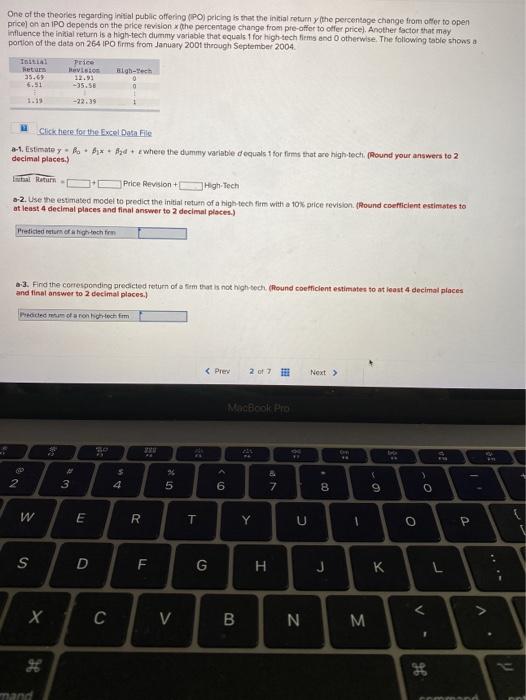

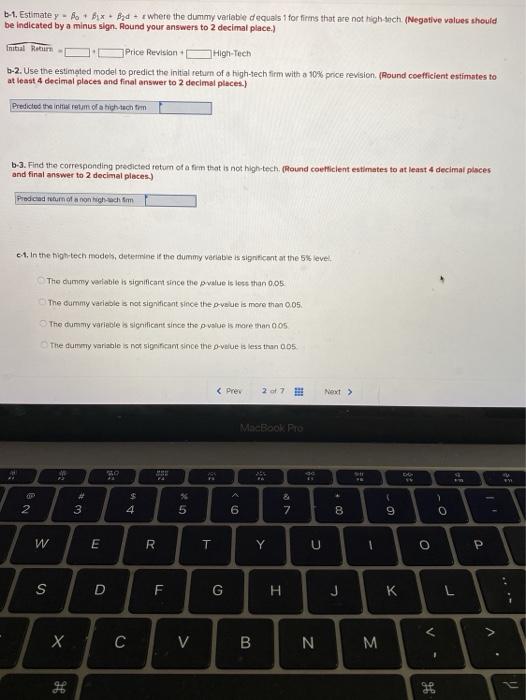

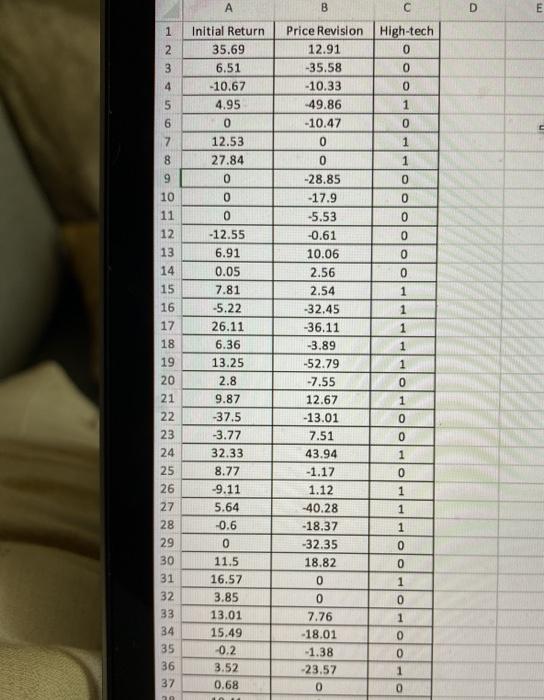

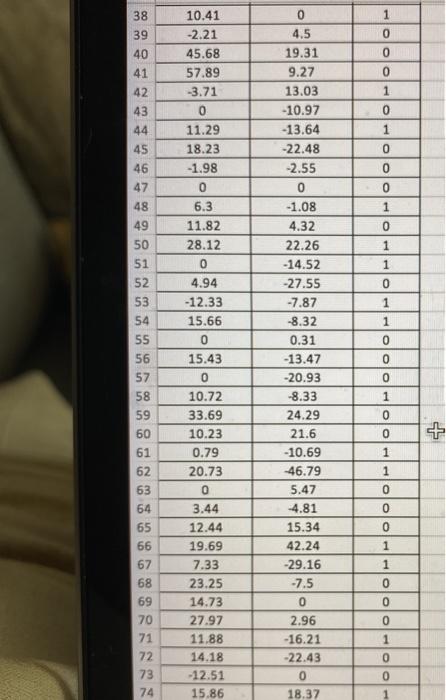

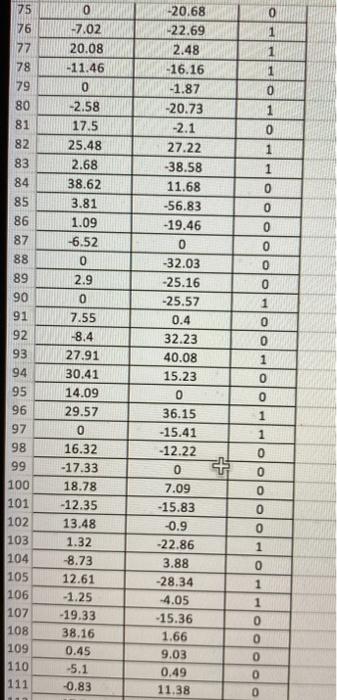

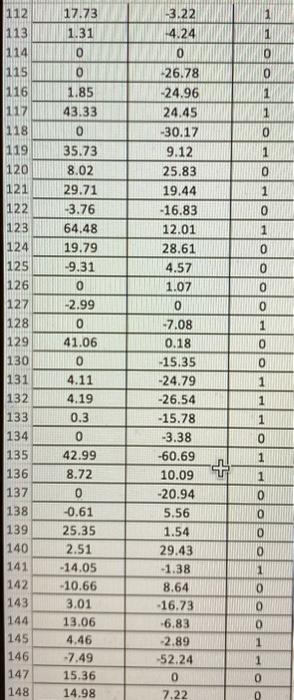

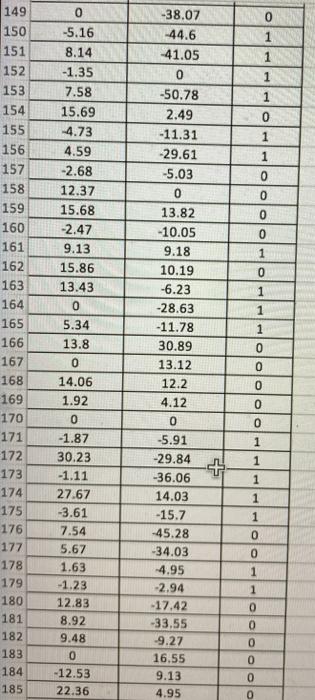

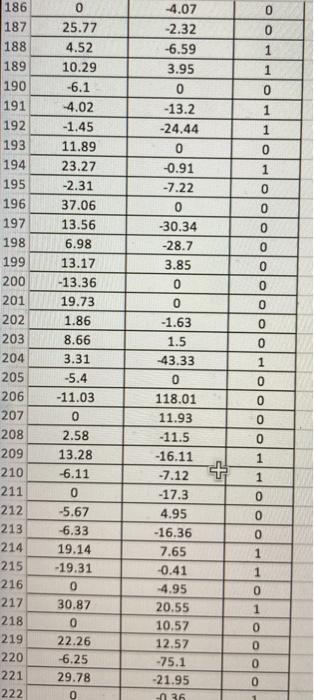

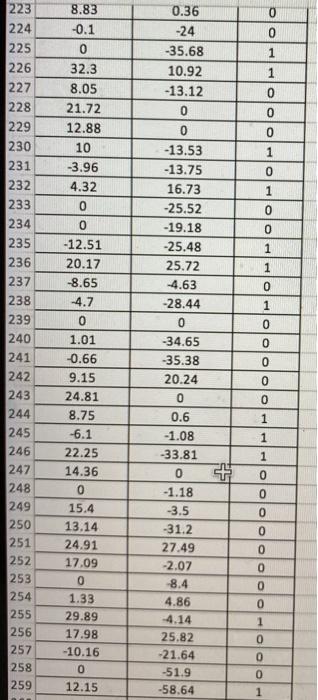

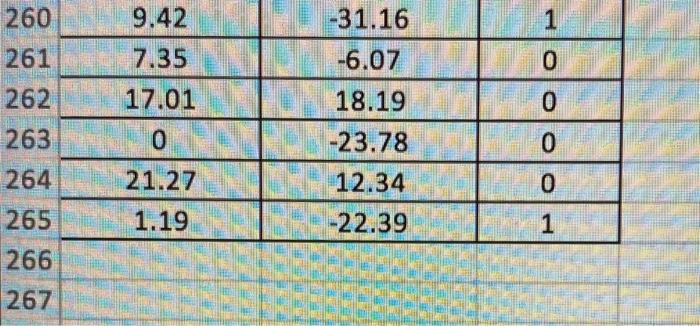

One of the theories regarding initial public offering (PO) pricing is that the initial return the percentage change from offer to open price on an IPO depends on the price revision (the percentage change from pre-offer to offer price). Another factor that may influence the initial return is a high-tech dummy variable that equals 1 for high tech firms and otherwise. The following table shows a portion of the data on 264 IPO firms from January 2001 through September 2004 Total Price Return BV Bigbrech 35.6) 12.93 6.51 -22.39 Click here for the Excel Data File -1. Estimate y ... Byx x where the dummy variable dequals 1 for firms that are high-tech (Pound your answers to 2 decimal places.) al Rom Price Revision + High Tech 3-2. Use the estimated model to predict the initial return of a high tech firm with a 10% price revision (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Praticien of high tech from 2. Find the corresponding predicted return of a firm that is not high tech Mound coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicted moroch lech fm MacBook Pro 5 NB > % 5 3 BA 7 6 8 9 1. o w E R T Y U 1 0 S D F G H J K L X C V 00 N M : " and b-1. Estimate y - Bo Bix Bads where the dummy variable d equals 1 for finns that are not high tech. (Negative values should be indicated by a minus sign. Round your answers to 2 decimal place) Initial Return Price Revision High-Tech b-2. Use the estimated model to predict the initial retum of a high-tech firm with a 10% price revision (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicted the interesum of a high-tech tim b-3. Find the corresponding predicted return of a firm that is not high-tech (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicad turn of a non ho chim 0-1. In the high-tech models, determine if the dummy variable is significant at the 5% level The dummy variable is significant since the value is less than 0.05 The dummy variable is not significant since the p vawe is more than 0.06. The dummy variable significant since the value is more than 005 The dummy variables no significant since the p-value is less than 005 MacBook Pro FB * - P 2 $ 4 3 7 GS 5 6 1 0 00 9 W E R T Y U 1 O S D F G H J K L V > C V 00 N. M E 9 c-2. In the not high-tech models, determine if the dummy variable is significant at the 5% level. The dummy variable is significant since the p-value is less than 0.05. The dummy variable is not significant since the p-value is more than 0.05. The dummy variable is significant since the p-value is more than 0.05. The dummy variable is not significant since the p-value is less than 0.05. B D E 1 2 3 4 5 Initial Return 35.69 6.51 -10.67 4.95 0 12.53 27.84 0 Price Revision High-tech 12.91 0 -35.58 0 -10.33 0 -49.86 -10.47 0 0 1 6 7 8 9 1 0 0 0 0 0 10 11 12 13 14 15 16 17 18 19 20 0 0 1 1 21 0 -12.55 6.91 0.05 7.81 -5.22 26.11 6.36 13.25 2.8 9.87 -37.5 -3.77 32.33 8.77 -9.11 5.64 -0.6 0 11.5 16.57 3.85 13.01 15.49 -0.2 3.52 0.68 0 -28.85 -17.9 -5.53 -0.61 10.06 2.56 2.54 -32.45 -36.11 -3.89 -52.79 -7.55 12.67 -13.01 7.51 43.94 -1.17 1.12 -40.28 -18.37 -32.35 18.82 0 0 7.76 -18.01 -1.38 -23.57 0 1 1 1 0 1 0 0 1 0 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 1 1 1 0 0 1 0 1 0 0 1 0 38 1 39 40 41 0 0 42 0 4.5 19.31 9.27 13.03 -10.97 - 13.64 -22.48 -2.55 0 1 0 1 0 0 -1.08 1 0 1 1 0 1 1 10.41 -2.21 45.68 57.89 -3.71 0 11.29 18.23 -1.98 0 6.3 11.82 28.12 0 4.94 -12.33 15.66 0 15.43 0 10.72 33.69 10.23 0.79 20.73 0 3.44 12.44 19.69 7.33 23.25 14.73 27.97 11.88 14.18 -12.51 15.86 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 0 0 0 1 0 0 1 5 4.32 22.26 -14.52 -27.55 -7.87 -8.32 0.31 -13.47 -20.93 -8.33 24.29 21.6 -10.69 -46.79 5.47 4.81 15.34 42.24 -29.16 -7.5 0 2.96 -16.21 -22.43 0 18.37 OP 0 0 1 1 Oo 0 0 1 0 0 75 0 1 0 -7.02 