Question

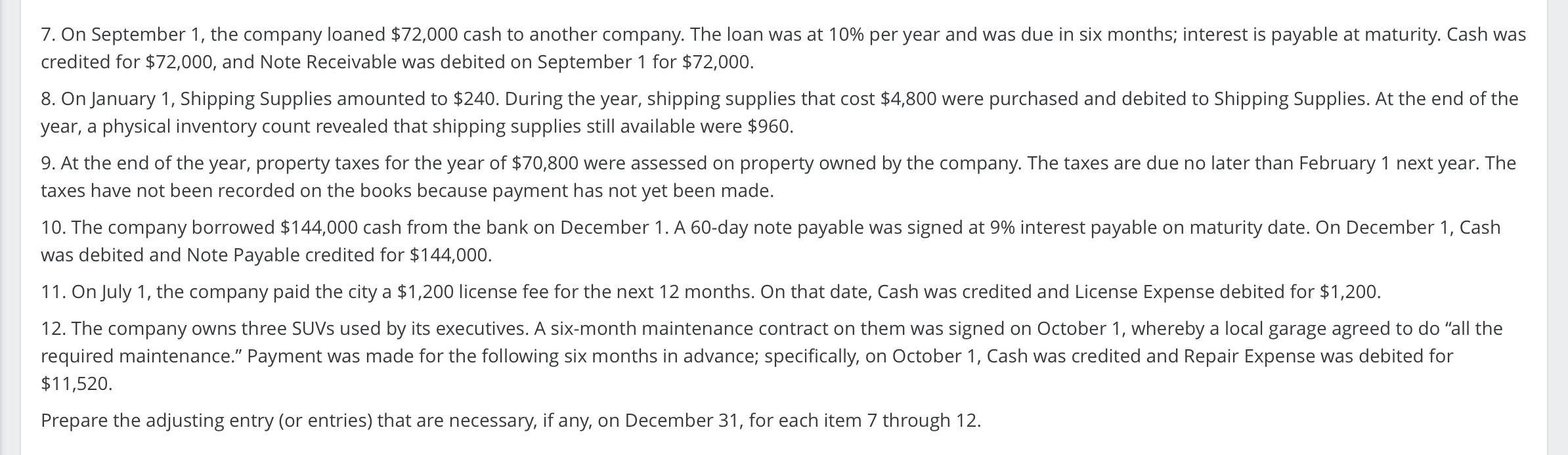

On September 1, the company loaned $72,000 cash to another company. The loan was at 10% per year and was due in six months; interest

On September 1, the company loaned

$72,000cash to another company. The loan was at

10%per year and was due in six months; interest is payable at maturity. Cash was credited for

$72,000, and Note Receivable was debited on September 1 for

$72,000.\ On January 1 , Shipping Supplies amounted to

$240. During the year, shipping supplies that cost

$4,800were purchased and debited to Shipping Supplies. At the end of the year, a physical inventory count revealed that shipping supplies still available were

$960.\ At the end of the year, property taxes for the year of

$70,800were assessed on property owned by the company. The taxes are due no later than February 1 next year. The taxes have not been recorded on the books because payment has not yet been made.\ The company borrowed

$144,000cash from the bank on December 1. A 60-day note payable was signed at

9%interest payable on maturity date. On December 1, Cash was debited and Note Payable credited for

$144,000.\ On July 1, the company paid the city a

$1,200license fee for the next 12 months. On that date, Cash was credited and License Expense debited for

$1,200.\ The company owns three SUVs used by its executives. A six-month maintenance contract on them was signed on October 1, whereby a local garage agreed to do "all the required maintenance." Payment was made for the following six months in advance; specifically, on October 1, Cash was credited and Repair Expense was debited for

$11,520.\ Prepare the adjusting entry (or entries) that are necessary, if any, on December 31, for each item 7 through 12.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started