Answered step by step

Verified Expert Solution

Question

1 Approved Answer

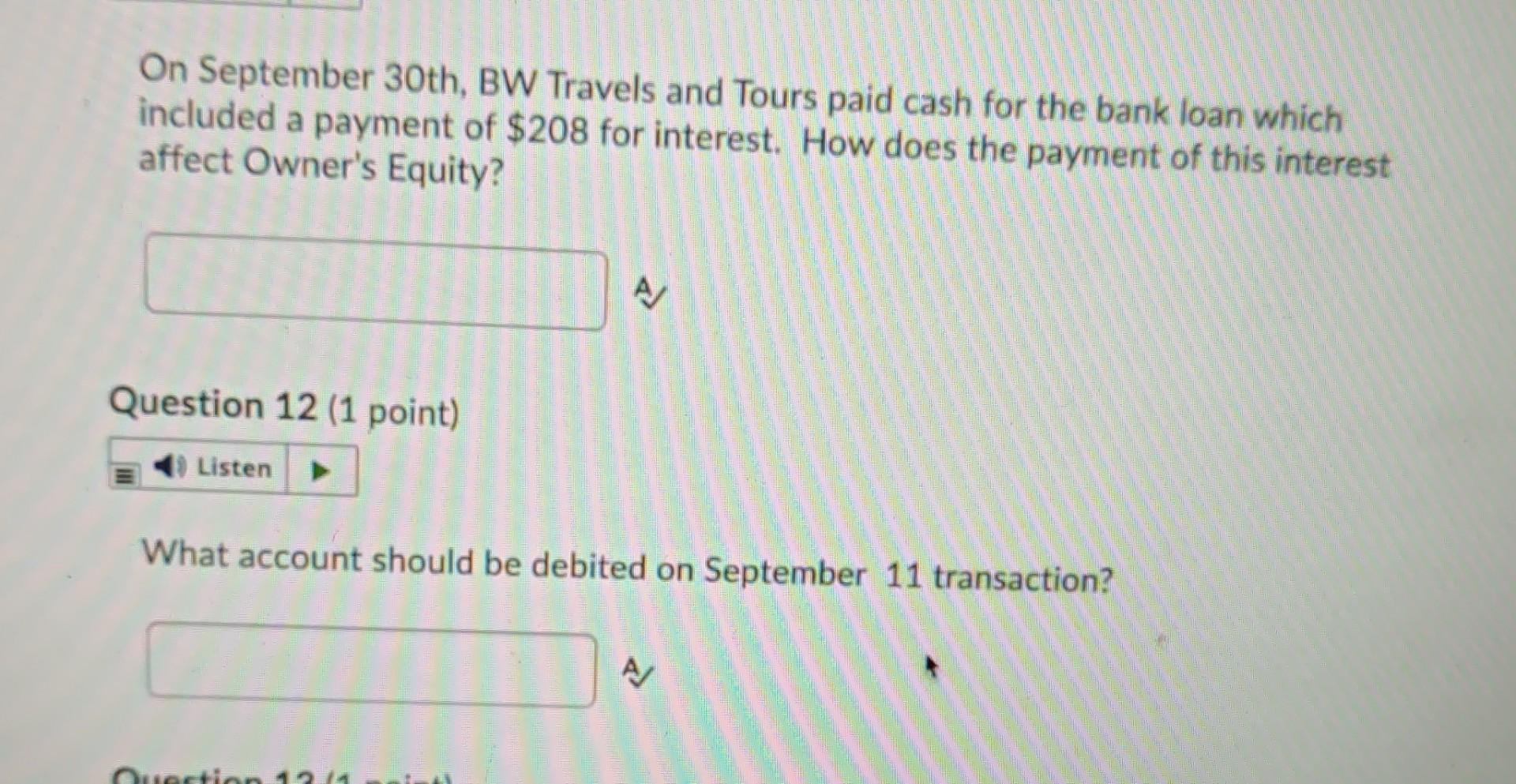

On September 30th, BW Travels and Tours paid cash for the bank loan which included a payment of $208 for interest. How does the payment

