Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only 4.23 and 4.28 Refer to the original data. By automating, the company could reduce variable unit. However, fixed expenses would increase by $72,000 each

only 4.23 and 4.28

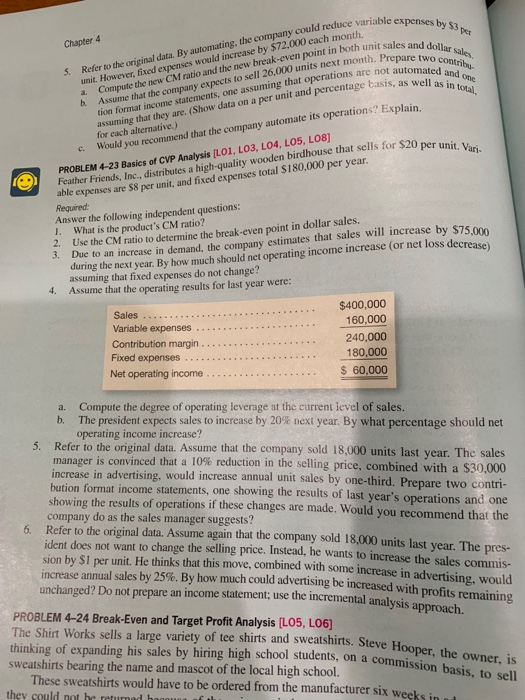

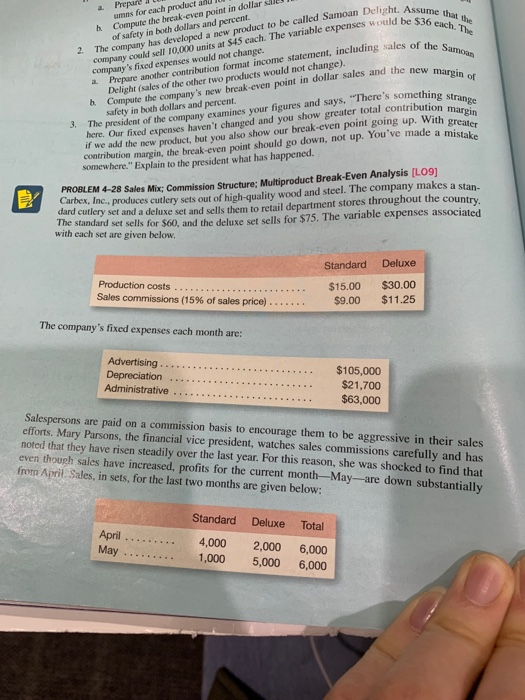

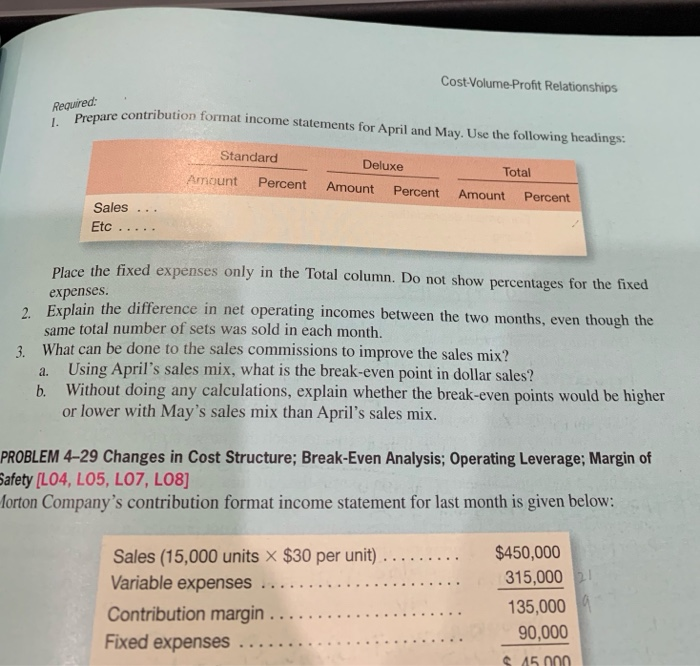

Refer to the original data. By automating, the company could reduce variable unit. However, fixed expenses would increase by $72,000 each month.penses a. Compute the new CM ratio and the new break-even point in both un by $3 pes Chapter 4 sales and dollar Assume that the company expects to sell 26,000 units next month. Pre b. 5. format income statements, one assuming that operations a suming that they are. (Show data on a per unit and percentag is, as well as in Would you recommend that the PROBLEM 4-23 Basics of CVP Analysis [LO1, LO3, L able expenses are $8 per unit, and fixed expenses tota for each alternative.) Would you recommend that the company automate its operations? 04, LO5, LO8) c. that sells for $20 per i that sells for $20 per unit. Vari- Feather Friends, Inc., distributes a high-quality wooden bird l S180,000 per year Answer the following independent questions: I. What is the product's CM ratio? 2. Use the CM ratio to determine the break-even point in dollar sales. dur ing the next year. By how much should net operating income increase (or net loss assuming that fixed expenses do not change? 3. Dae to an increase in demand, the company estimates that sales will increase by s75 4. Assume that the operating results for last year were Sales Variable expenses Contribution margin Fixed expenses Net operating income $400,000 160,000 240,000 180,000 $ 60,000 Compute the degree of operating leverage at the current level of sales a. The president expects sales to increase by 20% next year. By what percentage should net 5. Refer to the original data. Assume that the company sold 18,000 units last year. The sales uction in the selling price, combined with a $30,000 l unit sales by one-third. Prepare two contri- operating income increase? manager is convinced that a 10% red increase in advertising, would increase annua bution format income statements, one showing the results of last year's operations and one showing the results of operations if these changes are made. Would you recommend that the company do as the sales manager suggests? 6. Refer to the original data. Assume again that the company sold 18,000 units last year. The pres- ident does not want to change the selling price. Instead, he wants to increase the sales commis sion by $1 per unit. He thinks that this move, combined with some increase in advertising, would increase annual sales by 25%. By how much could advertising be increased unchanged? Do not prepare an income statement; use the incremental analysis a with profits remaining PROBLEM 4-24 Break-Even and Target Profit Analysis [LO5, LO6) The Shirt Works sells a large variety of tee shirts and sweatshirts. Steve Hooner thinking of expanding his sales by hiring high school students, on a commission sweatshirts bearing the name and mascot of the local high school. These sweatshirts would have to be ordered from the manufacturer six weeks in is, to sell . umns for each product anu h Compute the break-even point in dollar sll Prepart Asseach. The company could sell 10,000 units at $45 each. The variable ex company's fixed of safety in both dollars and percent. 