Question

One of the key comments from the SEC in its June 29, 2011, letter to Groupon involved Groupon's choice between gross and net reporting for

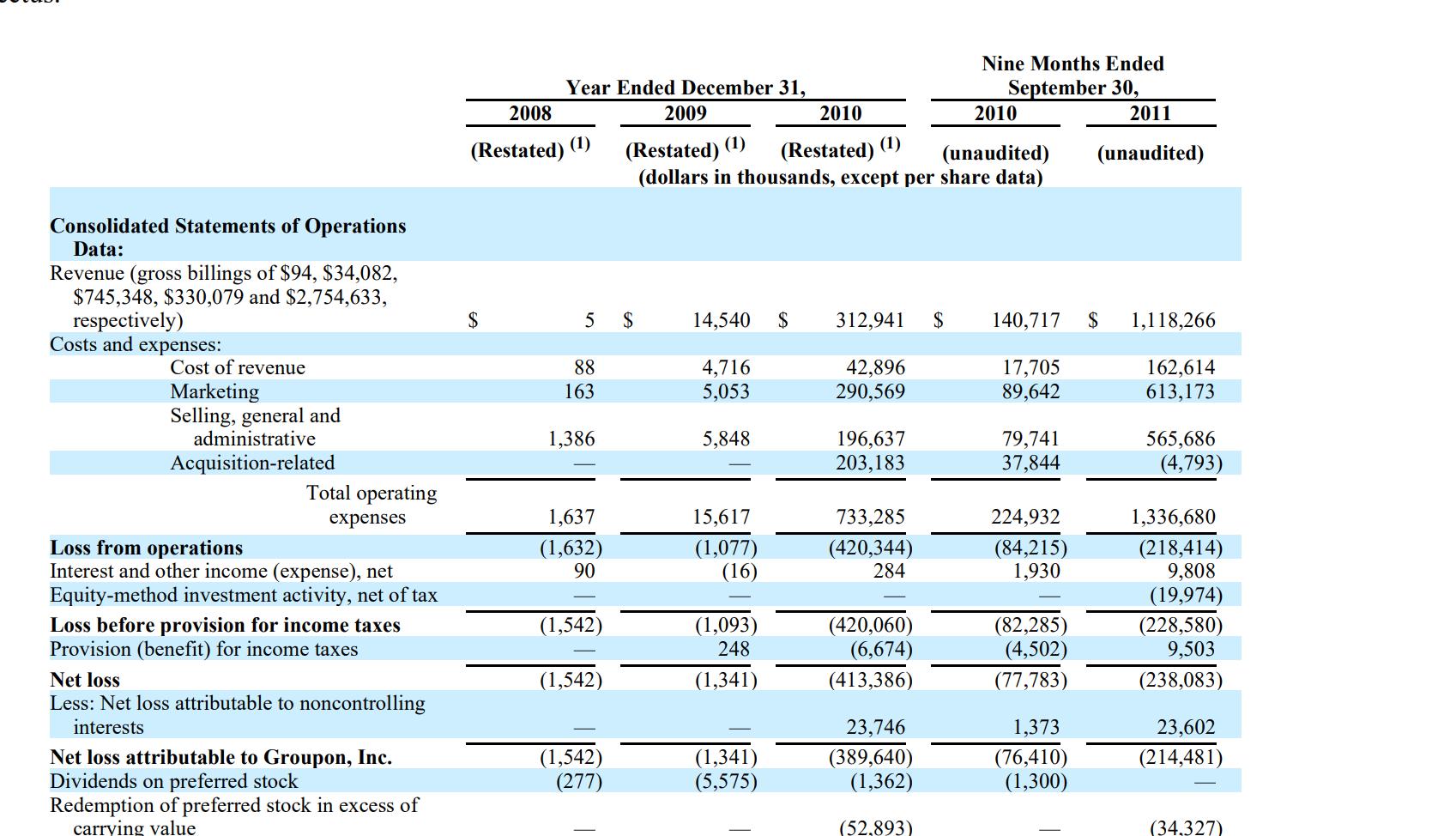

One of the key comments from the SEC in its June 29, 2011, letter to Groupon involved Groupon's choice between gross and net reporting for revenues.

