Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Only need 2 methods for deriving a valuation. I completed the market approach as shown above that looks similar to that one. Please, help! Thanks!

Only need 2 methods for deriving a valuation. I completed the market approach as shown above that looks similar to that one. Please, help! Thanks!

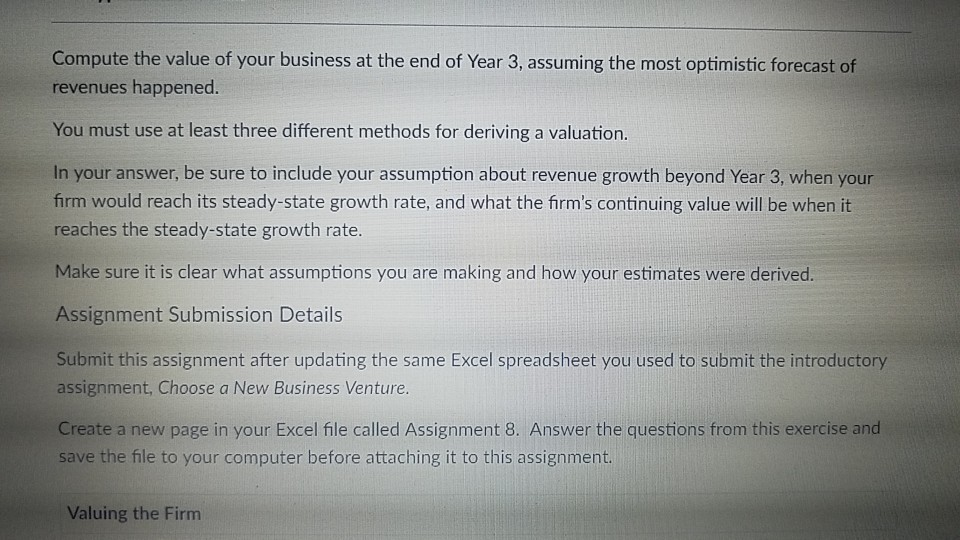

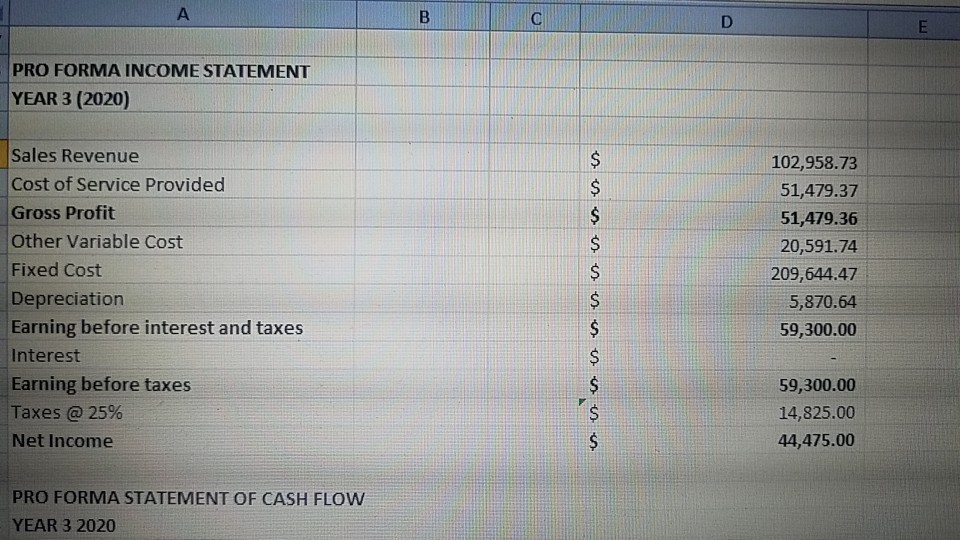

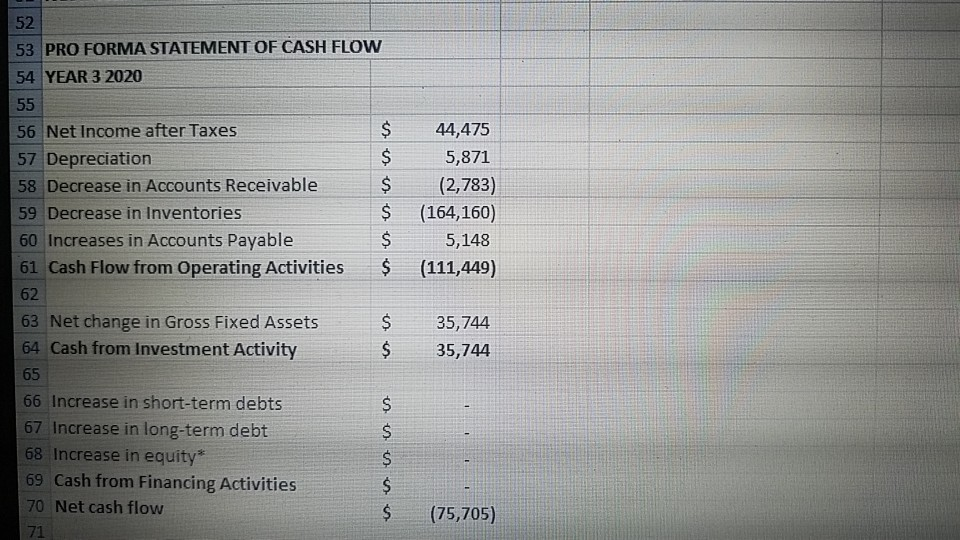

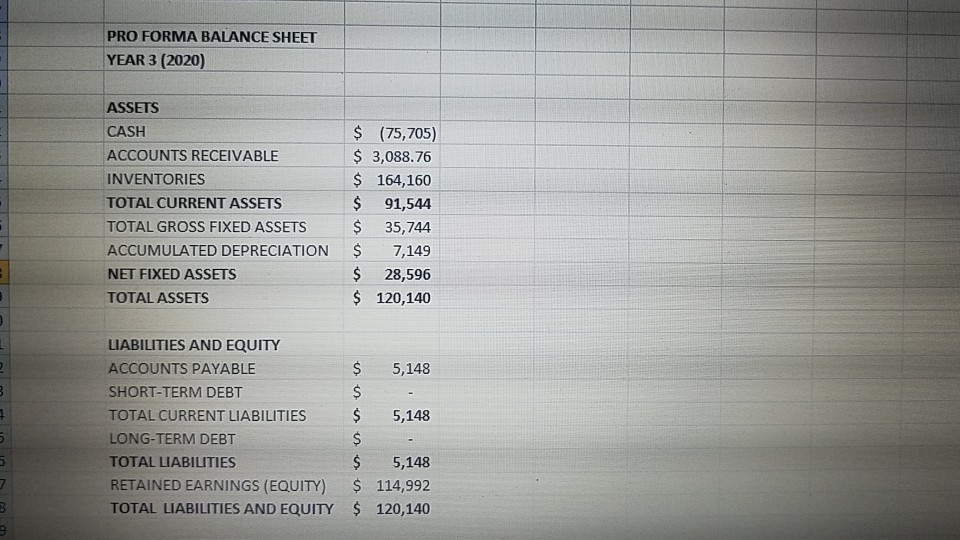

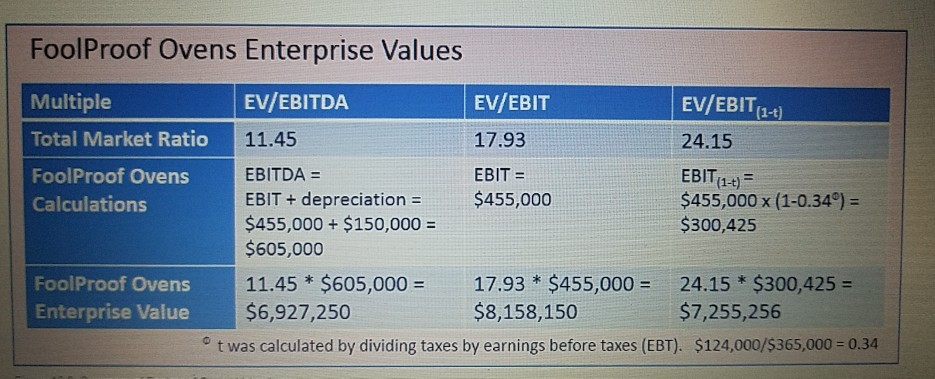

Compute the value of your business at the end of Year 3, assuming the most optimistic forecast of revenues happened. You must use at least three different methods for deriving a valuation. In your answer, be sure to include your assumption about revenue growth beyond Year 3, when your firm would reach its steady-state growth rate, and what the firm's continuing value will be when it reaches the steady-state growth rate. Make sure it is clear what assumptions you are making and how your estimates were derived. Assignment Submission Details Submit this assignment after updating the same Excel spreadsheet you used to submit the introductory assignment, Choose a New Business Venture. Create a new page in your Excel fle called Assignment 8. Answer the questions from this exercise and save the file to your computer before attaching it