Only need E-K

Only need E-K

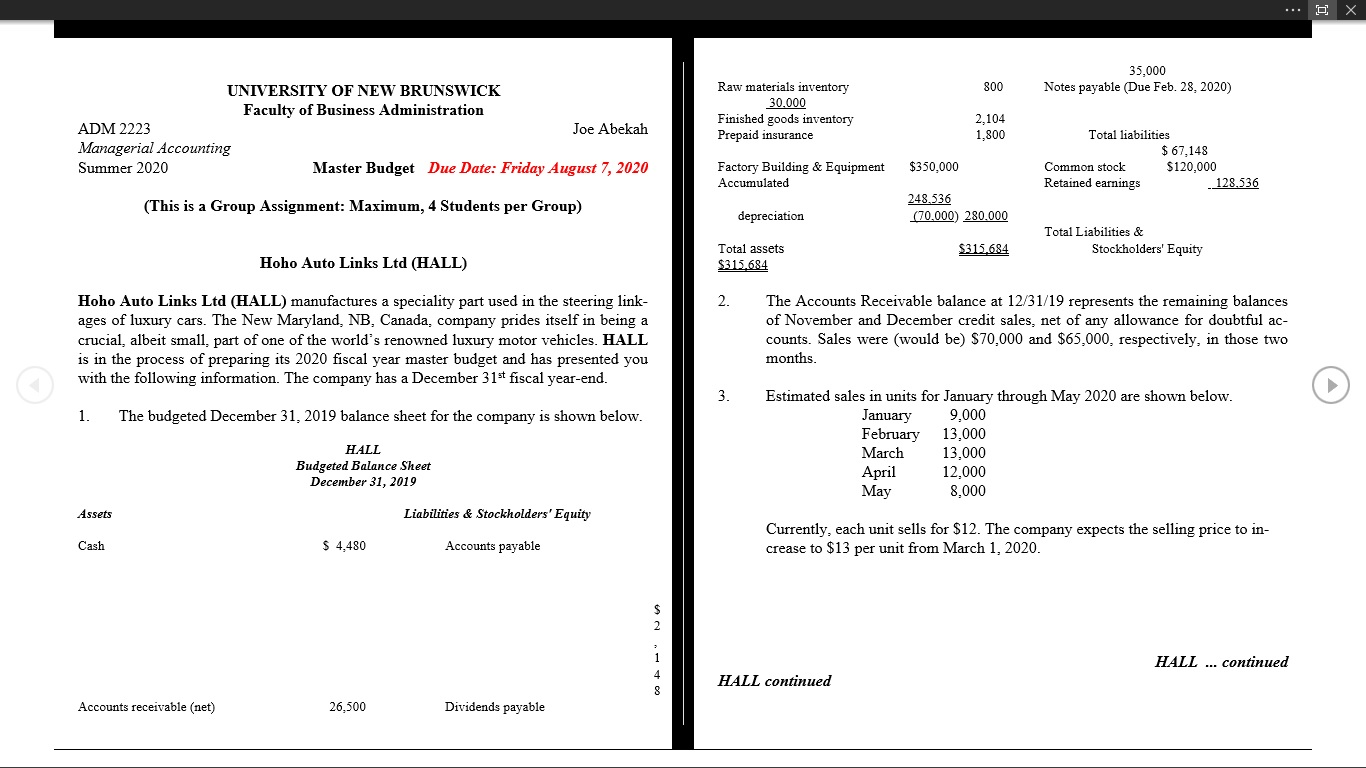

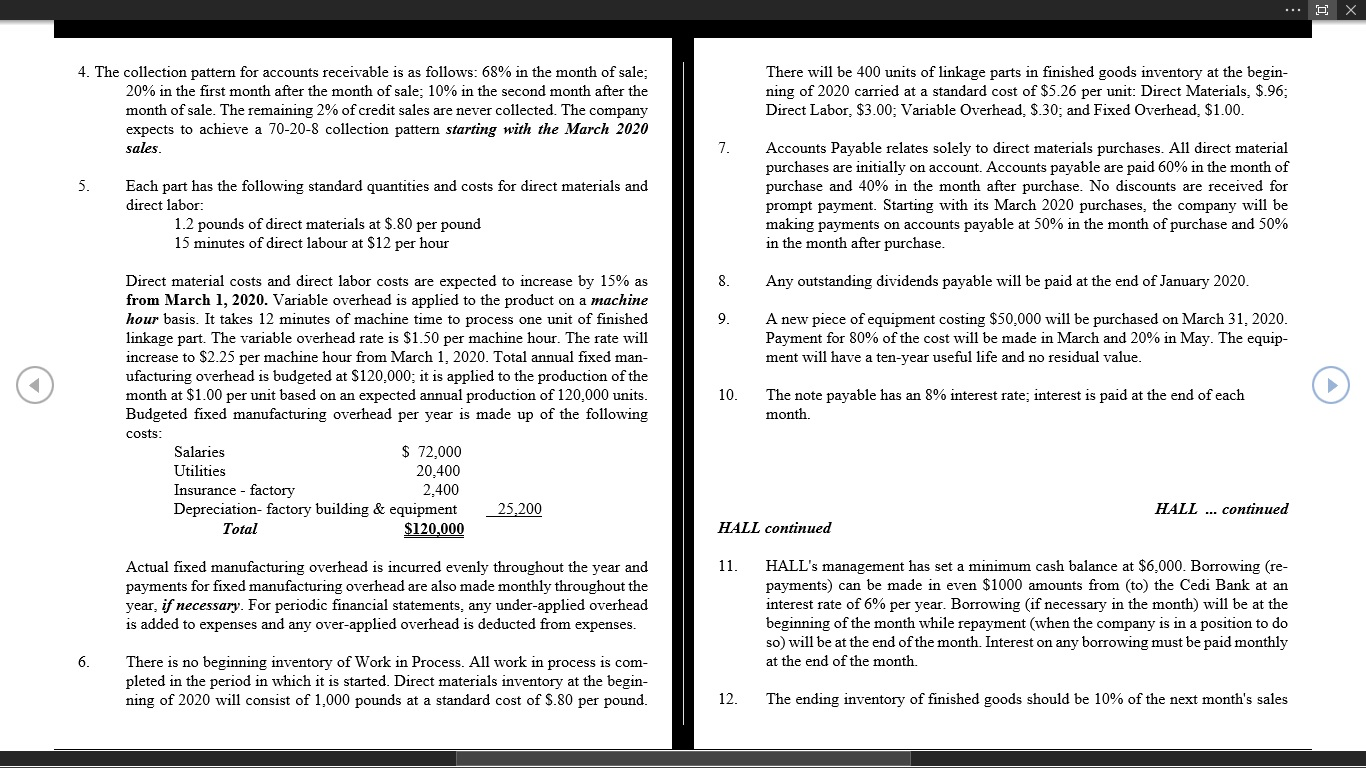