Compare the reported revenues, for fiscal years 2008, 2009, and 2010, in the original S-1 (June 2, 2011) and in the amended S-1 (November 1, 2011). What was the cause the changes? Did the changes have a material effect on reported revenues, cost of revenue and gross margin? Show calculations to support your conclusion on materiality.

Which of the two approaches do you think Groupon preferred? Why did they prefer it? Do you agree with Groupon or the SEC on this matter? Briefly explain?

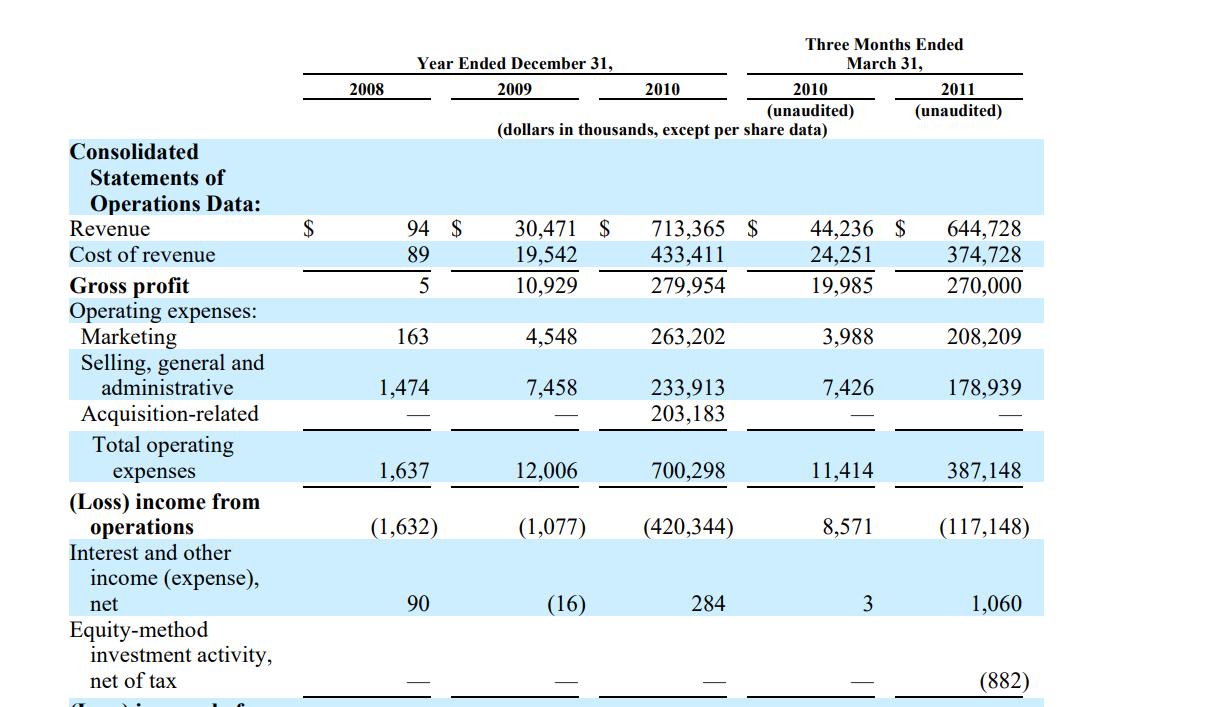

Consolidated Statements of Operations Data: Revenue Cost of revenue Gross profit Operating expenses: Marketing Selling, general and administrative Acquisition-related Total operating expenses (Loss) income from operations Interest and other income (expense), net Equity-method investment activity, net of tax $ 2008 Year Ended December 31, 94 $ 89 5 163 1,474 1,637 (1,632) 90 2009 2010 (unaudited) (dollars in thousands, except per share data) 30,471 $ 713,365 $ 19,542 433,411 10,929 279,954 4,548 7,458 12,006 2010 (1,077) (16) 263,202 233,913 203,183 700,298 (420,344) Three Months Ended March 31, 284 44,236 $ 24,251 19,985 3,988 7,426 11,414 8,571 3 2011 (unaudited) 644,728 374,728 270,000 208,209 178,939 387,148 (117,148) 1,060 (882)

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To compare the reported revenues for fiscal years 2008 2009 and 2010 in the original S1 June 2 2011 and the amended S1 November 1 2011 we need to exam...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started