Answered step by step

Verified Expert Solution

Question

1 Approved Answer

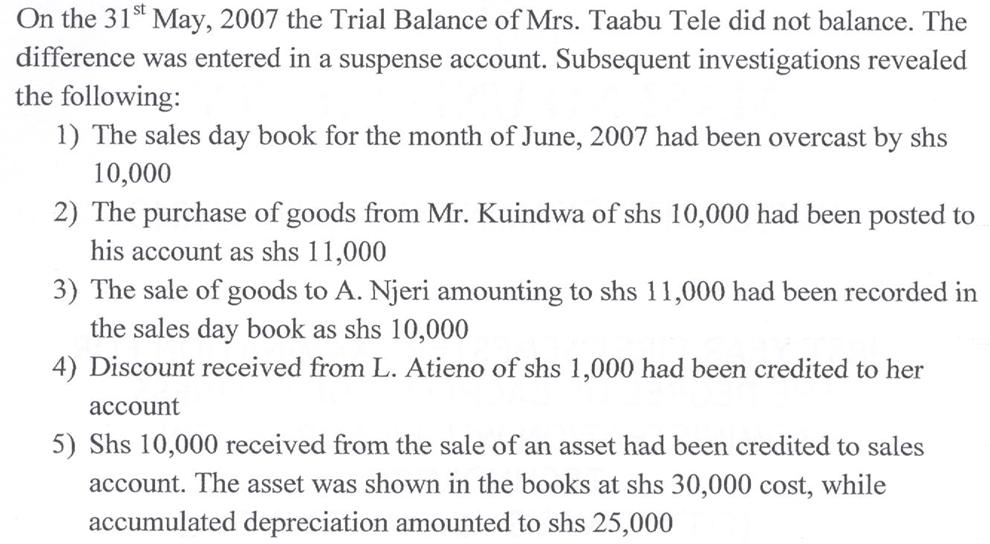

On the 31st May, 2007 the Trial Balance of Mrs. Taabu Tele did not balance. The difference was entered in a suspense account. Subsequent

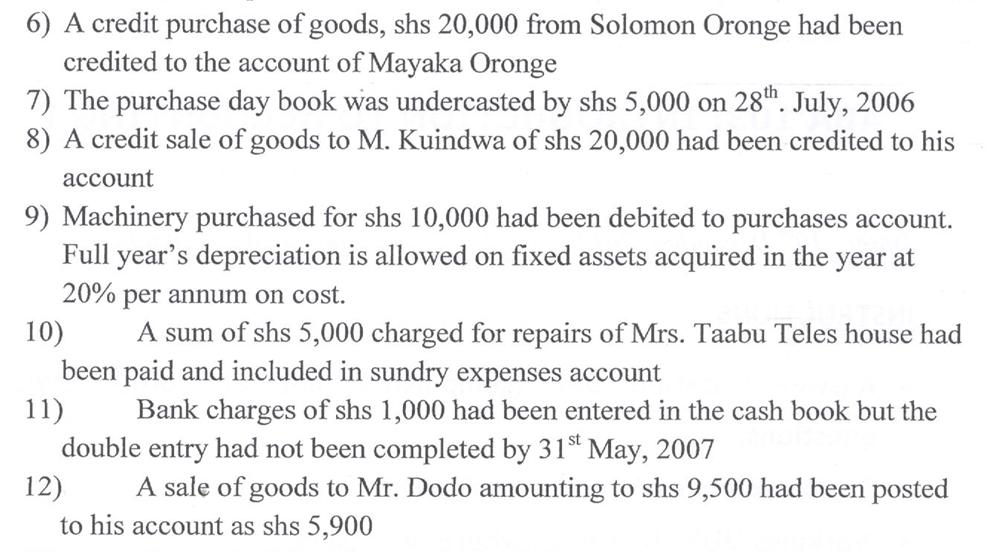

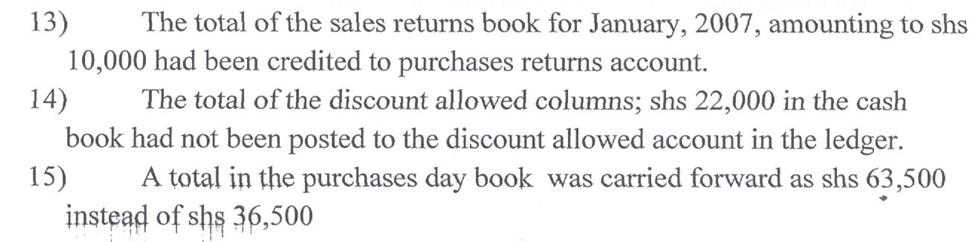

On the 31st May, 2007 the Trial Balance of Mrs. Taabu Tele did not balance. The difference was entered in a suspense account. Subsequent investigations revealed the following: 1) The sales day book for the month of June, 2007 had been overcast by shs 10,000 2) The purchase of goods from Mr. Kuindwa of shs 10,000 had been posted to his account as shs 11,000 3) The sale of goods to A. Njeri amounting to shs 11,000 had been recorded in the sales day book as shs 10,000 4) Discount received from L. Atieno of shs 1,000 had been credited to her account 5) Shs 10,000 received from the sale of an asset had been credited to sales account. The asset was shown in the books at shs 30,000 cost, while accumulated depreciation amounted to shs 25,000 6) A credit purchase of goods, shs 20,000 from Solomon Oronge had been credited to the account of Mayaka Oronge 7) The purchase day book was undercasted by shs 5,000 on 28th. July, 2006 8) A credit sale of goods to M. Kuindwa of shs 20,000 had been credited to his account 9) Machinery purchased for shs 10,000 had been debited to purchases account. Full year's depreciation is allowed on fixed assets acquired in the year at 20% per annum on cost. 10) A sum of shs 5,000 charged for repairs of Mrs. Taabu Teles house had been paid and included in sundry expenses account 11) Bank charges of shs 1,000 had been entered in the cash book but the double entry had not been completed by 31st May, 2007 12) A sale of goods to Mr. Dodo amounting to shs 9,500 had been posted to his account as shs 5,900 13) The total of the sales returns book for January, 2007, amounting to shs 10,000 had been credited to purchases returns account. 14) The total of the discount allowed columns; shs 22,000 in the cash book had not been posted to the discount allowed account in the ledger. A total in the purchases day book was carried forward as shs 63,500 instead of shs 36,500 15) 16) A page in the sales day book, totaling shs 65,000 was omitted from the amount posted to sales account. Required: a) Journal entries to correct the above errors and omissions b) The suspense account to clear the difference (26 marks)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Journal Entries 1 Sales Day Book Overca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started