Question

ONLY ANSWER QUESTION F a.) Compute the return on equity ratio for Coke and Pepsi for 2020. Which Company earned the higher return for its

ONLY ANSWER QUESTION F

ONLY ANSWER QUESTION F

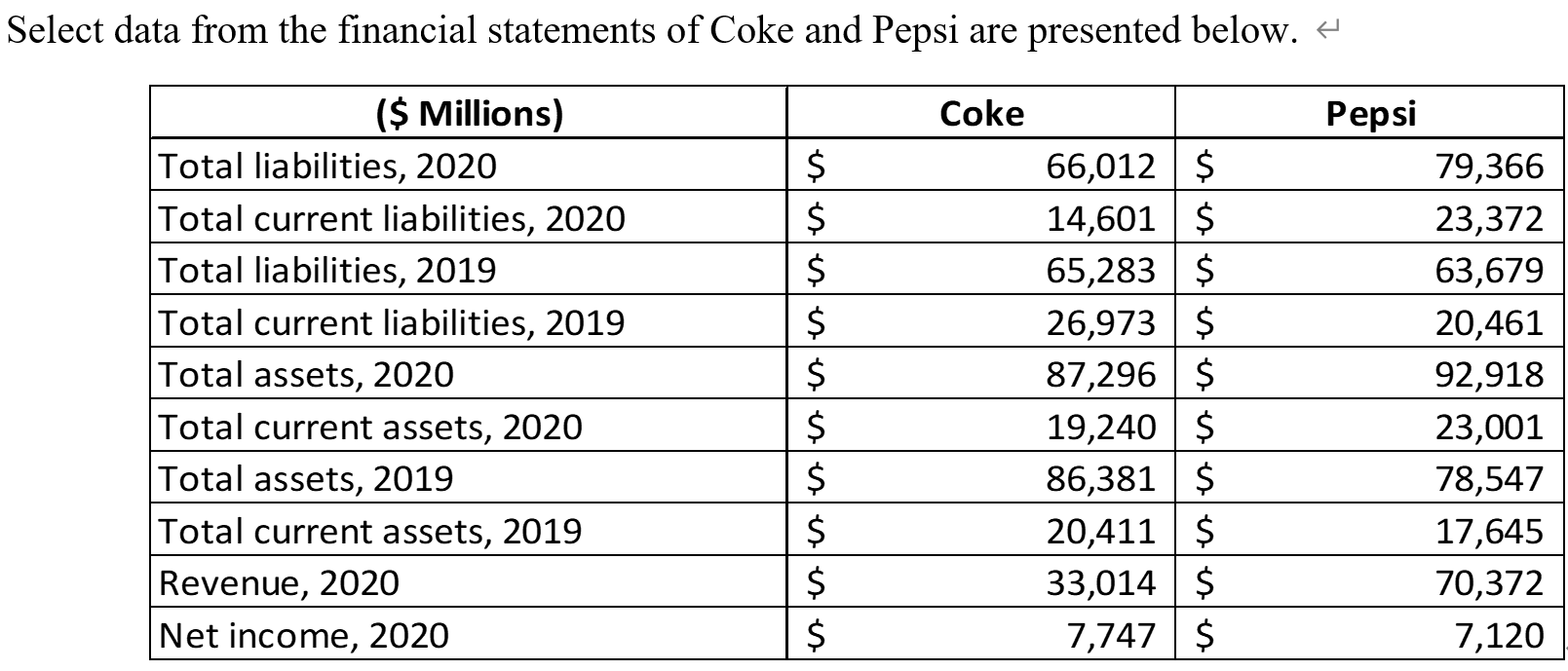

a.) Compute the return on equity ratio for Coke and Pepsi for 2020. Which Company earned the higher return for its shareholders? Does that surprise you and why? b.) Compute the debt-to-equity ratio for each company as of December 31, 2020. Which company relies more on creditor financing? c.) For each company, compute net income as a percentage of revenue in 2020. d.) For each company, calculate working capital and current ratio for 2020 and 2019. How did they change from 2019 to 2020 (improve or worsen)? What may have caused those changes provide detailed explanation? e.) For each company, compute the return on assets ratio (ignore any interest and tax impact just use net income/total average assets) for 2020. Which Company earned the higher return based on its assets? What does this ratio tell us about the company? f.) Based on your answers to questions a - e, compare these two competitors, specifically if you had $10,000, which would you invest in. Name at least 3 specific other items, other than the above ratios, that may be helpful in making your decision.

elect data from the financial statements of Coke and Pepsi are presented belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started