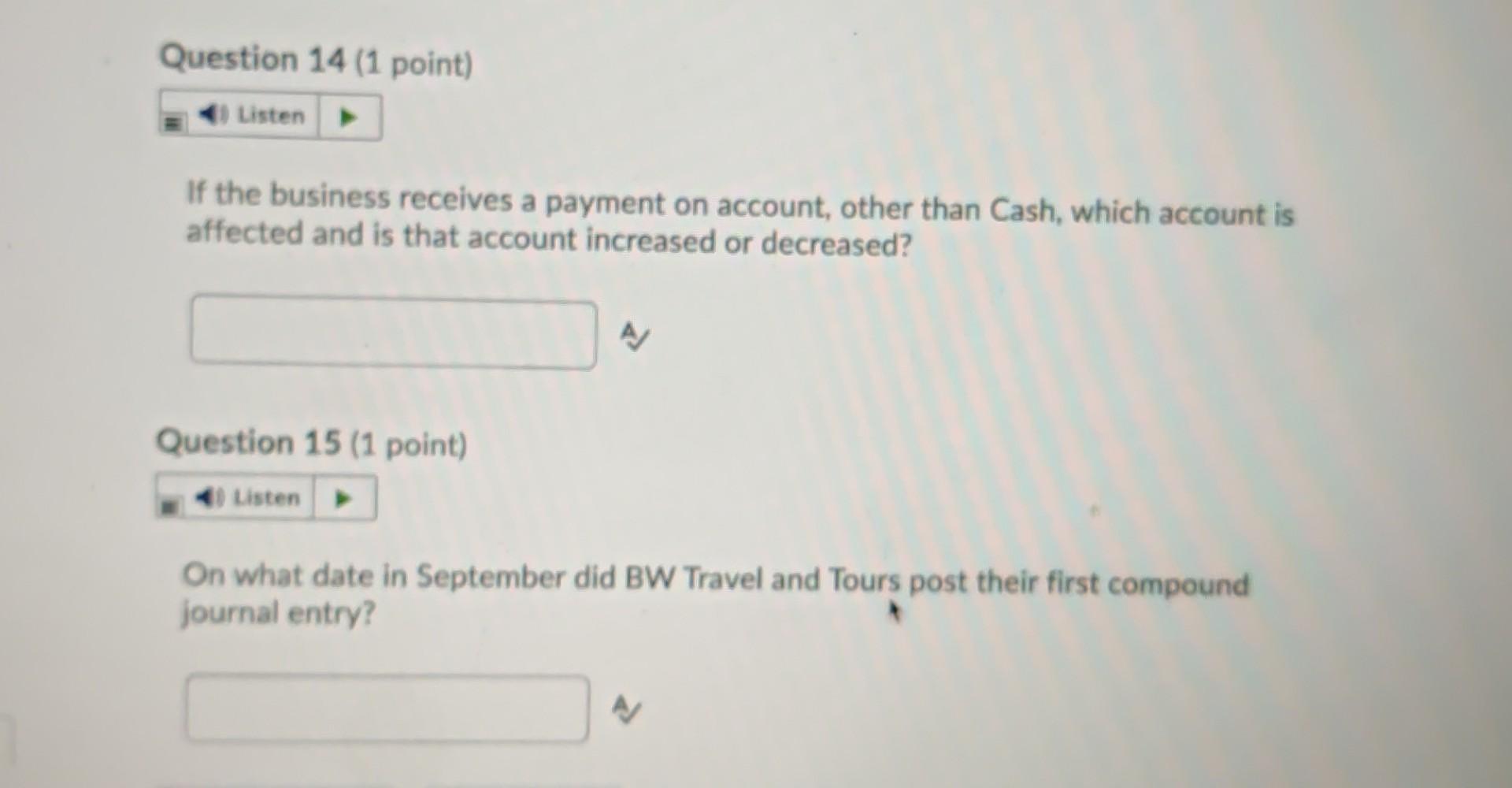

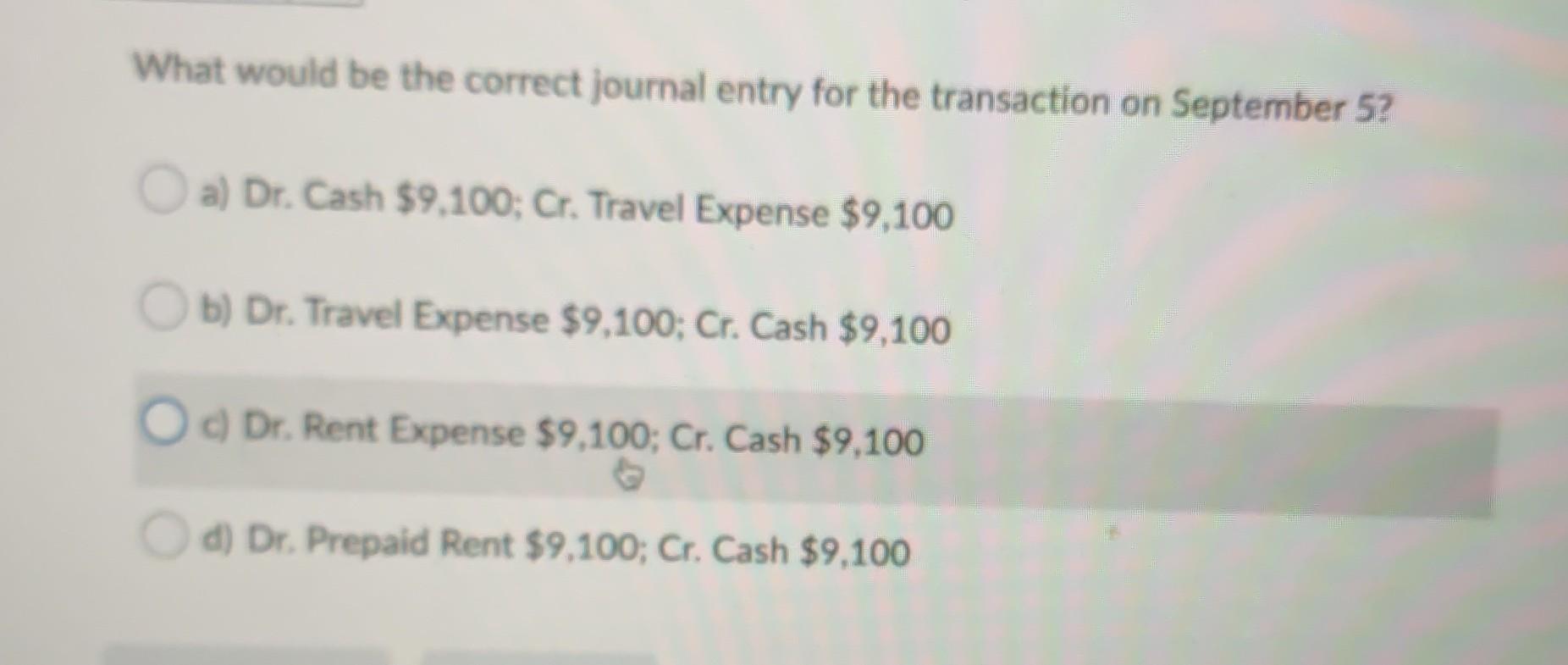

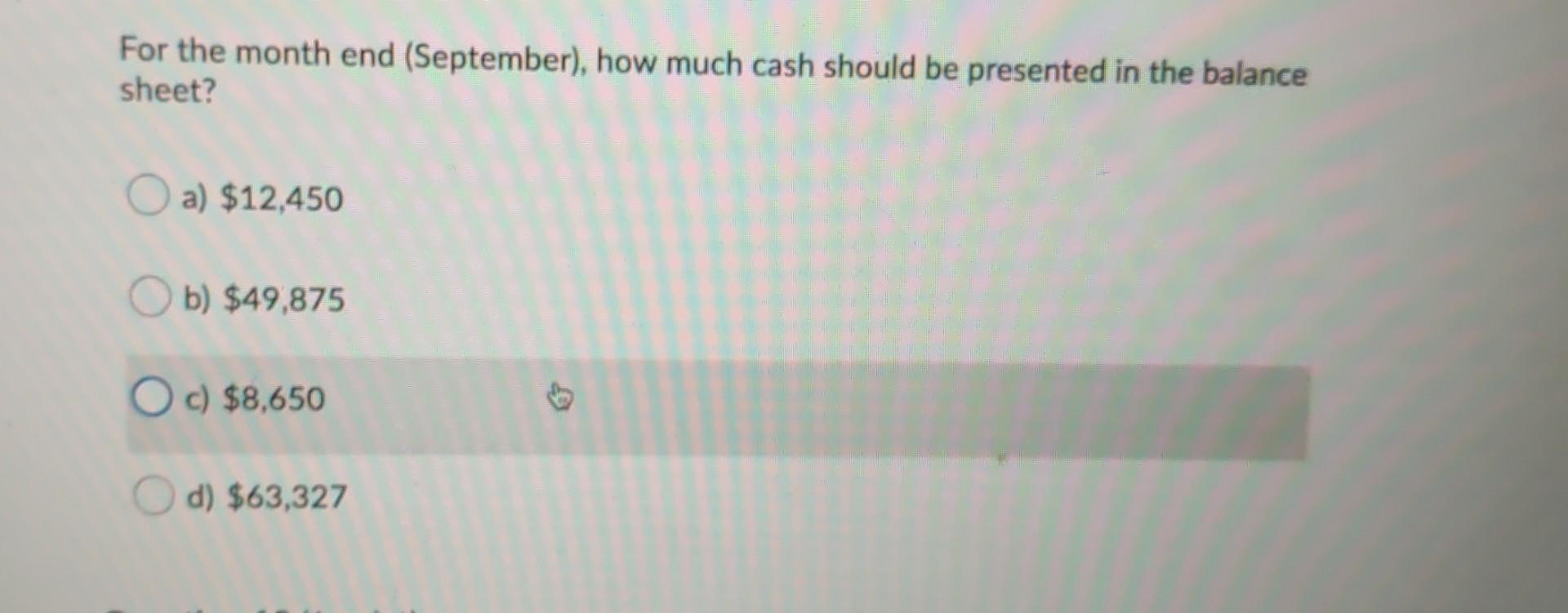

On September 30th, BW Travels and Tours paid cash for the bank loan which included a payment of $208 for interest. How does the payment of this interest affect Owner's Equity? A) Question 12 (1 point) Listen What account should be debited on September 11 transaction? 4 Question 1211 Question 14 (1 point) Listen If the business receives a payment on account, other than Cash, which account is affected and is that account increased or decreased? A Question 15 (1 point) 4. Listen On what date in September did BW Travel and Tours post