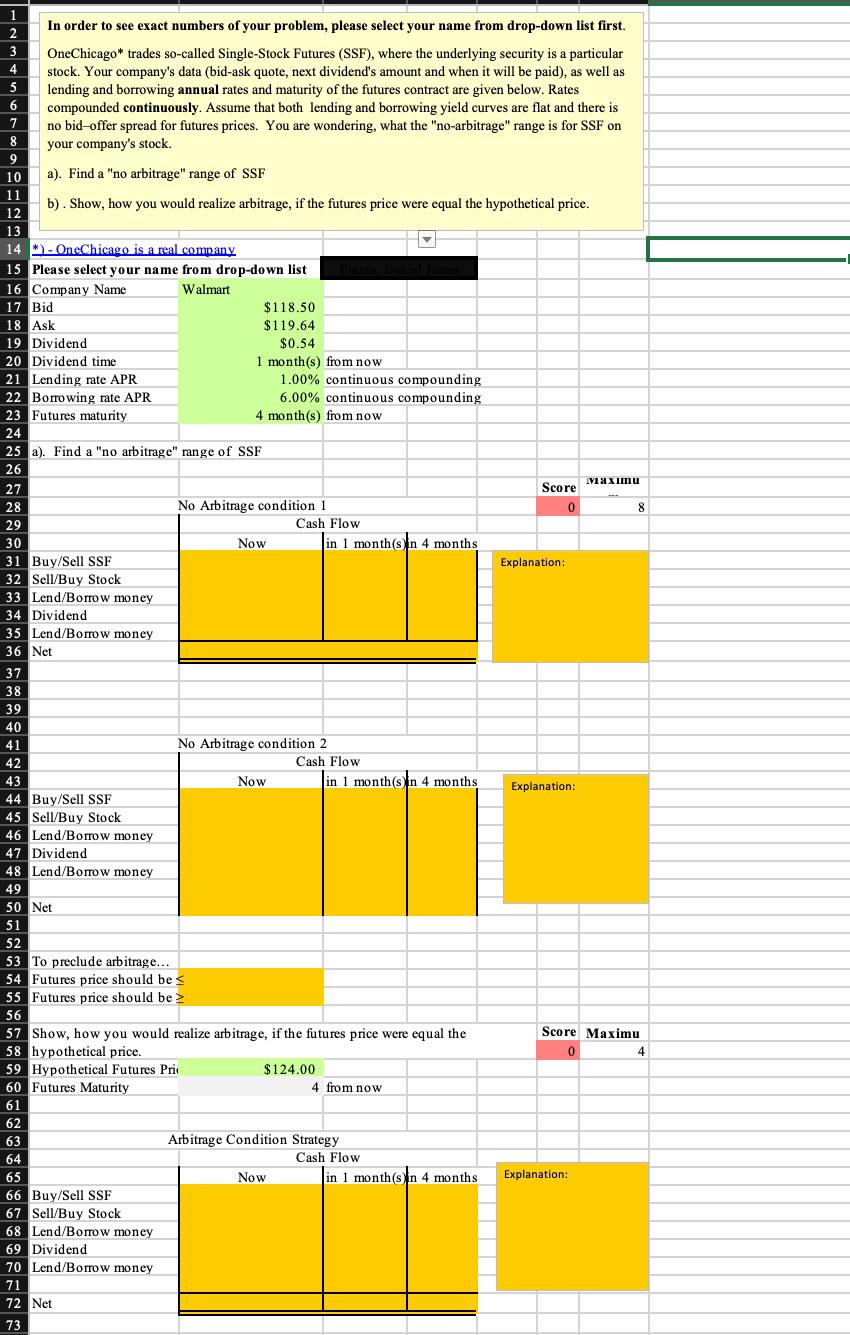

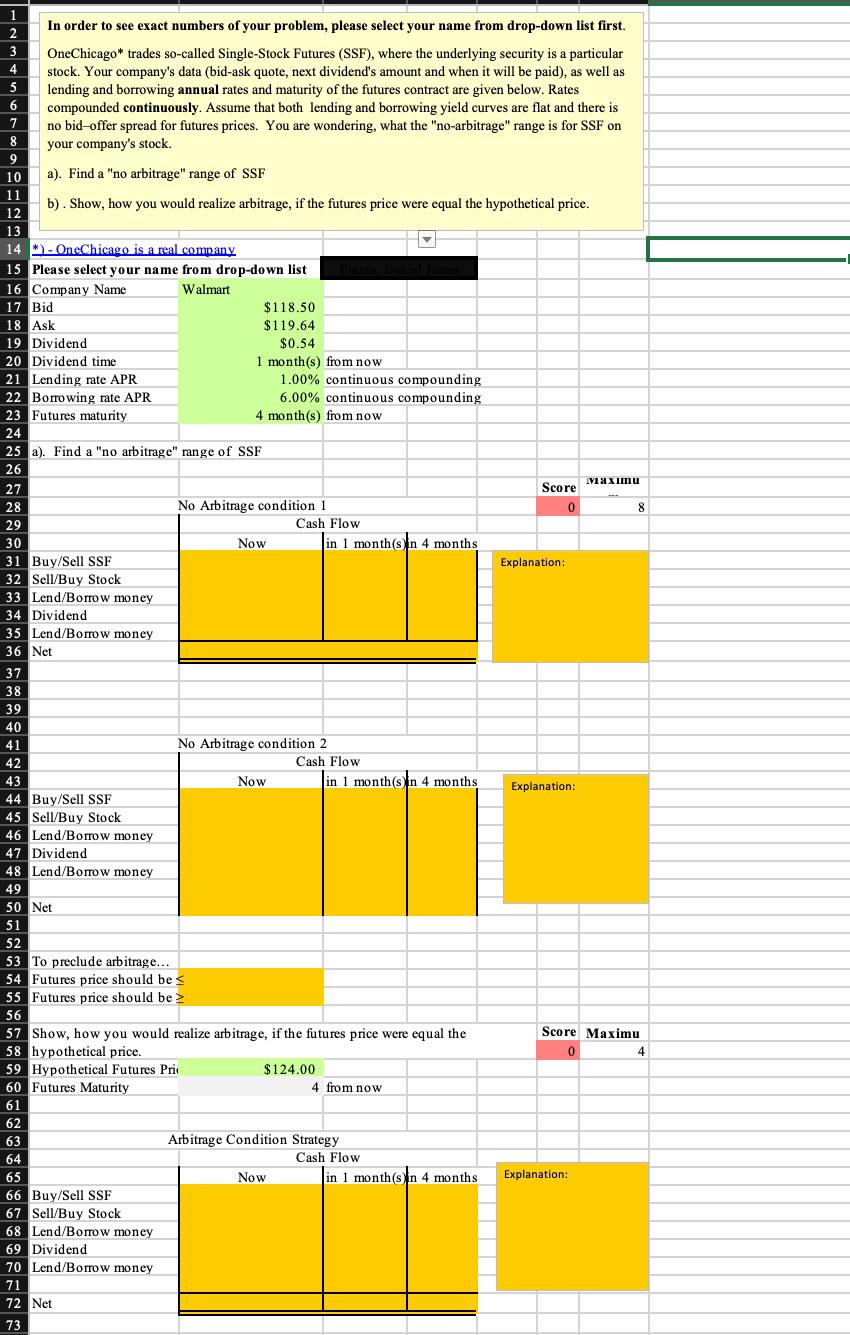

OneChicago* trades so-called Single-Stock Futures (SSF), where the underlying security is a particular stock. Your company's data (bid-ask quote, next dividend's amount and when it will be paid), as well as lending and borrowing annual rates and maturity of the futures contract are given below. Rates compounded continuously. Assume that both lending and borrowing yield curves are flat and there is no bidoffer spread for futures prices. You are wondering, what the "no-arbitrage" range is for SSF on your company's stock.

a). Find a "no arbitrage" range of SSF

b) . Show, how you would realize arbitrage, if the futures price were equal the hypothetical price.

