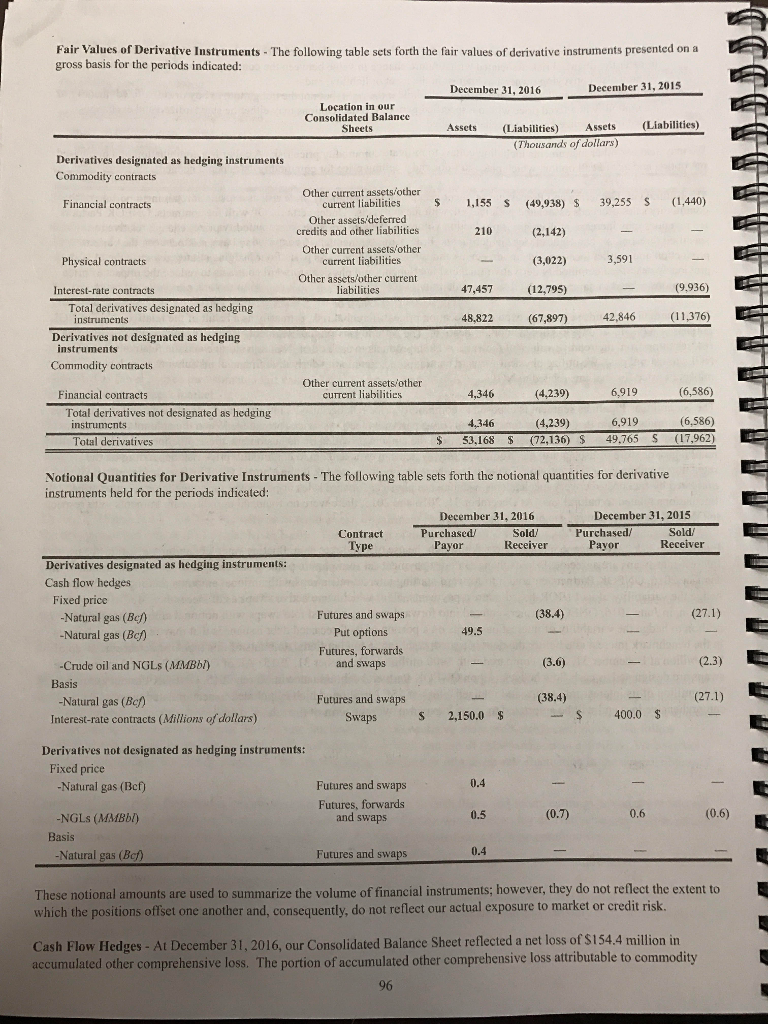

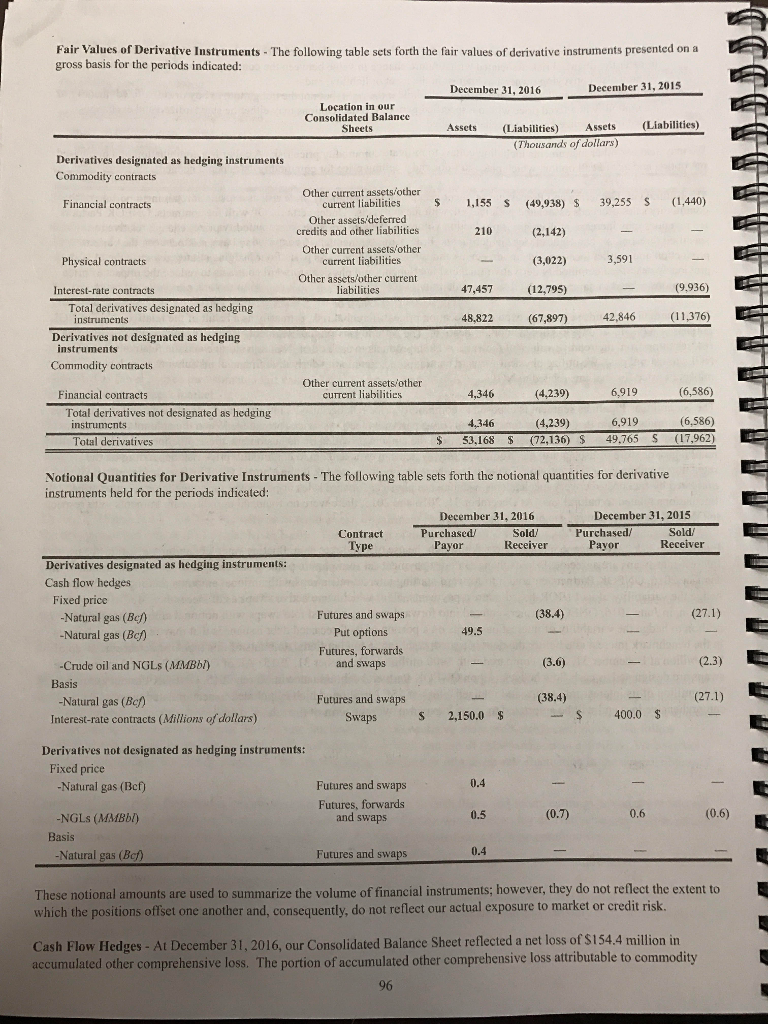

ONEOK hedges both interest rate risk (as evidenced by the swap discussed above) as well as commodity price risk related to movements in the prices of natural gas. ONEOK describes their derivative contracts in the chart on the bottom of p. 96. At 12/31/16, they have put options on 49.5 billion cubic feet (bcf) of natural gas.

a. As a holder of put options, does ONEOK benefit from increases or from decreases in the price of natural gas?

b. If these natural gas put options are a hedge of ONEOKs primary business operations, then ONEOKs primary business must benefit from which: increases in the price of natural gas or decreases in the price of natural gas?

The following table sets forth the fair values of derivative instruments presented on a Fair Values of Derivative Instruments gross basis for the periods indicated: December 31, 2016 December 31, 2015 Location in our Consolidated Balanee Sheets Assets (Liabilities) Assets (Liabilities) Thousands of dollars) Derivatives designated as hedging instruments Commodity contracts Other current assets other Financial contracts $ 1,155 (49,938) $ 39,25S S (1,440) current liabilities Other assets deferred credits and other liabilities Other current assets/other current liabilities Other assets/other current liabilities 210 (2.142) (3,022) (12,795) (67,897) Physical contracts Interest-rate contracts 47,457 (9,936) Total derivatives designated as hedging instruments 48,822 42,846 (11,376) Derivatives not