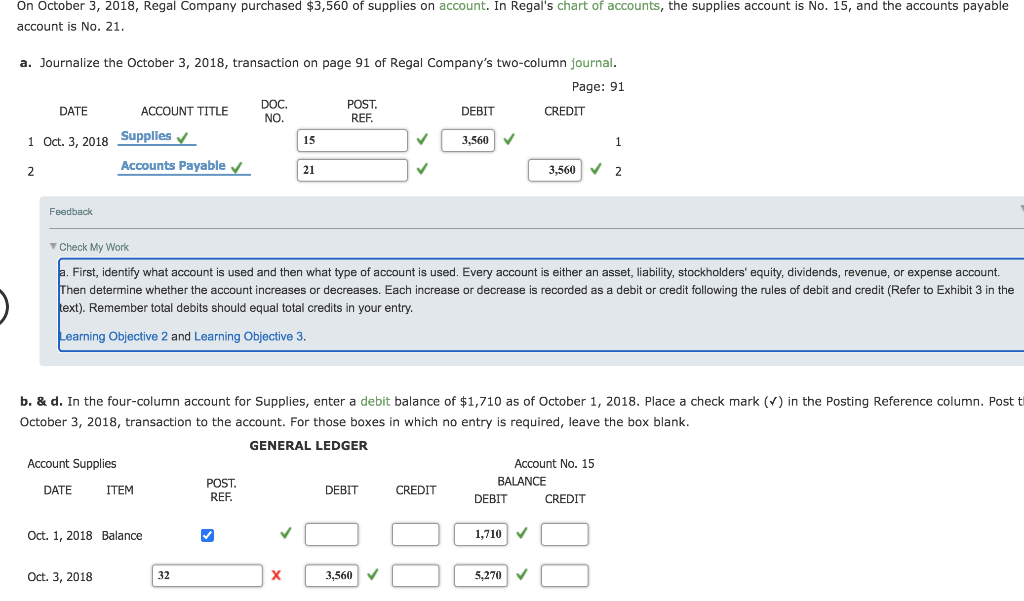

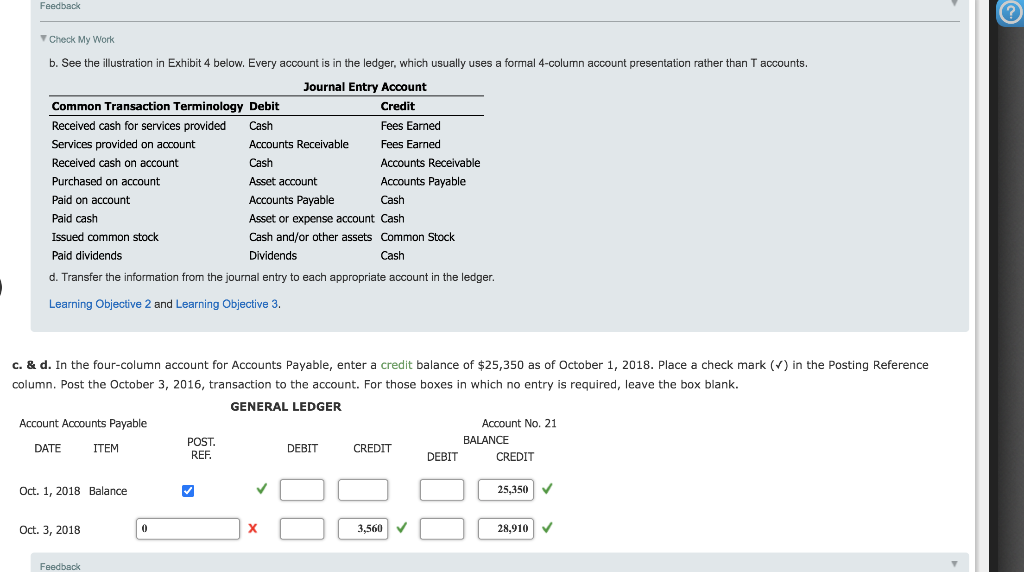

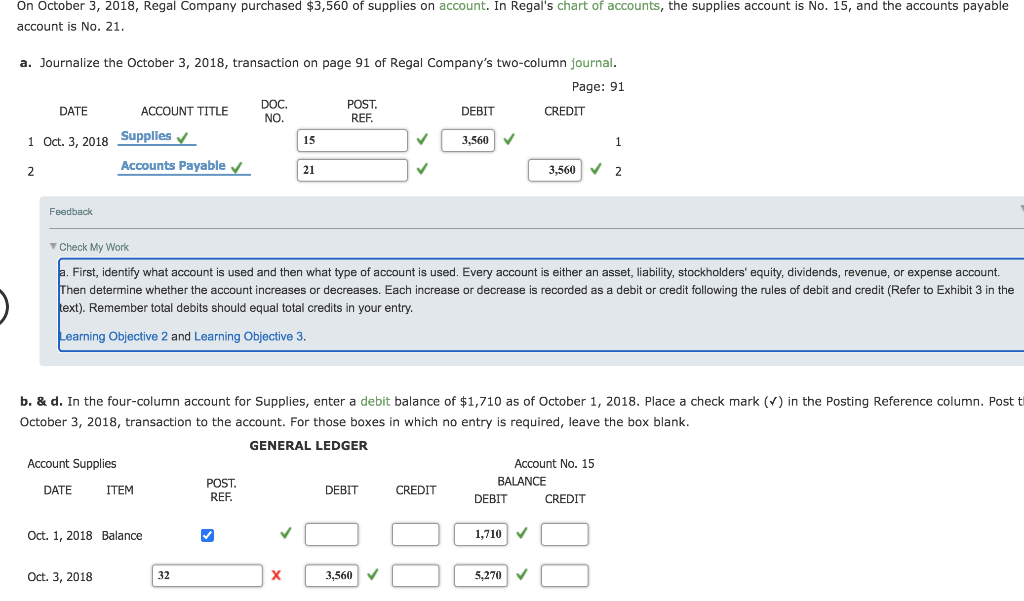

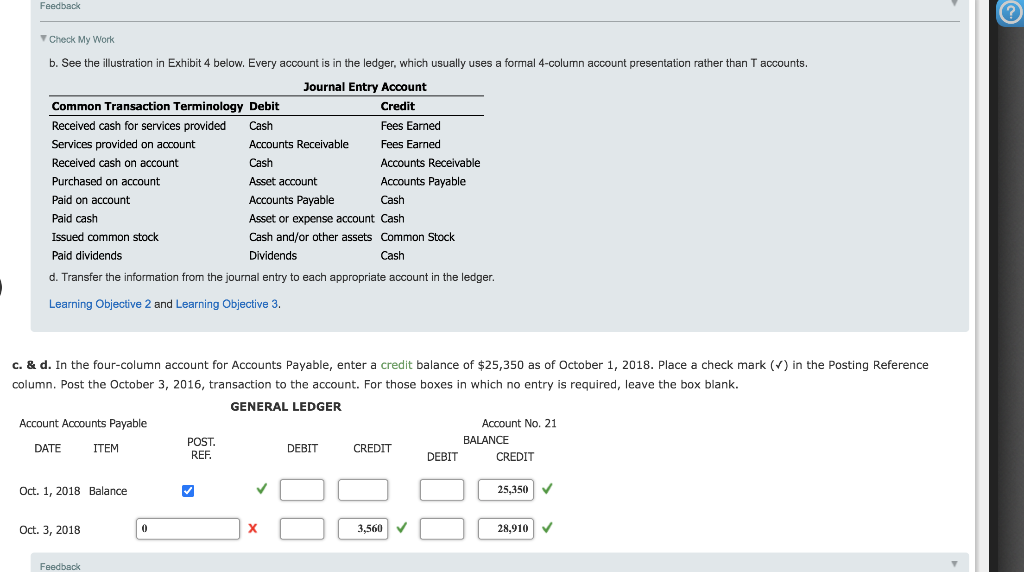

On October 3, 2018, Regal Company purchased $3,560 of supplies on account. In Regal's chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21. a. Journalize the October 3, 2018, transaction on page 91 of Regal Company's two-column journal. Page: 91 DATE ACCOUNT TITLE DOC. POST. NO. DEBIT CREDIT REF. 1 Oct. 3, 2018 Supplies 15 3,560 2 Accounts Payable 21 3,560 2 1 Feedback Check My Work 1. First, identify what account is used and then what type of account is used. Every account is either an asset, liability, stockholders' equity, dividends, revenue, or expense account. Then determine whether the account increases or decreases. Each increase or decrease is recorded as a debit or credit following the rules of debit and credit (Refer to Exhibit 3 in the text). Remember total debits should equal total credits in your entry. Learning Objective 2 and Learning Objective 3. b. & d. In the four-column account for Supplies, enter a debit balance of $1,710 as of October 1, 2018. Place a check mark (v) in the Posting Reference column. Post t October 3, 2018, transaction to the account. For those boxes in which no entry is required, leave the box blank. GENERAL LEDGER Account Supplies