Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only Hand Written or on Document accepted , No Excel work Accepted , And Do it on ASAP Basis , With Workings Q3. How do

Only Hand Written or on Document accepted , No Excel work Accepted , And Do it on ASAP Basis , With Workings

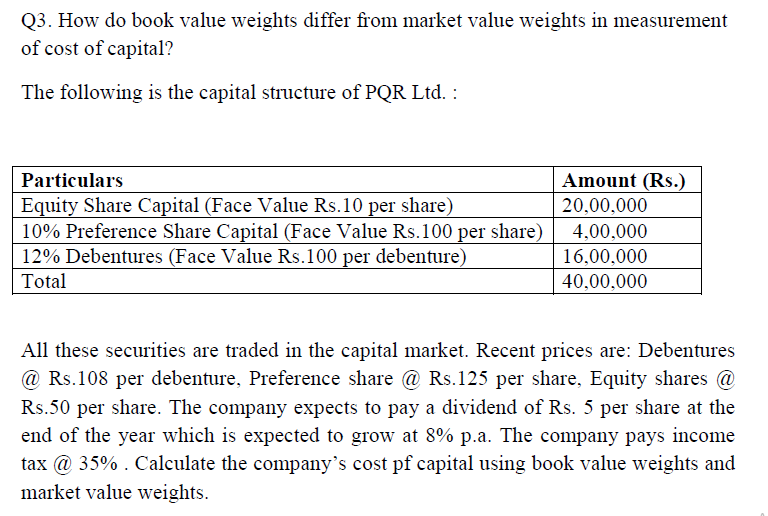

Q3. How do book value weights differ from market value weights in measurement of cost of capital? The following is the capital structure of PQR Ltd. : Particulars Equity Share Capital (Face Value Rs.10 per share) 10% Preference Share Capital (Face Value Rs.100 per share) 12% Debentures (Face Value Rs.100 per debenture) Total Amount (Rs.) 20.00.000 4,00,000 16,00,000 40,00,000 All these securities are traded in the capital market. Recent prices are: Debentures @ Rs.108 per debenture, Preference share @ Rs.125 per share, Equity shares @ Rs.50 per share. The company expects to pay a dividend of Rs. 5 per share at the end of the year which is expected to grow at 8% p.a. The company pays income tax @ 35%. Calculate the company's cost pf capital using book value weights and market value weightsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started