20.08 -11.46 1 0 1 0 1 76 77 78 79 80 81 82 83 84 85 86 0 -2.58 17.5 25.48 2.68 38.62 3.81 1.09 -6.52 0 1 1 0 0 0 88 89 90 2.9 0 0 0 0 1 0 92 93 94 -20.68 -22.69 2.48 -16.16 -1.87 -20.73 -2.1 27.22 -38.58 11.68 -56.83 -19.46 0 -32.03 -25.16 -25.57 0.4 32.23 40.08 15.23 0 36.15 -15.41 - 12.22 0 7.09 -15.83 -0.9 -22.86 3.88 -28.34 4.05 -15.36 1.66 9.03 0.49 11.38 0 1 0 0 1 95 96 97 98 1 99 0 0 0 7.55 -8.4 27.91 30.41 14.09 29.57 0 16.32 -17.33 18.78 -12.35 13.48 1.32 -8.73 12.61 -1.25 -19.33 38.16 0.45 -5.1 -0.83 100 101 102 103 104 105 106 107 108 109 110 111 0 0 1 0 1 1 lololololo 1 112 113 114 115 116 0 0 1 117 0 1 0 1 0 1 0 0 0 0 1 0 17.73 1.31 0 0 1.85 43.33 0 35.73 8.02 29.71 -3.76 64.48 19.79 -9.31 0 -2.99 0 41.06 0 4.11 4.19 0.3 0 42.99 8.72 0 -0.61 25.35 2.51 -14.05 -10.66 3.01 13.06 4.46 -7.49 15.36 14.98 -3.22 4.24 0 -26.78 -24.96 24.45 -30.17 9.12 25.83 19.44 -16.83 12.01 28.61 4.57 1.07 0 -7.08 0.18 -15.35 -24.79 -26.54 -15.78 -3.38 -60.69 10.09 -20.94 5.56 1.54 29.43 -1.38 8.64 -16.73 -6.83 -2.89 -52.24 0 7.22 0 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 1 1 1 0 1 + 1 0 0 0 0 1 0 0 0 1 1 0 0 0 0 0 1 1 0 1 1 0 1 0 0 0 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 0 0 0 -4.07 -2.32 -6.59 3.95 0 -13.2 -24.44 0 -0.91 -7.22 0 -30.34 -28.7 3.85 0 0 -1.63 1.5 -43.33 0 118.01 11.93 -11.5 -16.11 0 25.77 4.52 10.29 -6.1 4.02 -1.45 11.89 23.27 -2.31 37.06 13.56 6.98 13.17 -13.36 19.73 1.86 8.66 3.31 -5.4 -11.03 0 2.58 13.28 -6.11 0 -5.67 -6.33 19.14 -19.31 0 30.87 0 22.26 -6.25 29.78 0 0 0 1 0 0 0 0 1 -7.12 1 0 0 0 1 1 0 -17.3 4.95 -16.36 7.65 -0.41 -4.95 20.55 10.57 12.57 -75.1 -21.95 - 36 218 219 220 221 222 1 0 0 0 0 0 8.83 -0.1 0 32.3 0 1 1 0 0 0 8.05 21.72 12.88 10 -3.96 4.32 0 1 0 1 0 0 0 -12.51 20.17 -8.65 -4.7 0 1 1 0 1 0 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 0.36 -24 -35.68 10.92 -13.12 0 0 -13.53 -13.75 16.73 -25.52 -19.18 -25.48 25.72 -4.63 -28.44 0 -34.65 -35.38 20.24 0 0.6 -1.08 -33.81 0 -1.18 -3.5 -31.2 27.49 -2.07 8.4 4.86 -4.14 25.82 -21.64 -51.9 -58.64 0 0 0 0 1 1 1.01 -0.66 9.15 24.81 8.75 -6.1 22.25 14.36 0 15.4 