Score Maximu 1 2 In order to see exact numbers of your problem, please select your name from drop-down list first. 3 3 OneChicago* trades so-called Single-Stock Futures (SSF), where the underlying security is a particular 4 4 stock. Your company's data (bid-ask quote, next dividend's amount and when it will be paid), as well as 5 lending and borrowing annual rates and maturity of the futures contract are given below. Rates 6 compounded continuously. Assume that both lending and borrowing yield curves are flat and there is 7 7 no bid offer spread for futures prices. You are wondering, what the "no-arbitrage" range is for SSF on 8 8 your company's stock. 9 10 a). Find a "no arbitrage" range of SSF 11 b). Show, how you would realize arbitrage, if the futures price were equal the hypothetical price. 12 13 14 - OneChicago is a real company 15 Please select your name from drop-down list 16 Company Name Walmart 17 Bid $118.50 18 Ask $119.64 19 Dividend $0.54 20 Dividend time 1 month(s) from now 21 Lending rate APR 1.00% continuous compounding 22 Borrowing rate APR 6.00% continuous compounding 23 Futures maturity 4 month(s) from now 24 25 a). Find a "no arbitrage" range of SSF 26 27 28 No Arbitrage condition 1 0 8 29 Cash Flow 30 Now in 1 month(sin 4 months 31 Buy/Sell SSF Explanation: 32 Sell/Buy Stock 33 Lend/Borrow money 34 Dividend 35 Lend/Borrow money 36 Net 37 38 39 40 41 No Arbitrage condition 2 42 Cash Flow 43 Now in 1 months in 4 months Explanation: : 44 Buy/Sell SSF 45 Sell/Buy Stock 46 Lend/Borrow money 47 Dividend 48 Lend/Borrow money 49 50 Net 51 52 53 To preclude arbitrage... 54 Futures price should be 55 Futures price should be 56 57 Show, how you would realize arbitrage, if the futures price were equal the Score Maximu 58 hypothetical price. 0 4 59 Hypothetical Futures Pris $124.00 60 Futures Maturity 4 from now 61 62 63 Arbitrage Condition Strategy 64 Cash Flow 65 Now in 1 month(sin 4 months Explanation: 66 Buy/Sell SSF 67 Sell/Buy Stock 68 Lend/Borrow money 69 Dividend 70 Lend/Borrow money 71 72 Net 73 Score Maximu 1 2 In order to see exact numbers of your problem, please select your name from drop-down list first. 3 3 OneChicago* trades so-called Single-Stock Futures (SSF), where the underlying security is a particular 4 4 stock. Your company's data (bid-ask quote, next dividend's amount and when it will be paid), as well as 5 lending and borrowing annual rates and maturity of the futures contract are given below. Rates 6 compounded continuously. Assume that both lending and borrowing yield curves are flat and there is 7 7 no bid offer spread for futures prices. You are wondering, what the "no-arbitrage" range is for SSF on 8 8 your company's stock. 9 10 a). Find a "no arbitrage" range of SSF 11 b). Show, how you would realize arbitrage, if the futures price were equal the hypothetical price. 12 13 14 - OneChicago is a real company 15 Please select your name from drop-down list 16 Company Name Walmart 17 Bid $118.50 18 Ask $119.64 19 Dividend $0.54 20 Dividend time 1 month(s) from now 21 Lending rate APR 1.00% continuous compounding 22 Borrowing rate APR 6.00% continuous compounding 23 Futures maturity 4 month(s) from now 24 25 a). Find a "no arbitrage" range of SSF 26 27 28 No Arbitrage condition 1 0 8 29 Cash Flow 30 Now in 1 month(sin 4 months 31 Buy/Sell SSF Explanation: 32 Sell/Buy Stock 33 Lend/Borrow money 34 Dividend 35 Lend/Borrow money 36 Net 37 38 39 40 41 No Arbitrage condition 2 42 Cash Flow 43 Now in 1 months in 4 months Explanation: : 44 Buy/Sell SSF 45 Sell/Buy Stock 46 Lend/Borrow money 47 Dividend 48 Lend/Borrow money 49 50 Net 51 52 53 To preclude arbitrage... 54 Futures price should be 55 Futures price should be 56 57 Show, how you would realize arbitrage, if the futures price were equal the Score Maximu 58 hypothetical price. 0 4 59 Hypothetical Futures Pris $124.00 60 Futures Maturity 4 from now 61 62 63 Arbitrage Condition Strategy 64 Cash Flow 65 Now in 1 month(sin 4 months Explanation: 66 Buy/Sell SSF 67 Sell/Buy Stock 68 Lend/Borrow money 69 Dividend 70 Lend/Borrow money 71 72 Net 73