Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On-Line Learning Corporation obtained a charter at the beginning of this year that authorized 62,000 shares of no-par common stock and 36,000 shares of preferred

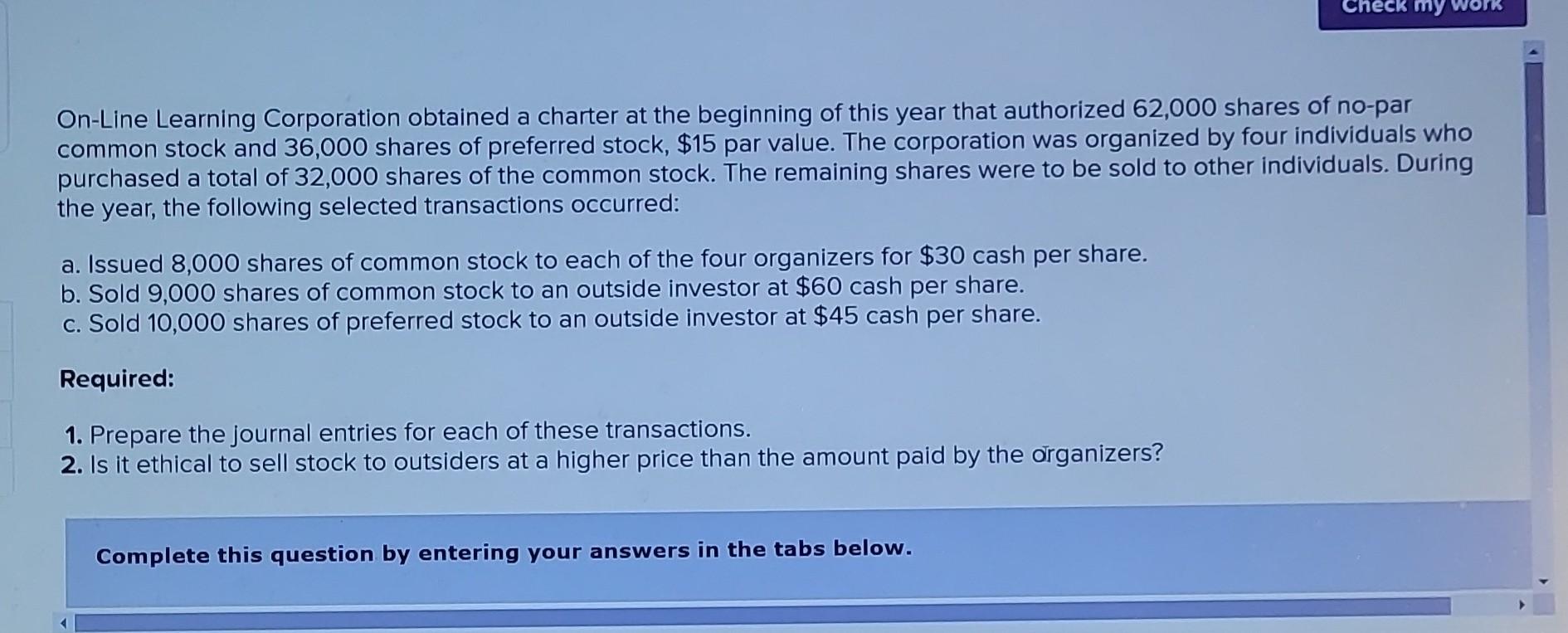

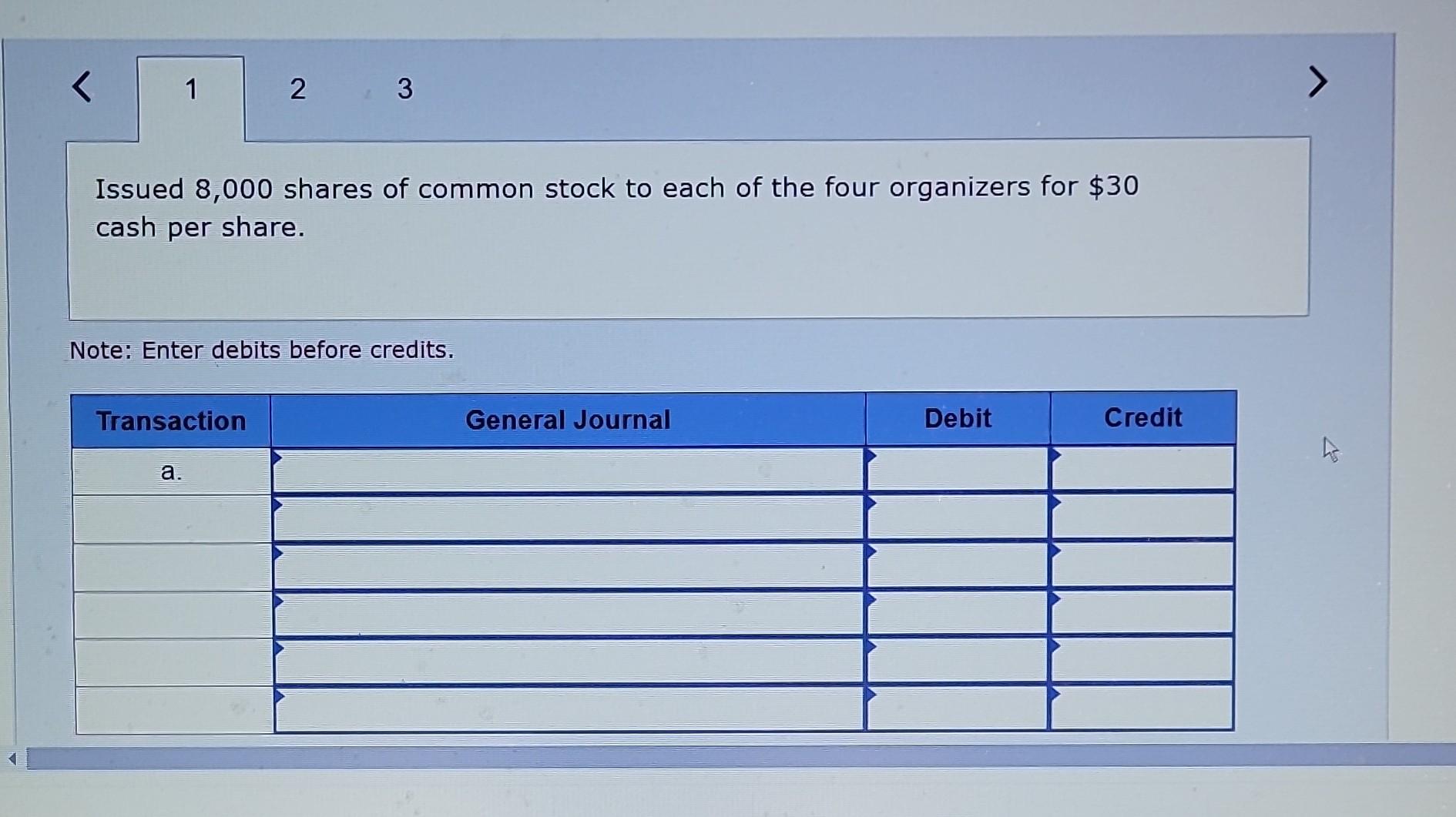

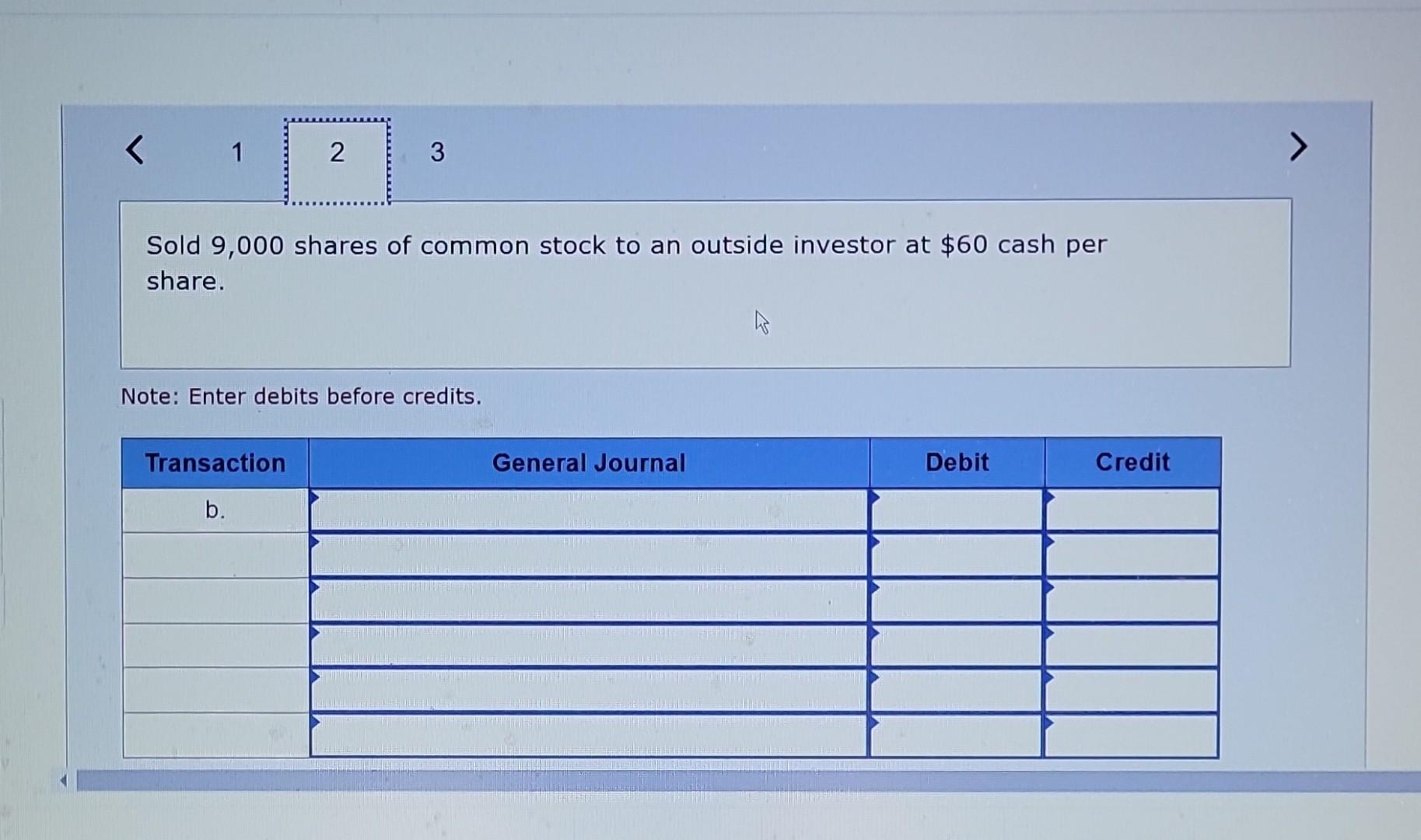

On-Line Learning Corporation obtained a charter at the beginning of this year that authorized 62,000 shares of no-par common stock and 36,000 shares of preferred stock, $15 par value. The corporation was organized by four individuals who purchased a total of 32,000 shares of the common stock. The remaining shares were to be sold to other individuals. During the year, the following selected transactions occurred: a. Issued 8,000 shares of common stock to each of the four organizers for $30 cash per share. b. Sold 9,000 shares of common stock to an outside investor at $60 cash per share. c. Sold 10,000 shares of preferred stock to an outside investor at $45 cash per share. Required: 1. Prepare the journal entries for each of these transactions. 2. Is it ethical to sell stock to outsiders at a higher price than the amount paid by the organizers? Complete this question by entering your answers in the tabs below. Sold 9,000 shares of common stock to an outside investor at $60 cash per share. Note: Enter debits before credits. Issued 8,000 shares of common stock to each of the four organizers for $30 cash per share. Note: Enter debits before credits. Sold 10,000 shares of preferred stock to an outside investor at $45 cash per share. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started