Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on the basis of CRA Income Tax and Benefit Return form. employment income= Rental income= Taxable capital gains= business income= Provincial or territorial credits= can

on the basis of CRA Income Tax and Benefit Return form.

employment income=

Rental income=

Taxable capital gains=

business income=

Provincial or territorial credits=

can I have the answer step by step.

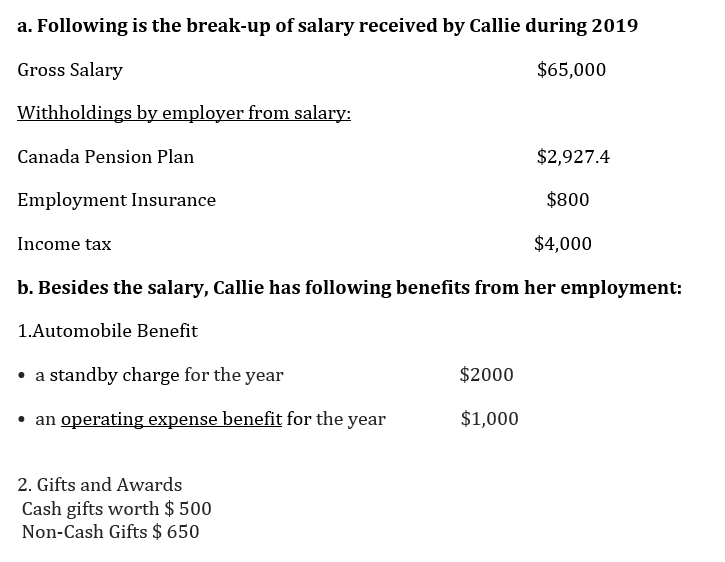

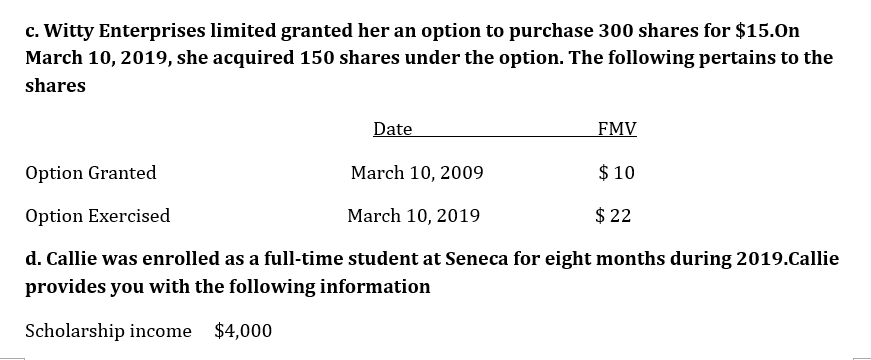

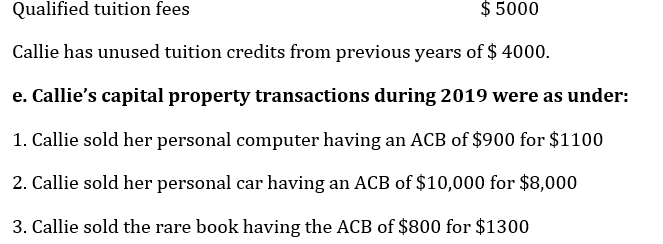

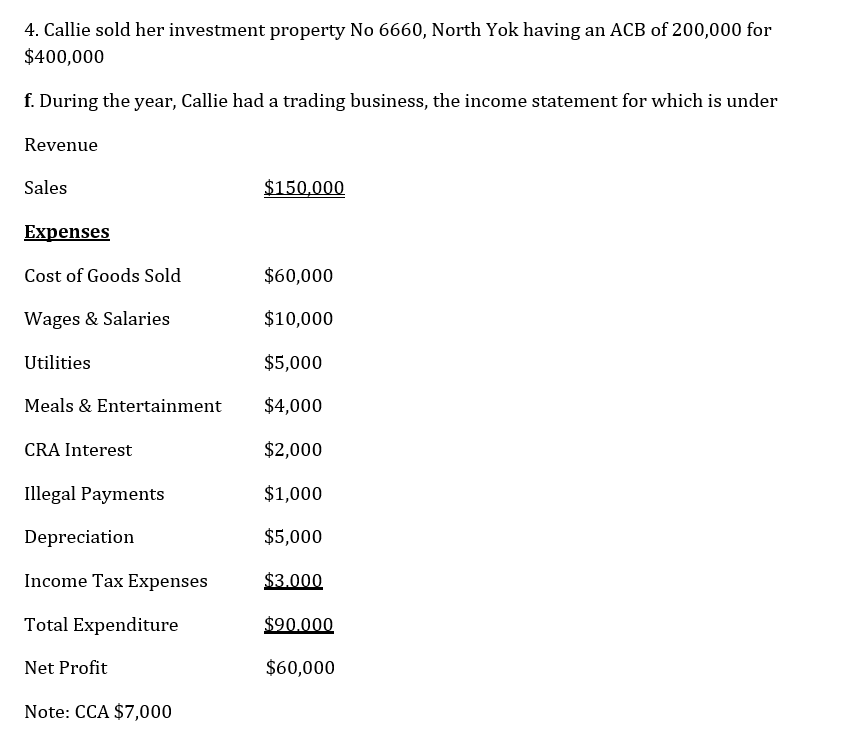

a. Following is the break-up of salary received by Callie during 2019 Gross Salary $65,000 Withholdings by employer from salary: Canada Pension Plan $2,927.4 Employment Insurance $800 Income tax $4,000 b. Besides the salary, Callie has following benefits from her employment: 1.Automobile Benefit a standby charge for the year $2000 an operating expense benefit for the year $1,000 2. Gifts and Awards Cash gifts worth $ 500 Non-Cash Gifts $ 650 c. Witty Enterprises limited granted her an option to purchase 300 shares for $15.On March 10, 2019, she acquired 150 shares under the option. The following pertains to the shares Date FMV Option Granted March 10, 2009 $ 10 Option Exercised March 10, 2019 $ 22 d. Callie was enrolled as a full-time student at Seneca for eight months during 2019.Callie provides you with the following information Scholarship income $4,000 Qualified tuition fees $ 5000 Callie has unused tuition credits from previous years of $ 4000. e. Callie's capital property transactions during 2019 were as under: 1. Callie sold her personal computer having an ACB of $900 for $1100 2. Callie sold her personal car having an ACB of $10,000 for $8,000 3. Callie sold the rare book having the ACB of $800 for $1300 4. Callie sold her investment property No 6660, North Yok having an ACB of 200,000 for $400,000 f. During the year, Callie had a trading business, the income statement for which is under Revenue Sales $150.000 Expenses Cost of Goods Sold $60,000 Wages & Salaries $10,000 Utilities $5,000 Meals & Entertainment $4,000 CRA Interest $2,000 Illegal Payments $1,000 