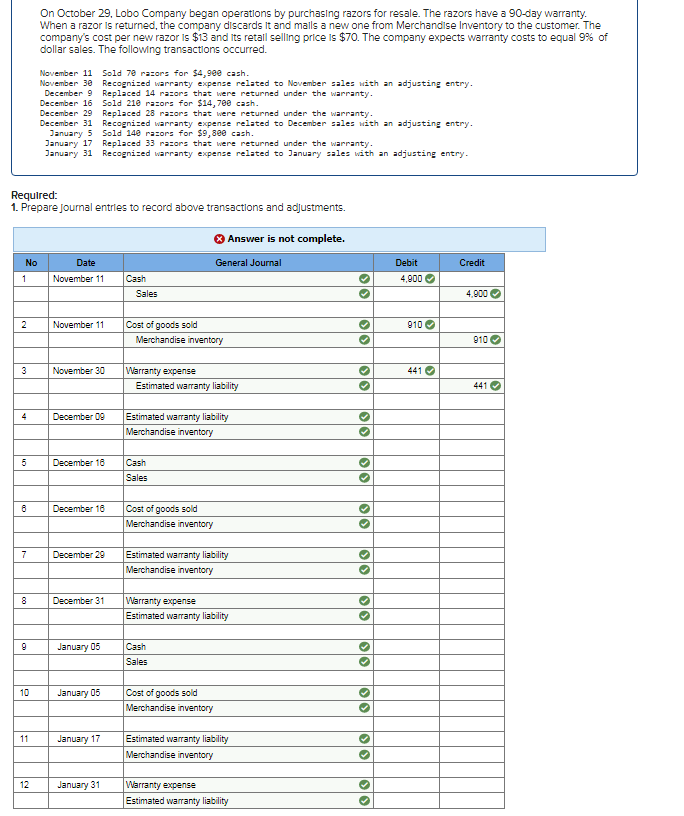

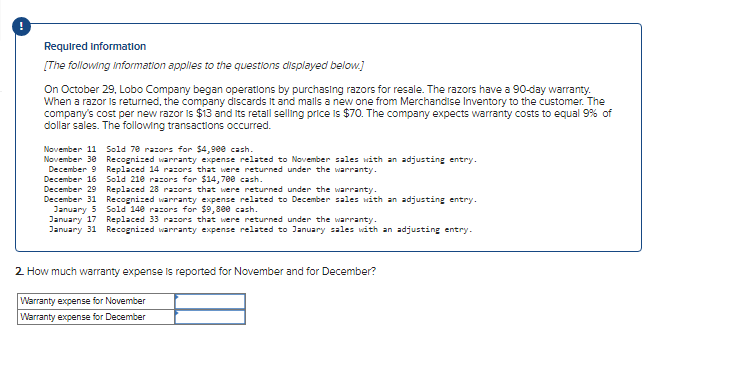

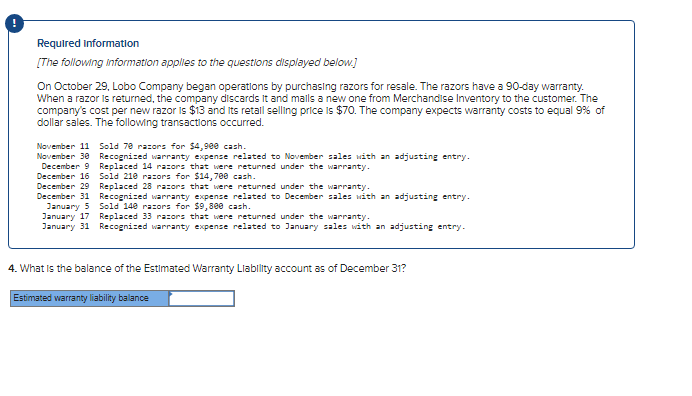

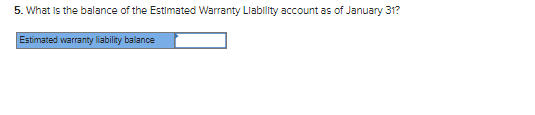

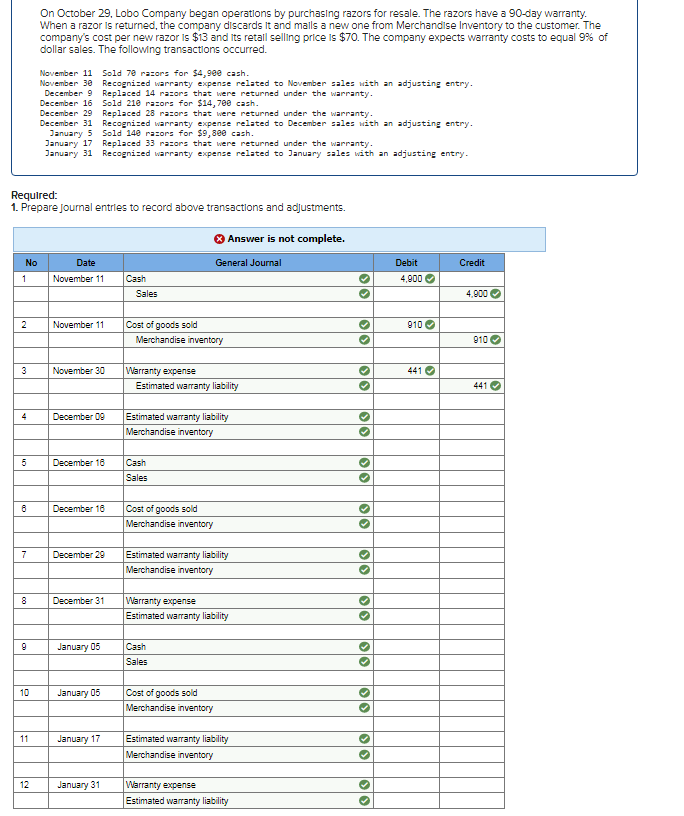

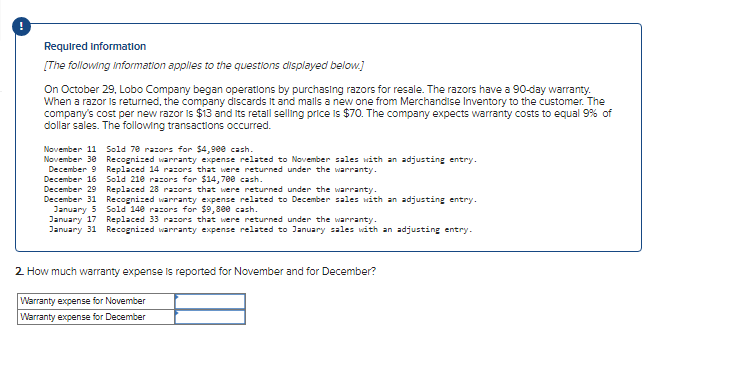

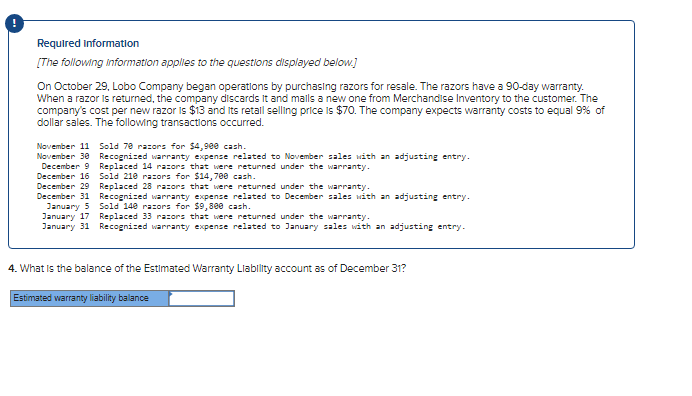

On October 29 , Lobo Compary began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 9% of dollar sales. The following transactlons occurred. Nowember 11 Sold 79 razorz for $4,960cash. Nowember 30 Recognized warranty expense related to November zalez uith an adjusting entry. December 9 Replaced 14 razorz that were returned under the warranty. December 16 Sold 210 razorz for $14,760 cash. December 29 Replaced 28 razorz that were returned under the warranty. December 31 Recognized warranty expense related to December salez with an adjusting entry. January 5 Sold 140 razorz for $9,800 cash. January 17 Replaced 33 razorz that were returned under the warranty. January 31 Recognized warranty expense related to January salez with an adjusting entry. Required: 1. Prepare joumal entrles to record above transactions and adjustments. Required information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and lts retall selling price is $70. The company expects warranty costs to equal 9% of dollar sales. The following transactlons occurred. November 11 Sold 76razorz for $4,900cash. November 30 Recognized warranty expense related to November zalez with an adjuzting entry. December 9 Replaced 14 razorz that were returned under the warranty. December 16 Sold 210 razorz for $14,700 cash. December 29 Replaced 28 razorz that were returned under the