13.14 24.91 17.09 0 1.33 29.89 17.98 -10.16 0 12.15 1 0 0 0 0 0 0 0 0 1 0 0 0 1 -31.16 -6.07 260 9.42 261 7.35 262 17.01 263 0 264 21.27 18.19 GOOOO -23.78 12.34 1.19 -22.39 1 265 266 267 One of the theories regarding initial public offering (PO) pricing is that the initial return the percentage change from offer to open price on an IPO depends on the price revision (the percentage change from pre-offer to offer price). Another factor that may influence the initial return is a high-tech dummy variable that equals 1 for high tech firms and otherwise. The following table shows a portion of the data on 264 IPO firms from January 2001 through September 2004 Total Price Return BV Bigbrech 35.6) 12.93 6.51 -22.39 Click here for the Excel Data File -1. Estimate y ... Byx x where the dummy variable dequals 1 for firms that are high-tech (Pound your answers to 2 decimal places.) al Rom Price Revision + High Tech 3-2. Use the estimated model to predict the initial return of a high tech firm with a 10% price revision (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Praticien of high tech from 2. Find the corresponding predicted return of a firm that is not high tech Mound coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicted moroch lech fm MacBook Pro 5 NB > % 5 3 BA 7 6 8 9 1. o w E R T Y U 1 0 S D F G H J K L X C V 00 N M : " and b-1. Estimate y - Bo Bix Bads where the dummy variable d equals 1 for finns that are not high tech. (Negative values should be indicated by a minus sign. Round your answers to 2 decimal place) Initial Return Price Revision High-Tech b-2. Use the estimated model to predict the initial retum of a high-tech firm with a 10% price revision (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicted the interesum of a high-tech tim b-3. Find the corresponding predicted return of a firm that is not high-tech (Round coefficient estimates to at least 4 decimal places and final answer to 2 decimal places.) Predicad turn of a non ho chim 0-1. In the high-tech models, determine if the dummy variable is significant at the 5% level The dummy variable