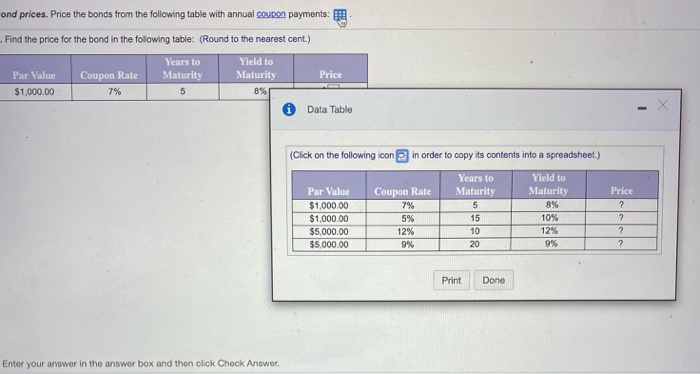

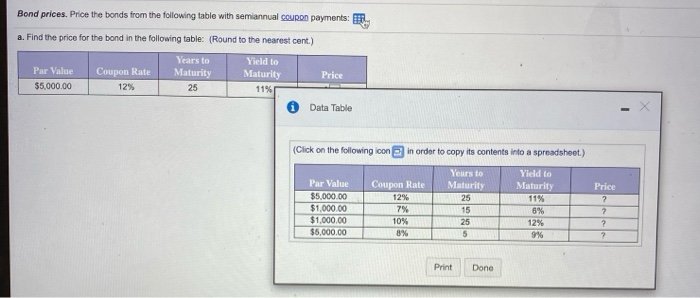

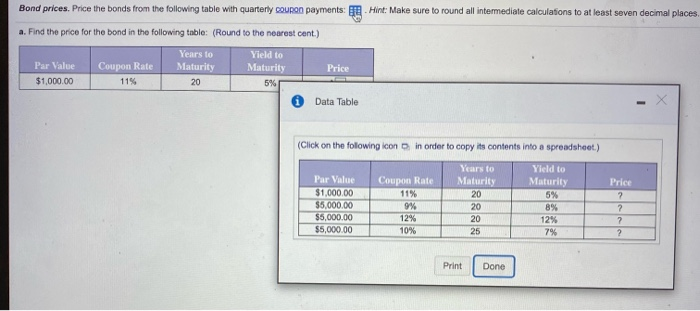

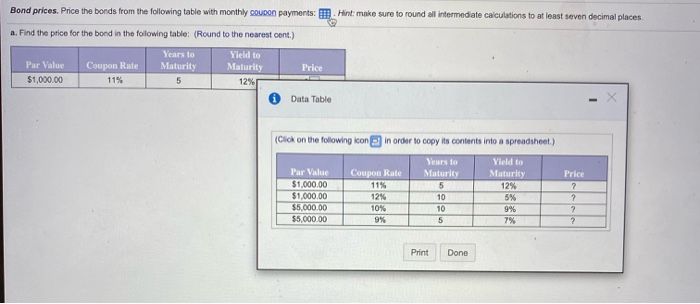

ond prices. Price the bonds from the following table with annual Coupon payments: Find the price for the bond in the following table: (Round to the nearest cent) Yield to Maturity Years to Maturity 5 Par Value $1,000. 00 Price Coupon Rate 7 % i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Coupon Rate 7% Par Value $1,000.00 $1,000.00 $5,000.00 $5,000.00 Years to Yield to Maturity Maturity Price 58% 7 15 10% 7 10 12% 209% 5% 12% 9% Print Done Enter your answer in the answer box and then click Check Answer. Bond prices. Price the bonds from the following table with semiannual coupon payments: a. Find the price for the bond in the following table (Round to the nearest cont.) Par Value $5,000.00 Years to Maturity 25 Coupon Rate 12% Price Yield to Maturity 11% 0 Data Table (Click on the following on in order to copy its contents into a spreadsheet.) Years to Maturity Yield to Maturity Coupon Rate Price 12 91% Par Value $5,000.00 $1,000.00 $1,000.00 $5,000.00 10% 0% 12% 9% Print Done Bond prices. Price the bonds from the following table with quarterly coupon payments: Hint: Make sure to round all intermediate calculations to at least seven decimal places a. Find the price for the bond in the following table: (Round to the nearest cant) Yield to Maturity Years to Maturity 20 Par Value $1,000.00 Price Coupon Rate 11% 0 Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Years to Maturity Yield to Maturity Coupon Rate 20 Par Value $1,000.00 $5,000.00 $5.000.00 $5,000.00 20 1046 Print Done Bond prices. Price the bonds from the following table with monthly coupon payments: Hint: make sure to round all intermediate calculations to at least seven decimal places. a. Find the price for the bond in the following table: (Round to the nearest cont.) Years to Maturity Yield to Maturity Price Par Value $1,000.00 Coupon Rate 11% 0 Data Table (Click on the folowing icon in order to copy its contents into a spreadsheet.) Years to Maturity Yieki to Maturity Coupon Rate Price 11% Par Value $1.000.00 $1,000.00 55.60000 $5,000.00 5255 10% 9 Print Done