Depreciation $5,000 Income Tax Expenses $3.000 Total Expenditure $90.000 Net Profit $60,000 Note: CCA $7,000 g. During the year, Callie had a gross rental income of $30,000 from her residential property. Callie spent $ 4,500 on repairs and maintenance of the said property. a. Following is the break-up of salary received by Callie during 2019 Gross Salary $65,000 Withholdings by employer from salary: Canada Pension Plan $2,927.4 Employment Insurance $800 Income tax $4,000 b. Besides the salary, Callie has following benefits from her employment: 1.Automobile Benefit a standby charge for the year $2000 an operating expense benefit for the year $1,000 2. Gifts and Awards Cash gifts worth $ 500 Non-Cash Gifts $ 650 c. Witty Enterprises limited granted her an option to purchase 300 shares for $15.On March 10, 2019, she acquired 150 shares under the option. The following pertains to the shares Date FMV Option Granted March 10, 2009 $ 10 Option Exercised March 10, 2019 $ 22 d. Callie was enrolled as a full-time student at Seneca for eight months during 2019.Callie provides you with the following information Scholarship income $4,000 Qualified tuition fees $ 5000 Callie has unused tuition credits from previous years of $ 4000. e. Callie's capital property transactions during 2019 were as under: 1. Callie sold her personal computer having an ACB of $900 for $1100 2. Callie sold her personal car having an ACB of $10,000 for $8,000 3. Callie sold the rare book having the ACB of $800 for $1300 4. Callie sold her investment property No 6660, North Yok having an ACB of 200,000 for $400,000 f. During the year, Callie had a trading business, the income statement for which is under Revenue Sales $150.000 Expenses Cost of Goods Sold $60,000 Wages & Salaries $10,000 Utilities $5,000 Meals & Entertainment $4,000 CRA Interest $2,000 Illegal Payments $1,000 Depreciation $5,000 Income Tax Expenses $3.000 Total Expenditure $90.000 Net Profit $60,000 Note: CCA $7,000 g. During the year, Callie had a gross rental income of $30,000 from her residential property. Callie spent $ 4,500 on repairs and maintenance of the said property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started