Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One Stop Consulting is preparing year-end financial statements dated December 31, 2019, and has to make several adjustments before the financial statements car be prepared.

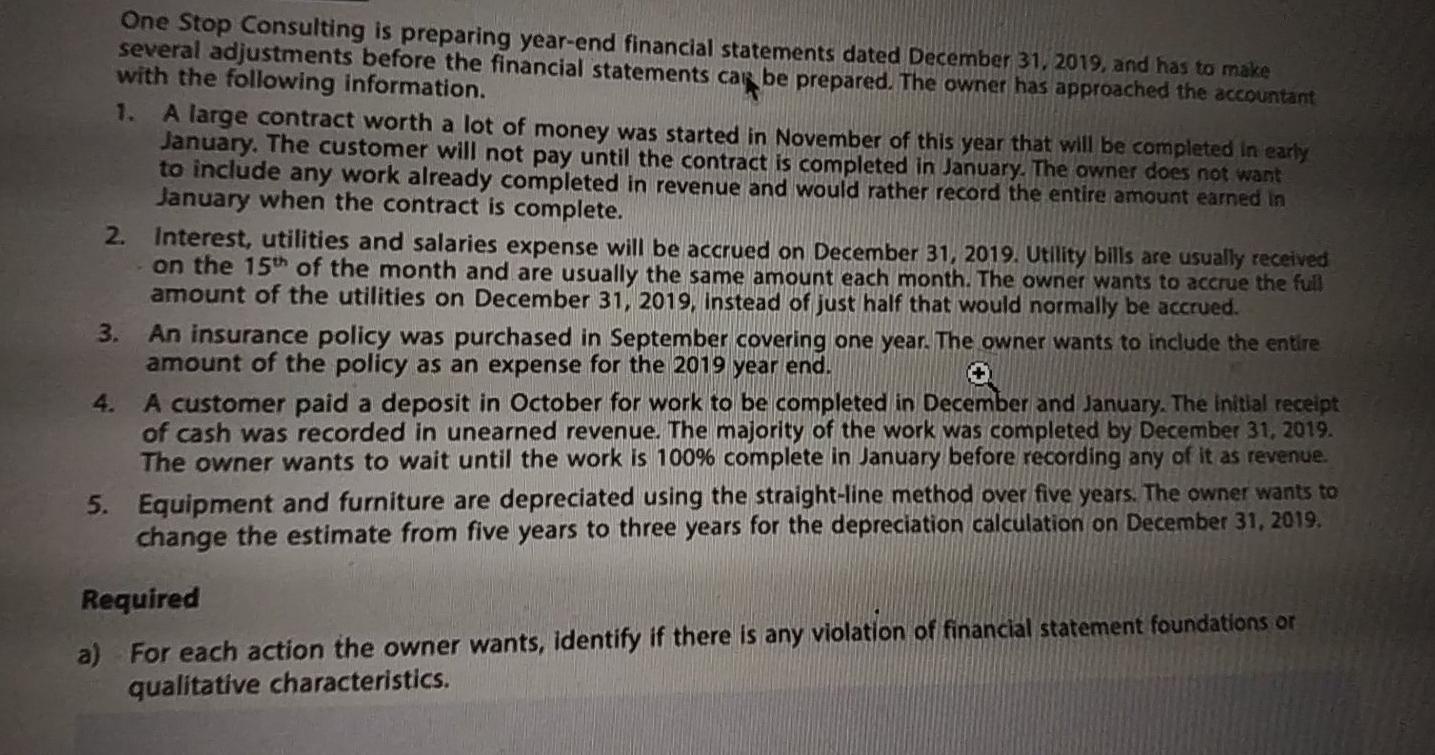

One Stop Consulting is preparing year-end financial statements dated December 31, 2019, and has to make several adjustments before the financial statements car be prepared. The owner has approached the accountant with the following information. 1. A large contract worth a lot of money was started in November of this year that will be completed in early January. The customer will not pay until the contract is completed in January. The owner does not want to include any work already completed in revenue and would rather record the entire amount earned in January when the contract is complete. 2. Interest, utilities and salaries expense will be accrued on December 31, 2019. Utility bills are usually received on the 15th of the month and are usually the same amount each month. The owner wants to accrue the full amount of the utilities on December 31, 2019. Instead of just half that would normally be accrued. 3. An insurance policy was purchased in September covering one year. The owner wants to include the entire amount of the policy as an expense for the 2019 year end. + 4. A customer paid a deposit in October for work to be completed in December and January. The initial receipt of cash was recorded in unearned revenue. The majority of the work was completed by December 31, 2019. The owner want to wait until the work is 100% complete in January before recording any of it as revenue. 5. Equipment and furniture are depreciated using the straight-line method over five years. The owner wants to change the estimate from five years to three years for the depreciation calculation on December 31, 2019. Required a) For each action the owner wants, identify if there is any violation of financial statement foundations or qualitative characteristics

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started