Answered step by step

Verified Expert Solution

Question

1 Approved Answer

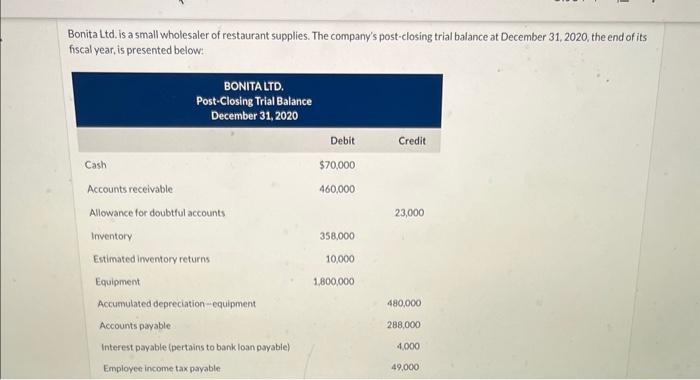

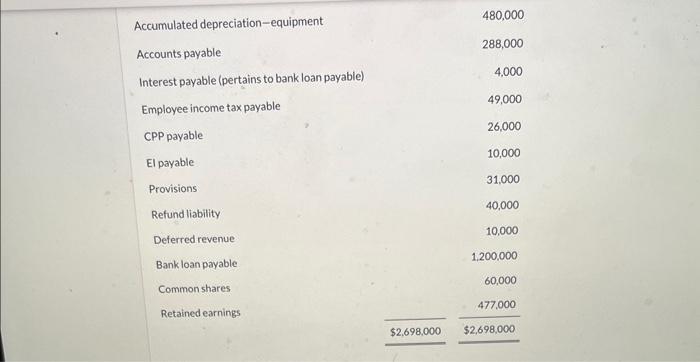

only need 11 Bonita Ltd. is a small wholesaler of restaurant supplies. The company's post-closing trial balance at December 31, 2020, the end of its

only need 11

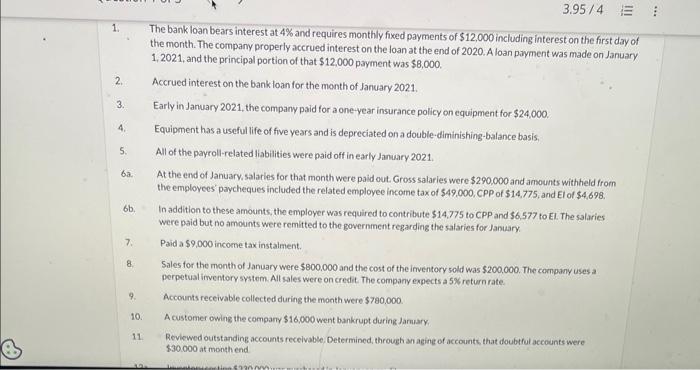

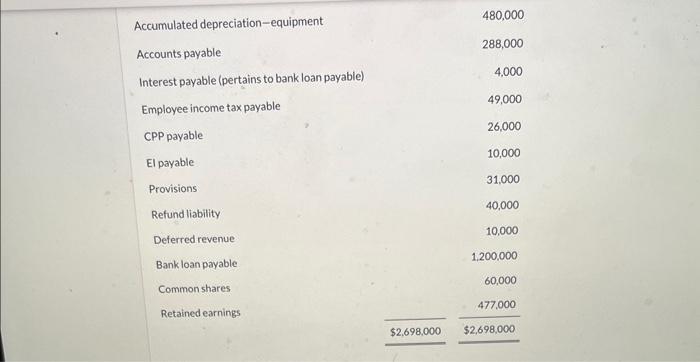

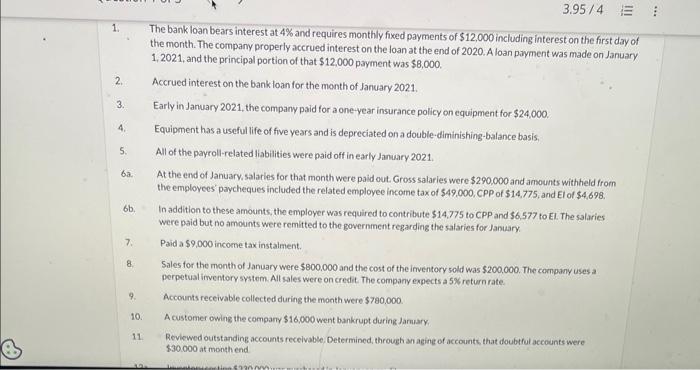

Bonita Ltd. is a small wholesaler of restaurant supplies. The company's post-closing trial balance at December 31, 2020, the end of its fiscal year, is presented below: Accumulated depreciation-equipment Accounts payable Interest payable (pertains to bank loan payable) Employee income tax payable CPP payable El payable Provisions Refund liability Deferred revenue Bank loan payable Common shares Retained earnings $2,698,000$277,000$2,698,000 1. The bank loan bears interest at 4% and requires monthly fixed payments of $12,000 including interest on the first day of the month. The company properly accrued interest on the loan at the end of 2020 . A loan payment was made on January 1, 2021, and the principal portion of that $12,000 payment was $8,000. 2. Accrued interest on the bank loan for the month of January 2021. 3. Early in January 2021, the company paid for a one-year insurance policy on equipment for $24,000. 4. Equipment has a useful life of five years and is depreciated on a double-diminishing-balance basis. 5. All of the payroll-related liabilities were paid off in early Janwary 2021. 6a. At the end of January salaries for that month were paid out Gross salaries were $290,000 and announts withiheld from the employees paycheques included the related employee income tax of $49,000,CPP of $14,775, and El of $4,698. 6b. In addition to these amounts, the employer was required to contribute $14,775 to CPP and 56,577 to EI. The salaries were paid but no amounts were remitted to the government regarding the salaries for January. 7. Paid a $9,000 income tax instalment. 8. Sales for the month of January were $800,000 and the cost of the inventory sold was $200,000. The company uses a perpetual inventery system. All sales were on credit. The company expects a 5% return rate. 9. Accounts receivable collected during the month were $780.000. 10. A customer owing the company $16,000 went bankrupt during farmary. 11. Reviewed outstanding accounts receivable, Determined, through an aging of accounts that doubtrul accounts were 130.000 at month end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started