warranty. December 31 Recognized warranty expense related to December zalez with an adjuzting entry. January 5 Sold 140 razorz for $9,800 cash. January 17 Replaced 33 razorz that were returned under the warranty. January 31 Recognized warranty expense related to January zalez with an adjusting entry. 2. How much warranty expense Is reported for November and for December? Required Information [The following information applies to the questions displayed below.] On October 29, Lobo Company began operatlons by purchasing razors for resale. The razors have a 90 -day warranty. When a razor is returned, the company discards it and malls a new one from Merchandise Inventory to the customer. The company's cost per new razor is $13 and its retall selling price is $70. The company expects warranty costs to equal 9% of dollar sales. The following transactions occurred. Nowember 11 Sold 70 razorz for $4,900 cash. November 30 Recognized warranty expense related to Nowember zalez with an adjusting entry. December 9 Replaced 14 razorz that were returned under the warranty. December 16 Sold 210 razors for $14,700 cash. December 29 Replaced 28 razorz that were returned under the warranty. December 31 Recognized warranty expense related to December zalez with an adjusting entry. January 5 Sold 140razorz for $9,800cash. January 17 Replaced 33 razorz that were returned under the warranty. January 31 Recognized warranty expense related to January zalez with an adjusting entry' 4. What is the balance of the Estimated Warranty Llability account as of December 31 ? 5. What is the balance of the Estimated Warranty Llability account as of January 31