is significant since the value is less than 0.05 The dummy variable is not significant since the p vawe is more than 0.06. The dummy variable significant since the value is more than 005 The dummy variables no significant since the p-value is less than 005 MacBook Pro FB * - P 2 $ 4 3 7 GS 5 6 1 0 00 9 W E R T Y U 1 O S D F G H J K L V > C V 00 N. M E 9 c-2. In the not high-tech models, determine if the dummy variable is significant at the 5% level. The dummy variable is significant since the p-value is less than 0.05. The dummy variable is not significant since the p-value is more than 0.05. The dummy variable is significant since the p-value is more than 0.05. The dummy variable is not significant since the p-value is less than 0.05. B D E 1 2 3 4 5 Initial Return 35.69 6.51 -10.67 4.95 0 12.53 27.84 0 Price Revision High-tech 12.91 0 -35.58 0 -10.33 0 -49.86 -10.47 0 0 1 6 7 8 9 1 0 0 0 0 0 10 11 12 13 14 15 16 17 18 19 20 0 0 1 1 21 0 -12.55 6.91 0.05 7.81 -5.22 26.11 6.36 13.25 2.8 9.87 -37.5 -3.77 32.33 8.77 -9.11 5.64 -0.6 0 11.5 16.57 3.85 13.01 15.49 -0.2 3.52 0.68 0 -28.85 -17.9 -5.53 -0.61 10.06 2.56 2.54 -32.45 -36.11 -3.89 -52.79 -7.55 12.67 -13.01 7.51 43.94 -1.17 1.12 -40.28 -18.37 -32.35 18.82 0 0 7.76 -18.01 -1.38 -23.57 0 1 1 1 0 1 0 0 1 0 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 1 1 1 0 0 1 0 1 0 0 1 0 38 1 39 40 41 0 0 42 0 4.5 19.31 9.27 13.03 -10.97 - 13.64 -22.48 -2.55 0 1 0 1 0 0 -1.08 1 0 1 1 0 1 1 10.41 -2.21 45.68 57.89 -3.71 0 11.29 18.23 -1.98 0 6.3 11.82 28.12 0 4.94 -12.33 15.66 0 15.43 0 10.72 33.69 10.23 0.79 20.73 0 3.44 12.44 19.69 7.33 23.25 14.73 27.97 11.88 14.18 -12.51 15.86 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 0 0 0 1 0 0 1 5 4.32 22.26 -14.52 -27.55 -7.87 -8.32 0.31 -13.47 -20.93 -8.33 24.29 21.6 -10.69 -46.79 5.47 4.81 15.34 42.24 -29.16 -7.5 0 2.96 -16.21 -22.43 0 18.37 OP 0 0 1 1 Oo 0 0 1 0 0 75 0 1 0 -7.02 20.08 -11.46 1 0 1 0 1 76 77 78 79 80 81 82 83 84 85 86 0 -2.58 17.5 25.48 2.68 38.62 3.81 1.09 -6.52 0 1 1 0 0 0 88 89 90 2.9 0 0 0 0 1 0 92 93 94 -20.68 -22.69 2.48 -16.16 -1.87 -20.73 -2.1 27.22 -38.58 11.68 -56.83 -19.46 0 -32.03 -25.16 -25.57 0.4 32.23 40.08 15.23 0 36.15 -15.41 - 12.22 0 7.09 -15.83 -0.9 -22.86 3.88 -28.34 4.05 -15.36 1.66 9.03 0.49 11.38 0 1 0 0 1 95 96 97 98 1 99 0 0 0 7.55 -8.4 27.91 30.41 14.09 29.57 0 16.32 -17.33 18.78 -12.35 13.48 1.32 -8.73 12.61 -1.25 -19.33 38.16 0.45 -5.1 -0.83 100 101 102 103 104 105 106 107 108 109 110 111 0 0 1 0 1 1 lololololo 1 112 113 114 115 116 0 0 1 117 0 1 0 1 0 1 0 0 0 0 1 0 17.73 1.31 0 0 1.85 43.33 0 35.73 8.02 29.71 -3.76 64.48 19.79 -9.31 0 -2.99 0 41.06 0 4.11 4.19 0.3 0 42.99 8.72 0 -0.61 25.35 2.51 -14.05 -10.66 3.01 13.06 4.46 -7.49 15.36 14.98 -3.22 4.24 0 -26.78 -24.96 24.45 -30.17 9.12 25.83 19.44 -16.83 12.01 28.61 4.57 1.07 0 -7.08 0.18 -15.35 -24.79 -26.54 -15.78 -3.38 -60.69 10.09 -20.94 5.56 1.54 29.43 -1.38 8.64 -16.73 -6.83 -2.89 -52.24 0 7.22 0 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 1 1 1 0 1 + 1 0 0 0 0 1 0 0 0 1 1 0 0 0 0 0 1 1 0 1 1 0 1 0 0 0 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 0 0 0 -4.07 -2.32 -6.59 3.95 0 -13.2 -24.44 0 -0.91 -7.22 0 -30.34 -28.7 3.85 0 0 -1.63 1.5 -43.33 0 118.01 11.93 -11.5 -16.11 0 25.77 4.52 10.29 -6.1 4.02 -1.45 11.89 23.27 -2.31 37.06 13.56 6.98 13.17 -13.36 19.73 1.86 8.66 3.31 -5.4 -11.03 0 2.58 13.28 -6.11 0 -5.67 -6.33 19.14 -19.31 0 30.87 0 22.26 -6.25 29.78 0 0 0 1 0 0 0 0 1 -7.12 1 0 0 0 1 1 0 -17.3 4.95 -16.36 7.65 -0.41 -4.95 20.55 10.57 12.57 -75.1 -21.95 - 36 218 219 220 221 222 1 0 0 0 0 0 8.83 -0.1 0 32.3 0 1 1 0 0 0 8.05 21.72 12.88 10 -3.96 4.32 0 1 0 1 0 0 0 -12.51 20.17 -8.65 -4.7 0 1 1 0 1 0 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 0.36 -24 -35.68 10.92 -13.12 0 0 -13.53 -13.75 16.73 -25.52 -19.18 -25.48 25.72 -4.63 -28.44 0 -34.65 -35.38 20.24 0 0.6 -1.08 -33.81 0 -1.18 -3.5 -31.2 27.49 -2.07 8.4 4.86 -4.14 25.82 -21.64 -51.9 -58.64 0 0 0 0 1 1 1.01 -0.66 9.15 24.81 8.75 -6.1 22.25 14.36 0 15.4 13.14 24.91 17.09 0 1.33 29.89 17.98 -10.16 0 12.15 1 0 0 0 0 0 0 0 0 1 0 0 0 1 -31.16 -6.07 260 9.42 261 7.35 262 17.01 263 0 264 21.27 18.19 GOOOO -23.78 12.34 1.19 -22.39 1 265 266 267