to this assignment. Valuing the Firm PRO FORMA BALANCE SHEET YEAR 3(2020) ASSETS CASH ACCOUNTS RECEIVABLE INVENTORIES TOTAL CURRENT ASSETS TOTAL GROSS FIXED ASSETS ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS $ (75,705) 3,088.76 $164,160 $ 91,544 35,744 7,149 $ 28,596 120,140 LIABILITIES AND EQUITY ACCOUNTS PAYABLE SHORT-TERM DEBT TOTAL CURRENT LIABILITIES 5,148 LONG-TERM DEBT TOTAL LIABILITIES RETAINED EARNINGS (EQUITY) 114,992 TOTAL LIABILITIES AND EQUITY 120,140 S 5,148 5,148 FoolProof Ovens Enterprise Values Multiple Total Market Ratio FoolProof Ovens Calculations EV/EBITDA 11.45 EBITDA EBIT + depreciation$455,000 $455,000 + $150,000 = $605,000 EV/EBIT 17.93 EBIT = EV/EBIT) 24.15 EBIT 1) $455,000 x (1-0.349 = $300,425 FoolProof Ovens Enterprise Value 11.45 * $605,00017.93* $455,00024.15* $300,425- $6,927,250 $8,158,150 $7,255,256 0 t was calculated by dividing taxes by earnings before taxes (EBT). $124,000/$365,000 0.34 Compute the value of your business at the end of Year 3, assuming the most optimistic forecast of revenues happened. You must use at least three different methods for deriving a valuation. In your answer, be sure to include your assumption about revenue growth beyond Year 3, when your firm would reach its steady-state growth rate, and what the firm's continuing value will be when it reaches the steady-state growth rate. Make sure it is clear what