Answered step by step

Verified Expert Solution

Question

1 Approved Answer

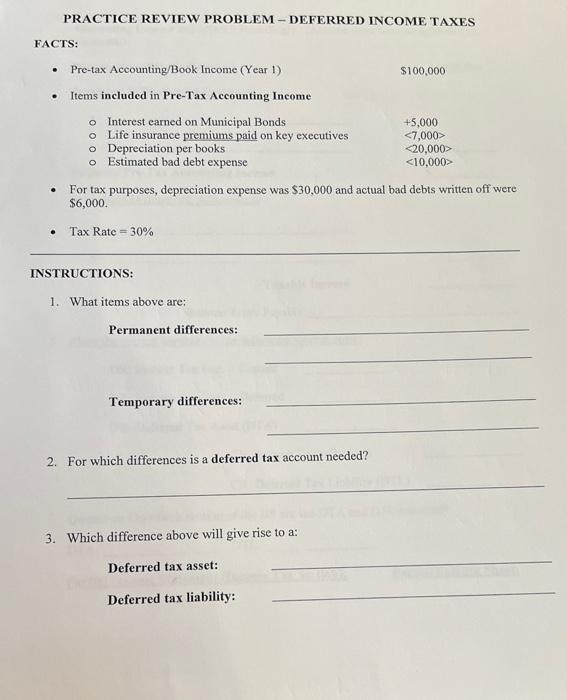

one question PRACTICE REVIEW PROBLEM - DEFERRED INCOME TAXES F - For tax purposes, depreciation expense was $30,000 and actual bad debts written off were

one question

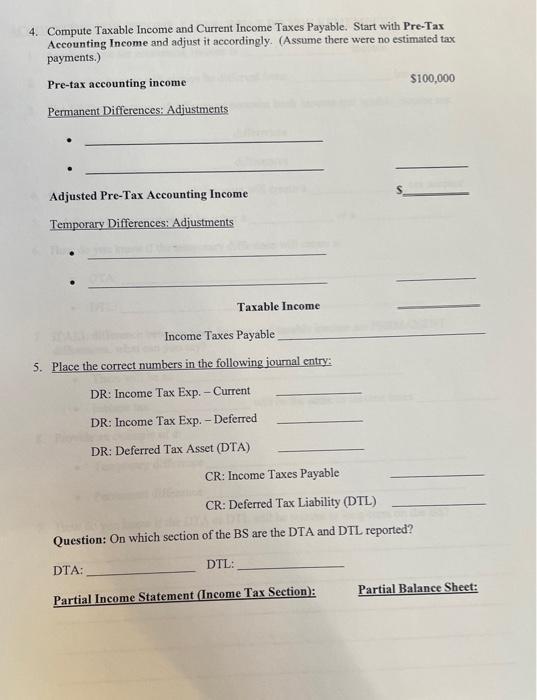

PRACTICE REVIEW PROBLEM - DEFERRED INCOME TAXES F - For tax purposes, depreciation expense was $30,000 and actual bad debts written off were $6,000 - Tax Rate =30% INSTRUCTIONS: 1. What items above are: Permanent differences: Temporary differences: 2. For which differences is a deferred tax account needed? 3. Which difference above will give rise to a: Deferred tax asset: Deferred tax liability: 4. Compute Taxable Income and Current Income Taxes Payable. Start with Pre-Tax Accounting Income and adjust it accordingly. (Assume there were no estimated tax payments.) Pre-tax accounting income $100,000 Permanent Differences: Adjustments Adjusted Pre-Tax Accounting Income Temporary Differences: Adjustments Taxable Income Income Taxes Payable 5. Place the correct numbers in the following journal entry: DR: Income Tax Exp. - Current DR: Income Tax Exp. - Deferred DR: Deferred Tax Asset (DTA)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started