Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only answer no explanation needed An entity leases a photo copier with legal assets passing after two years. The entity usually depreciates the photo copier

Only answer no explanation needed

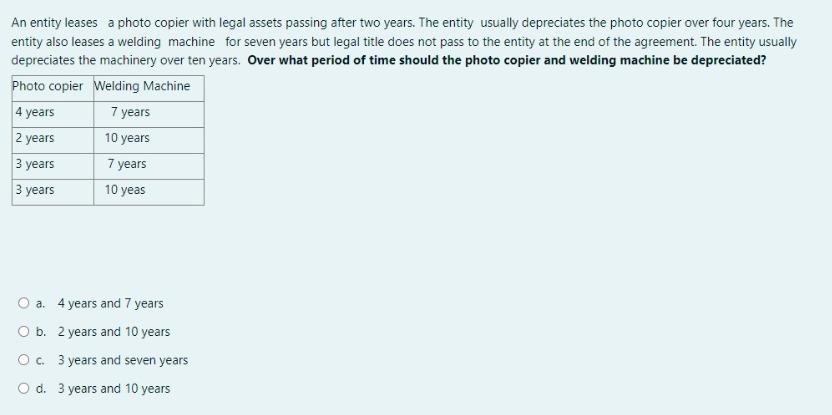

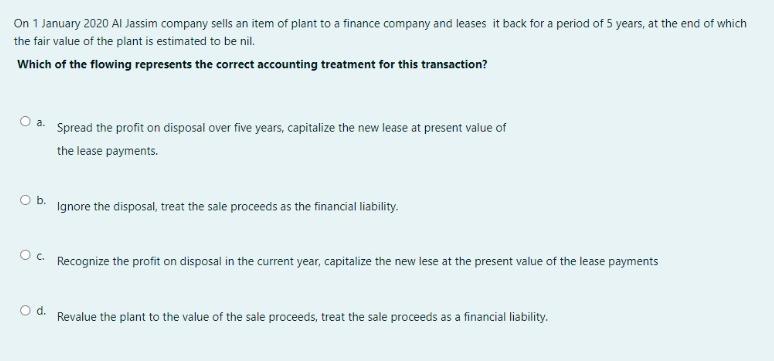

An entity leases a photo copier with legal assets passing after two years. The entity usually depreciates the photo copier over four years. The entity also leases a welding machine for seven years but legal title does not pass to the entity at the end of the agreement. The entity usually depreciates the machinery over ten years. Over what period of time should the photo copier and welding machine be depreciated? a. 4 years and 7 years b. 2 years and 10 years c. 3 years and seven years d. 3 years and 10 years On 1 January 2020 Al Jassim company sells an item of plant to a finance company and leases it back for a period of 5 years, at the end of which the fair value of the plant is estimated to be nil. Which of the flowing represents the correct accounting treatment for this transaction? a. Spread the profit on disposal over five years, capitalize the new lease at present value of the lease payments. b. Ignore the disposal, treat the sale proceeds as the financial liability. c. Recognize the profit on disposal in the current year, capitalize the new lese at the present value of the lease payments d. Revalue the plant to the value of the sale proceeds, treat the sale proceeds as a financial liabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started