. Obtain the daily gains, cumulative gains, margin balance and margin calls from the time

the investor opens the position to the time that she closes it.

B. What is the profit or loss of this investor?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started