Question

On September 30, our company purchases a foreign-currency-denominated debt security for 100,000. The security is classified as available-for-sale (AFS). We decide to hedge the risk

On September 30, our company purchases a foreign-currency-denominated debt security for 100,000. The security is classified as available-for-sale (AFS). We decide to hedge the risk of the currency fluctations of this available-for-sale security over the next three months and enter into a forward contract to sell 100,000 on December 31, at an exchange contract rate of 1 = $1.49.

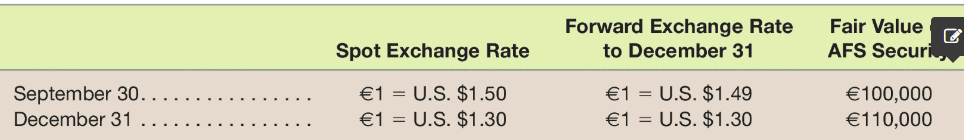

Assume the following exchange rates:

This transaction is designated as a foreign currency fair value hedge. Changes in the fair value of the AFS securities that are attributable to the hedged foreign currency risk are recorded in earnings, along with the change in the fair value of the hedging instrument (i.e., the forward-exchange contract in this example). Changes in the fair value of the AFS securities that are due to unhedged risks (i.e., the $US equivalent of changes in market value) will continue to be recorded in Other Comprehensive Income as required by FAS 115.

Prepare journal entries to record the following:

a. Purchase of the security on September 30

b. Adjusting entries at December 31

Forward Exchange Rate Fair Value AFS Secur to December 31 1 -U.S. $1.49 1 -U.S. $1.30 100,000 110,000 September 30 1 U.S. $1.30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started