Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Once you have completed the assignment below, you must submit your answers using the answer sheet provided in Canvas; not all answers will be

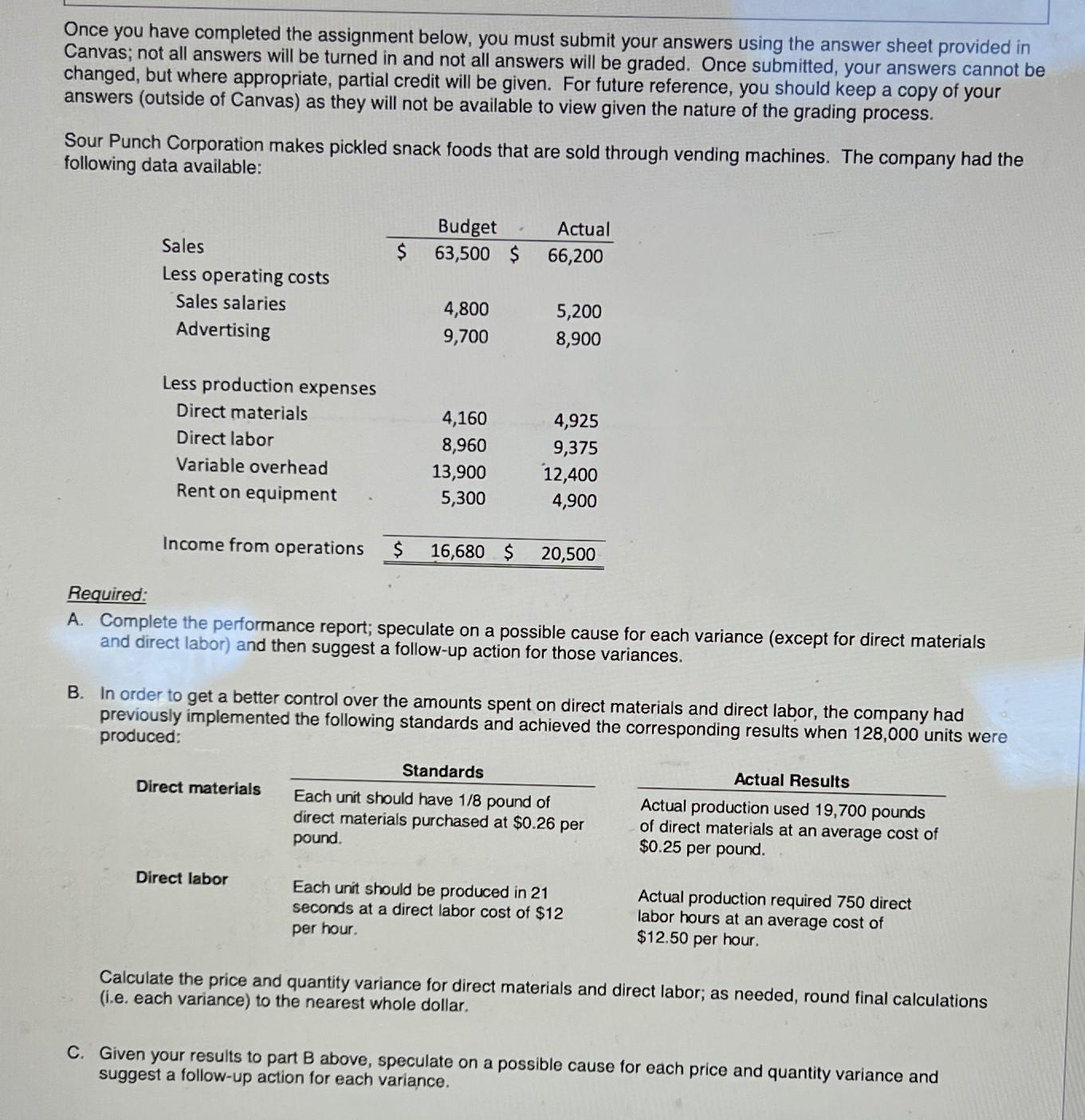

Once you have completed the assignment below, you must submit your answers using the answer sheet provided in Canvas; not all answers will be turned in and not all answers will be graded. Once submitted, your answers cannot be changed, but where appropriate, partial credit will be given. For future reference, you should keep a copy of answers (outside of Canvas) as they will not be available to view given the nature of the grading process. your Sour Punch Corporation makes pickled snack foods that are sold through vending machines. The company had the following data available: Sales $ Budget 63,500 $ Actual 66,200 Less operating costs Sales salaries 4,800 5,200 Advertising 9,700 8,900 Less production expenses Direct materials 4,160 4,925 Direct labor 8,960 9,375 Variable overhead 13,900 12,400 Rent on equipment 5,300 4,900 Income from operations $ 16,680 $ 20,500 Required: A. Complete the performance report; speculate on a possible cause for each variance (except for direct materials and direct labor) and then suggest a follow-up action for those variances. B. In order to get a better control over the amounts spent on direct materials and direct labor, the company had previously implemented the following standards and achieved the corresponding results when 128,000 units were produced: Direct materials Direct labor Standards Each unit should have 1/8 pound of direct materials purchased at $0.26 per pound. Each unit should be produced in 21 seconds at a direct labor cost of $12 per hour. Actual Results Actual production used 19,700 pounds of direct materials at an average cost of $0.25 per pound. Actual production required 750 direct labor hours at an average cost of $12.50 per hour. Calculate the price and quantity variance for direct materials and direct labor; as needed, round final calculations (i.e. each variance) to the nearest whole dollar. C. Given your results to part B above, speculate on a possible cause for each price and quantity variance and suggest a follow-up action for each variance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Performance Report and Variances Budgeted Sales 63500 Actual Sales 66200 Operating Costs Budgeted 66200 Actual 63500 Variance 2700 Favorable Possible Cause The favorable variance in operating costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started