assumptions you are making and how your estimates were derived. Assignment Submission Details Submit this assignment after updating the same Excel spreadsheet you used to submit the introductory assignment, Choose a New Business Venture. Create a new page in your Excel fle called Assignment 8. Answer the questions from this exercise and save the file to your computer before attaching it to this assignment. Valuing the Firm PRO FORMA BALANCE SHEET YEAR 3(2020) ASSETS CASH ACCOUNTS RECEIVABLE INVENTORIES TOTAL CURRENT ASSETS TOTAL GROSS FIXED ASSETS ACCUMULATED DEPRECIATION NET FIXED ASSETS TOTAL ASSETS $ (75,705) 3,088.76 $164,160 $ 91,544 35,744 7,149 $ 28,596 120,140 LIABILITIES AND EQUITY ACCOUNTS PAYABLE SHORT-TERM DEBT TOTAL CURRENT LIABILITIES 5,148 LONG-TERM DEBT TOTAL LIABILITIES RETAINED EARNINGS (EQUITY) 114,992 TOTAL LIABILITIES AND EQUITY 120,140 S 5,148 5,148 FoolProof Ovens Enterprise Values Multiple Total Market Ratio FoolProof Ovens Calculations EV/EBITDA 11.45 EBITDA EBIT + depreciation$455,000 $455,000 + $150,000 = $605,000 EV/EBIT 17.93 EBIT = EV/EBIT) 24.15 EBIT 1) $455,000 x (1-0.349 = $300,425 FoolProof Ovens Enterprise Value 11.45 * $605,00017.93* $455,00024.15* $300,425- $6,927,250 $8,158,150 $7,255,256 0 t was calculated by dividing taxes by earnings before taxes (EBT). $124,000/$365,000 0.34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started