00 units s4 each. The variable expenses would be S3a e ha income statement, including sales of the S cts would not change). 2. e company has developed a new product to be called Samoan Delight, A expenses would not chan a Prepare another contribution format break-even point in dollar sales and the new Compute the company's new safety in both dollars and percent. Delight (sales of the other two produ b. strange if we add the new product, but you also show our break-even point going up. Withgin somewhere." Explain to the president what has happened. here. Our fixed expenses haven't changed and you show greater total contribution contribution margin, the break-even point should go down, not up. You've made a 3. The president of the company examines your figures and says, "There's somethin PROBLEM 4-28 Sales Mix: Commission Structure: Multiproduct Break-Even Analysis [LO9) Carbex, Inc. produces cutlery sets out of high-quality wood and steel. The company makes a stan- dard cutlery set and a deluxe set and sells them to retail department stores throughout the country wh cdah rd se selk for S60, and the deluxe set sells for $75. The variable expenses associated The standard set set are given below. Standard Deluxe Production costs $15.00 $30.00 $9.00 $11.25 Sales commissions (15% of sales price) . . . . . . The company's fixed expenses each month are: $105,000 $21,700 $63,000 Administrative Salespersons are paid on a commission basis to encourage them to be aggressive in their sales efforts. Mary Parsons, the financial vice president, watches sales commissions carefully and has noted that they have risen steadily over the last year. For this reason, she was shocked to find that even though sales have increased, profits for the current month-May-are down substantially from Ajril Sales, in sets, for the last two months are given Standard Deluxe Total April May 4,000 2,000 6,000 1,000 5,000 6,000 Cost-Volume-Profit Relationships Required: contribution format income statements for April and May. Use the following headings: Standard Deluxe Amount Percent Amount Percent Amount Percent Total Sales Place the fixed expenses only in expenses the Total column. Do not show percentages for the fixed 2. Explain the difference in net operating incomes between the two months, even though the same total number of sets was sold in each month. hat can be done to the sales commissions to improve the sales mix? a. Using April's sales mix, what is the break-even point in dollar sales? b. Without doing any calculations, explain whether the break-even points would be higher 3. W or lower with May's sales mix than April's sales mix. PROBLEM 4-29 Changes in Cost Structure; Break-Even Analysis; Operating Leverage; Margin of Safety [L04, LO5, LO7, LO8] forton Company's contribution format income statement for last month is given below: Sales (15,000 units x $30 per unit) . ..$450,000 expenses 315,000 135,000 90,000 45 000 Fixed expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started