designated as hedging instruments Commadity contracts Other current assetsother current liabilities Financial contracts 4,346 (4,239) 6,919 (6,586) Total derivatives not designated as hedging instruments (6,586) S 53,168 (72,136) S 49,765 S (17,962) 4.346 (4,239) Total derivatives Notional Quantities for Derivative Instruments-The following table sets forth the notional quantities for derivative instruments held for the periods indicated: December 31, 2016 Sold December 31, 2015 Sold Purchased Payor Purchased Payor Contract Receiver Receiver Derivatives designated as hedging instruments: Cash flow hedges Fixed price (38.4) Futures and swaps Put options Futures, forwards and swaps Natural gas (Be) 49.5 Natural gas (Bc) -Crude oil and NGLs (MMBbi) (3.6) Sis -Natural gas (Be) Futures and swaps (38.4) Interest-rate contracts (Millions of dollars) Swaps S 2,150.0 S400.0 $ Derivatives not designated as hedging instruments: Fixed price Natural gas (Bcf) 0.4 Futures and swaps Futures, forwards and swaps NGLs (MAMBbl) 0.5 Sis Natural gas (Bc) Futures and swaps 0.4 These notional amounts are used to summarize the volume of financial instruments; however, they do not reflect the extent to which the positions offset one another and, consequently, do not reflect our actual exposure to market or credit risk Cash Flow Hedges - At December 31, 2016, our Consolidated Balance Sheet reflected a net loss of $154.4 million in accumulated other comprehensive loss. The portion of accumulated other comprehensive loss attributable to commodity 96