Answered step by step

Verified Expert Solution

Question

1 Approved Answer

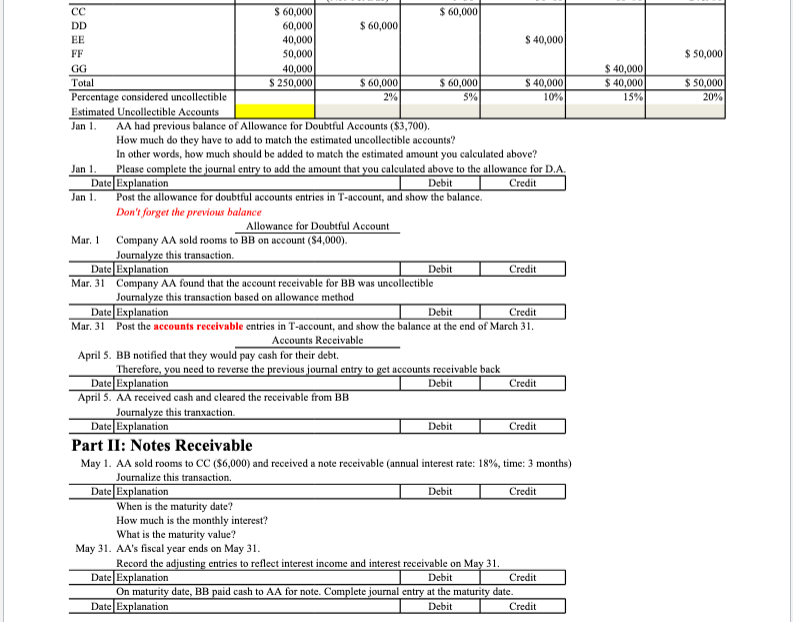

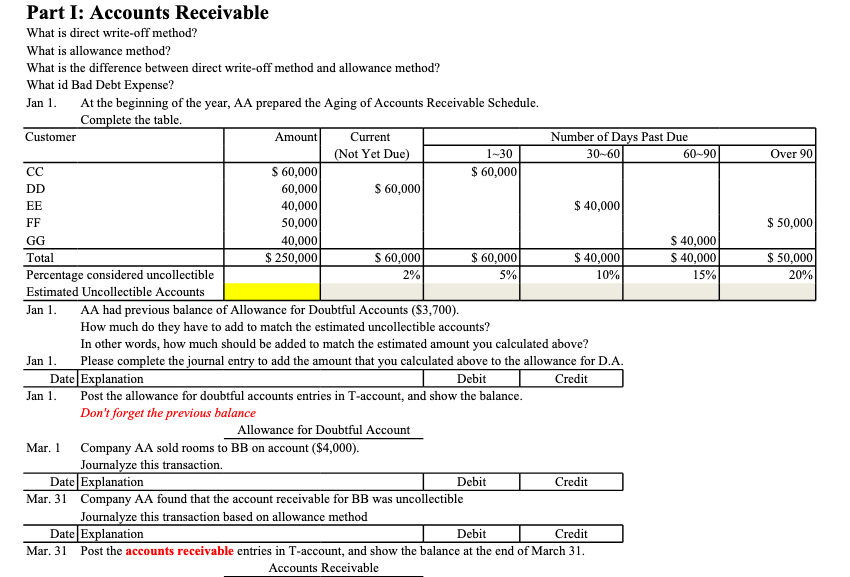

one worksheet hence why it was posted together, can't split the question. tyia! $ 50,000 $ 40,000 $ 40,000 15% $ 50,000 20% CC $

one worksheet hence why it was posted together, can't split the question.

tyia!

$ 50,000 $ 40,000 $ 40,000 15% $ 50,000 20% CC $ 60,000 $ 60,000 DD 60,000 $ 60,000 EE 40,000 $ 40,000 50,000 GG 40,000 Total $ 250,000 $ 60,000 $ 60,000 $ 40,000 Percentage considered uncollectible 2% 5% 10% Estimated Uncollectible Accounts Jan 1. AA had previous balance of Allowance for Doubtful Accounts ($3,700). How much do they have to add to match the estimated uncollectible accounts? In other words, how much should be added to match the estimated amount you calculated above? Jan 1. Please complete the journal entry to add the amount that you calculated above to the allowance for D.A. Date Explanation Debit Credit Jan 1. Post the allowance for doubtful accounts entries in T-account, and show the balance. Don't forget the previous balance Allowance for Doubtful Account Mar. 1 Company AA sold rooms to BB on account ($4,000). Journalyze this transaction Date Explanation Debit Credit Mar 31 Company AA found that the account receivable for BB was uncollectible Journalyze this transaction based on allowance method Date Explanation Debit Credit Mar. 31 Post the accounts receivable entries in T-account, and show the balance at the end of March 31. Accounts Receivable April 5. BB notified that they would pay cash for their debt. Therefore, you need to reverse the previous journal entry to get accounts receivable back Date Explanation Debit Credit April 5. AA received cash and cleared the receivable from BB Journalyze this tranxaction. Date Explanation Debit Credit Part II: Notes Receivable May 1. AA sold rooms to CC ($6,000) and received a note receivable (annual interest rate: 18%, time: 3 months) Journalize this transaction Date Explanation Debit Credit When is the maturity date? How much is the monthly interest? What is the maturity value? May 31. AA's fiscal year ends on May 31. Record the adjusting entries to reflect interest income and interest receivable on May 31. Date Explanation Debit Credit On maturity date, BB paid cash to AA for note. Complete journal entry at the maturity date. Date Explanation Debit Credit Over 90 $ 50,000 $50,000 20% 2% 5% Part I: Accounts Receivable What is direct write-off method? What is allowance method? What is the difference between direct write-off method and allowance method? What id Bad Debt Expense? Jan 1. At the beginning of the year, AA prepared the Aging of Accounts Receivable Schedule. Complete the table. Customer Amount Current Number of Days Past Due (Not Yet Due) 1-30 30-60 60-90 CC $ 60,000 $ 60,000 DD 60,000 $ 60,000 EE 40,000 $ 40,000 FF 50,000 GG 40,000 $ 40,000 Total $ 250,000 $ 60,000 $ 60,000 $ 40,000 $ 40,000 Percentage considered uncollectible 10% 15% Estimated Uncollectible Accounts Jan 1. AA had previous balance of Allowance for Doubtful Accounts ($3,700). How much do they have to add to match the estimated uncollectible accounts? In other words, how much should be added to match the estimated amount you calculated above? Jan 1. Please complete the journal entry to add the amount that you calculated above to the allowance for D.A. Date Explanation Debit Credit Jan 1. Post the allowance for doubtful accounts entries in T-account, and show the balance. Don't forget the previous balance Allowance for Doubtful Account Mar. 1 Company AA sold rooms to BB on account ($4,000). Journalyze this transaction. Date Explanation Debit Credit Mar. 31 Company AA found that the account receivable for BB was uncollectible Journalyze this transaction based on allowance method Date Explanation Debit Credit Mar. 31 Post the accounts receivable entries in T-account, and show the balance at the end of March 31. Accounts ReceivableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started