their first compound journal entry? What would be the correct journal entry for the transaction on September 5? a) Dr. Cash $9,100; Cr. Travel Expense $9,100 b) Dr. Travel Expense $9,100; Cr. Cash $9,100 O Dr. Rent Expense $9,100; Cr. Cash $9,100 d) Dr. Prepaid Rent $9,100; Cr. Cash $9,100 For the month end (September), how much cash should be presented in the balance sheet? O a) $12,450 b) $49,875 O c) $8,650 $ d) $63,327 Question 18 (1 point) Listen What is the opening balance in the Equipment Account in the ledger? a) $77,000 Ob) $52,000 $ c) $65,800 d) $22,200 Question 19 (1 point) Listen On September 30, BW Travel and Tours paid the interest portion of the loan, it: Reduces owner's equity Increases owner's equity Has nothing to do with owner's equity Could increase or decrease owner's equity Question 20 (1 point) Listen How much is the total of the Adjustments debit column on the Worksheet? O a) $23.260 5 b) $22,600 c) $23,750 d) $23,645 Listen Glacier Company purchased a machine which was installed and put into service on January 1, 2019 at a total cost of $128,000. Residual value was estimated at $8,000. The machine is being depreciated over eight years. How much is the depreciation for the year? a) $15,000 $ b) $17,000 c) $16,000 d) $14,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started