Question

On September 1, 20X1, Bauer Inc. has 10,000 ounces of silver, with an average cost of $12 per ounce, in inventory. The spot price for

On September 1, 20X1, Bauer Inc. has 10,000 ounces of silver, with an average cost of $12 per ounce, in inventory. The spot price for silver is $16 per ounce. Bauer decides to retain the inventory until the beginning of January 20X2, hoping that the price increases to $17 per ounce. To hedge its position, Bauer sells future contracts to sell 100,000 ounces of silver at $17 per ounce on January 2, 20X2. The market spot rates and future prices for silver are as follows:

| Spot Price | January 20X2 Future Price | |||||

| September 1, 20X1 | $ | 16 | $ | 17 | ||

| December 31, 20X1 | $ | 14.50 | $ | 15.50 | ||

| January 2, 20X2 | $ | 16.80 | $ | 16.80 | ||

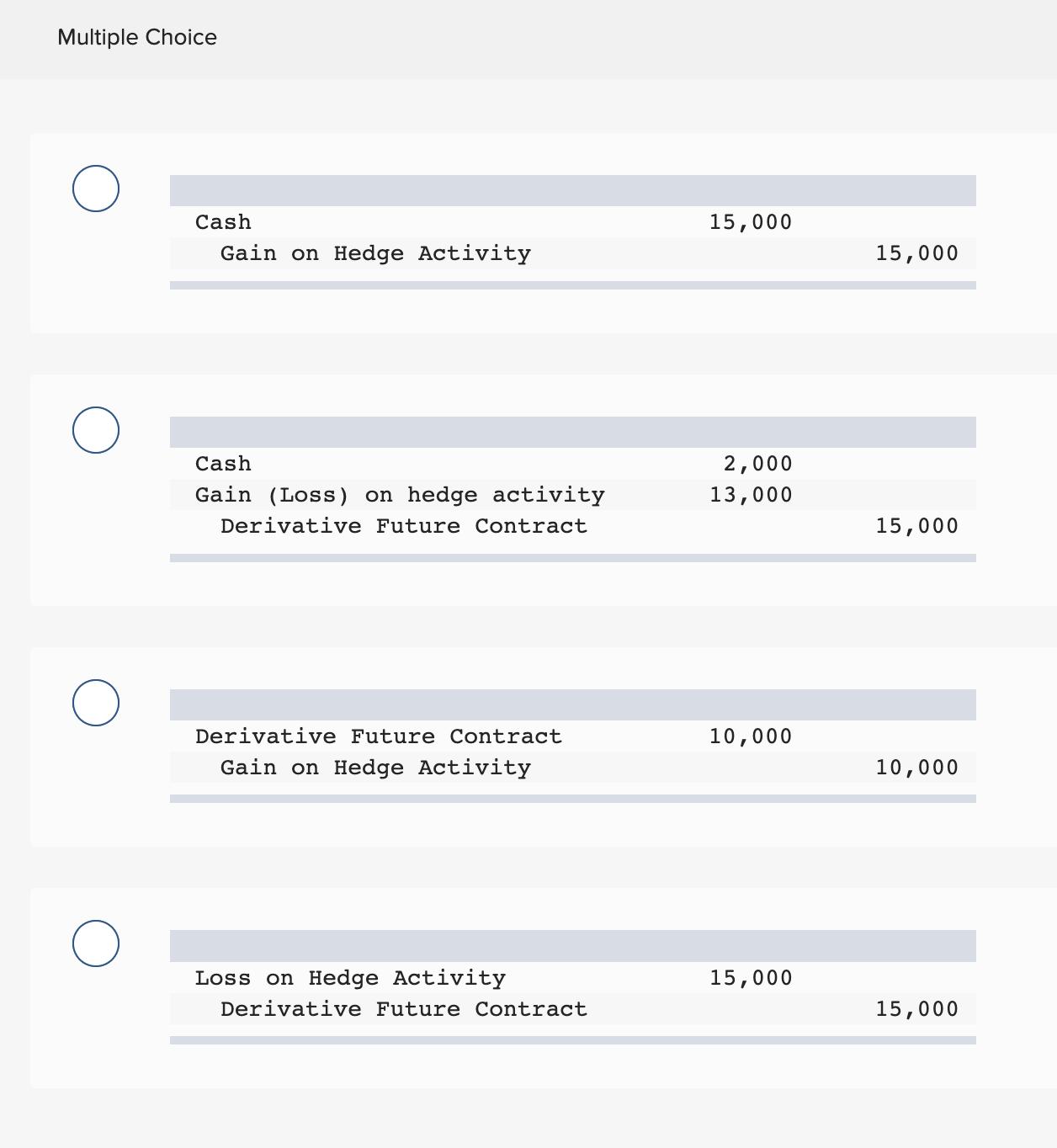

On January 2, 20X2, Bauer sells the silver at the spot rate of $16.80 and cancels the futures contract. Prepare the journal entry Bauer makes on 1/2/X2 to cancel the futures contract.

Multiple Choice O Cash Gain on Hedge Activity Cash Gain (Loss) on hedge activity Derivative Future Contract Derivative Future Contract Gain on Hedge Activity Loss on Hedge Activity Derivative Future Contract 15,000 2,000 13,000 10,000 15,000 15,000 15,000 10,000 15,000

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started