Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SHOW STEP BY STEP PLEASE The table for credit spread is required for question 1 !!!!!!! CHAPTER 9 | Debt Valuation and Interest Rates Mini-Case

SHOW STEP BY STEP PLEASE

The table for credit spread is required for question 1 !!!!!!!

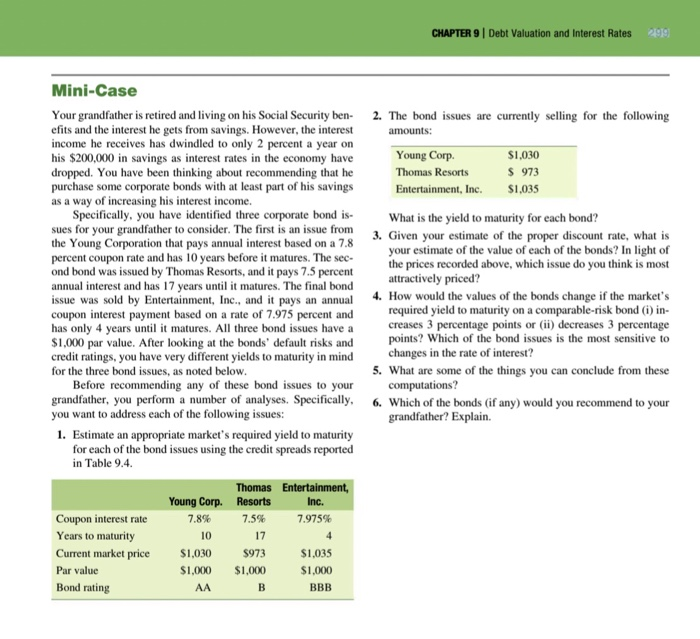

CHAPTER 9 | Debt Valuation and Interest Rates Mini-Case Your grandfather is retired and living on his Social Security ben- efits and the interest he gets from savings. However, the interest income he receives has dwindled to only 2 percent a year on his $200,000 in savings as interest rates in the economy have dropped. You have been thinking about recommending that he purchase some corporate bonds with at least part of his savings as a way of increasing his interest income 2. The bond issues are currently selling for the following Young Corp. Thomas Resorts Entertainment, Inc. $1,030 S 973 $1,035 Specifically, you have identified three corporate bond is- sues for your grandfather to consider. The first is an issue from the Young Corporation that pays annual interest based on a 7.8 What is the yield to maturity for each bond? 3. Given your estimate of the proper discount rate, what is your estimate of the value of each of the bonds? In light of percent coupon rate and has 10 years before it matures. The sec- the prices recorded above, which issue do you think is most ond bond was issued by Thomas Resorts, and it pays 7.5 percent annual interest and has 17 years until it matures. The final bond issue was sold by Entertainment, Inc., and it pays an annual attractively priced? . How would the values of the bonds change if the market's coupon interest payment based on a rate of 7.975 percent and required yield to maturity on a comparable-risk bond (i) in- has only 4 years until it matures. All three bond issues have a creases 3 percentage points or (ii) decreases 3 percentage 1,000 par value. After looking at the bonds' default risks and points? Which of the bond issues is the most sensitive to credit ratings, you have very different yields to maturity in mind for the three bond issues, as noted below changes in the rate of interest? 5. What are some of the things you can conclude from these Before recommending any of these bond issues to your computations? grandfather, you perform a number of analyses. Specifically,6. Which of the bonds (if any) would you recommend to your you want to address each of the following issues: grandfather? Explain. 1. Estimate an appropriate market's required yield to maturity for each of the bond issues using the credit spreads reported in Table 9.4 Young Corp. Resorts 7.5% 17 973 $1,000 $1,000 7.975% Coupon interest rate Years to maturity Current market price $1,030 Par value Bond rating 7.8% 10 $1,035 $1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started