Account No. 15 POST. BALANCE DATE ITEM DEBIT REF. CREDIT DEBIT CREDIT Oct. 1, 2018 Balance 1,710 Oct. 3, 2018 32 3,560 5,270 Feedback Check My Work b. See the illustration in Exhibit 4 below. Every account is in the ledger, which usually uses a formal 4-column account presentation rather than T accounts. Journal Entry Account Common Transaction Terminology Debit Credit Received cash for services provided Cash Fees Earned Services provided on account Accounts Receivable Fees Earned Received cash on account Cash Accounts Receivable Purchased on account Asset account Accounts Payable Paid on account Accounts Payable Cash Paid cash Asset or expense account Cash Issued common stock Cash and/or other assets Common Stock Paid dividends Dividends Cash d. Transfer the information from the journal entry to each appropriate account in the ledger. Learning Objective 2 and Learning Objective 3. c. & d. In the four-column account for Accounts Payable, enter a credit balance of $25,350 as of October 1, 2018. Place a check mark (V) in the Posting Reference column. Post the October 3, 2016, transaction to the account. For those boxes in which no entry is required, leave the box blank. GENERAL LEDGER Account Accounts Payable Account No. 21 POST. BALANCE DATE ITEM DEBIT REF. CREDIT DEBIT CREDIT Oct. 1, 2018 Balance 25,350 Oct. 3, 2018 0 3,560 28,910 Feedback