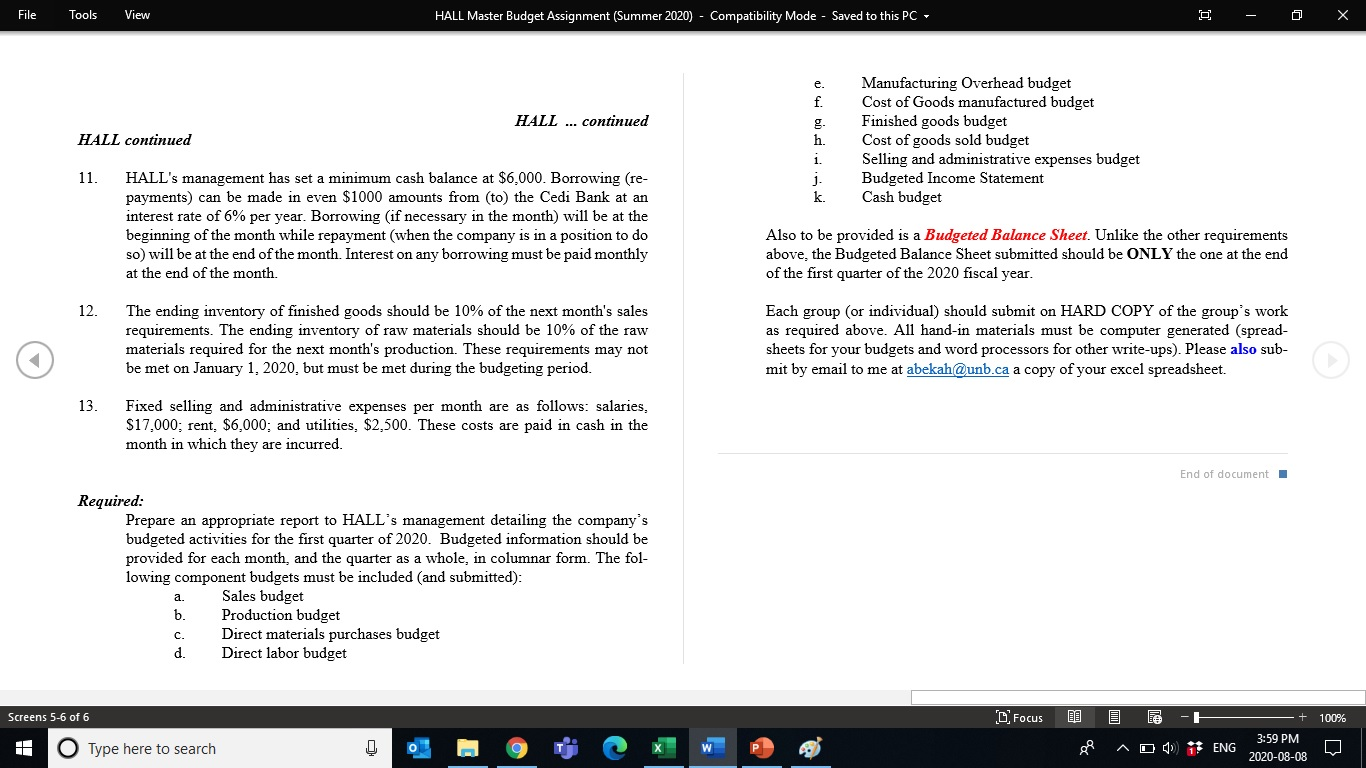

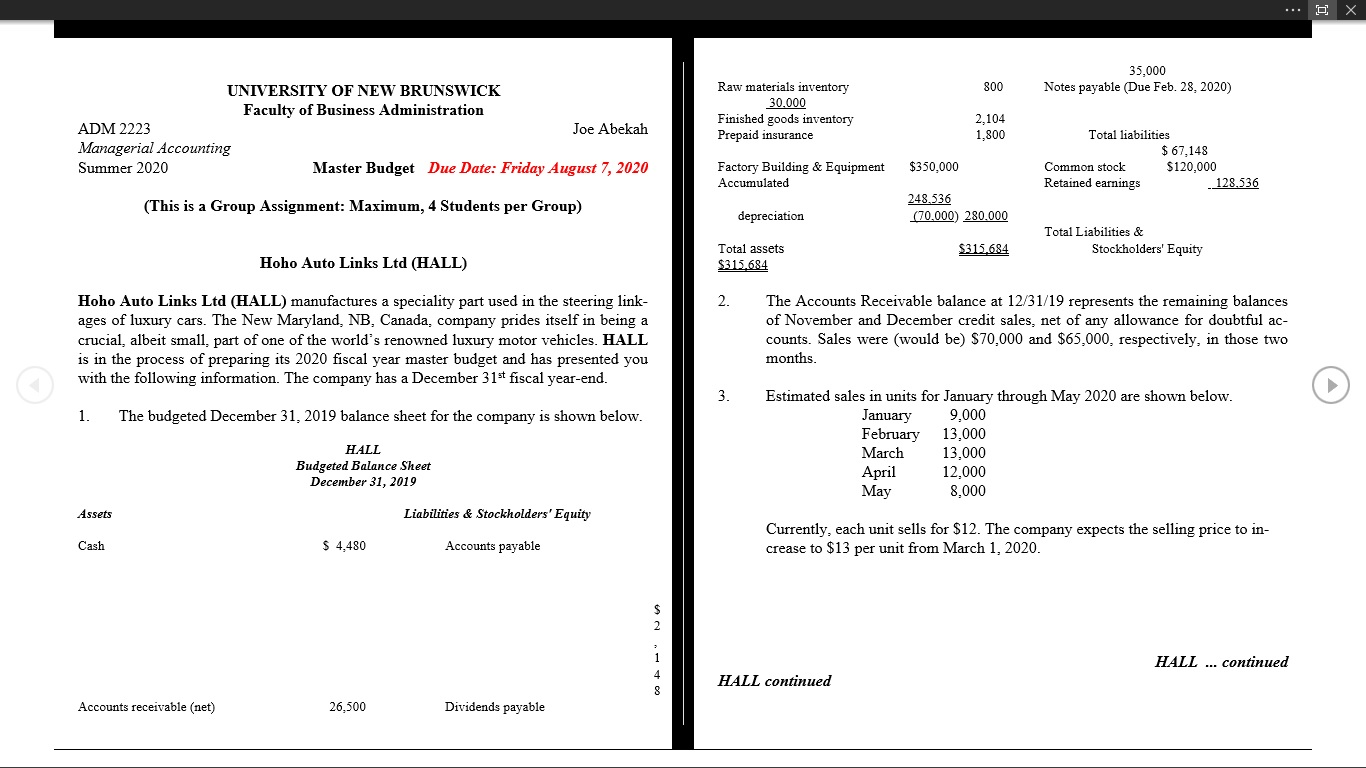

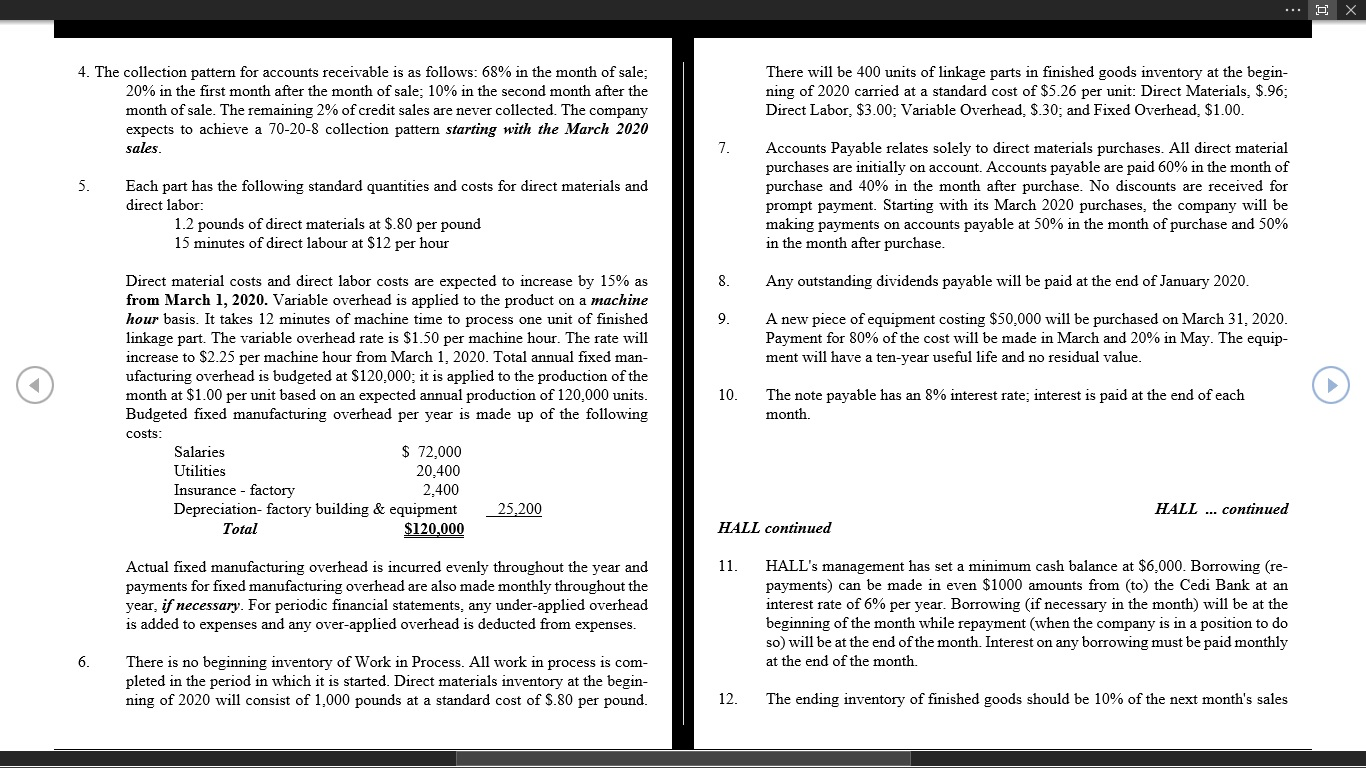

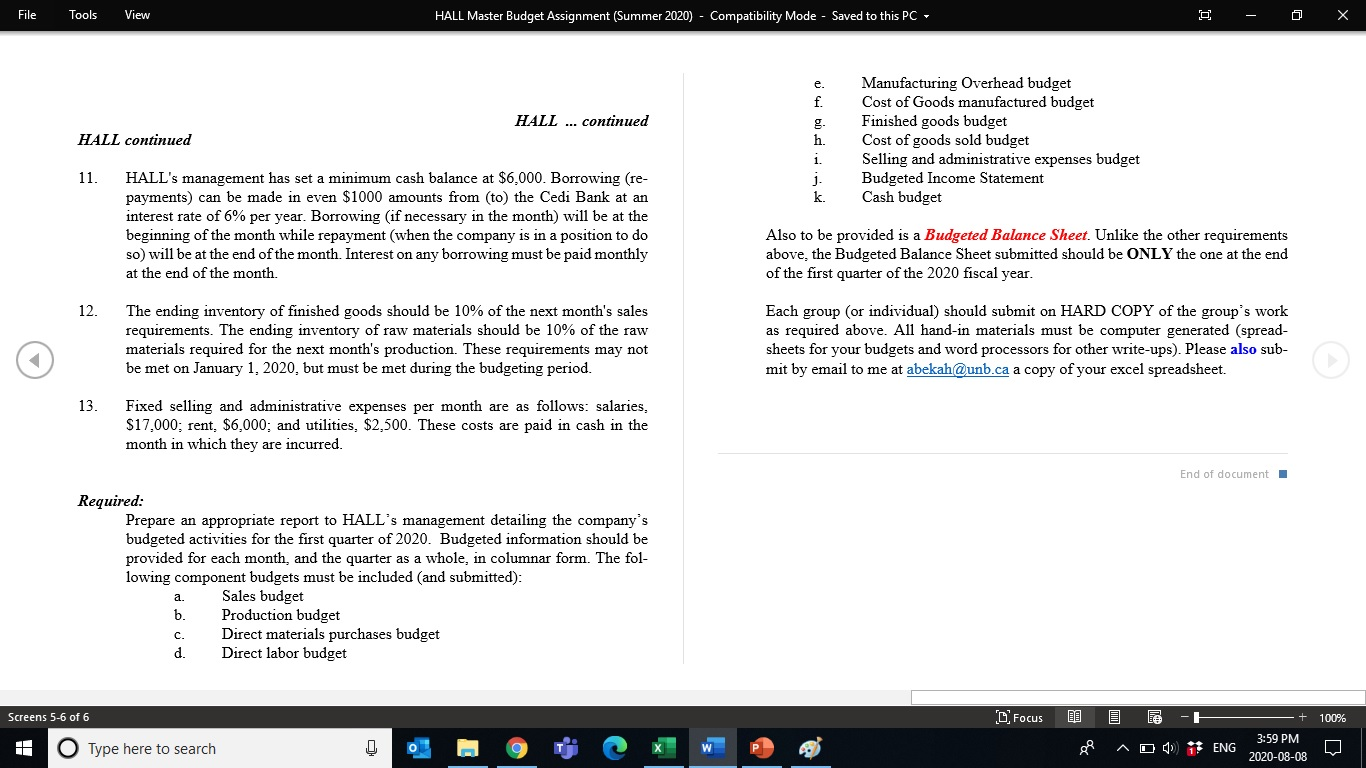

O 800 35,000 Notes payable (Due Feb. 28, 2020) UNIVERSITY OF NEW BRUNSWICK Faculty of Business Administration ADM 2223 Joe Abekah Managerial Accounting Summer 2020 Master Budget Due Date: Friday August 7, 2020 Raw materials inventory 30.000 Finished goods inventory Prepaid insurance 2.104 1,800 $350,000 Factory Building & Equipment Accumulated Total liabilities $ 67,148 Common stock $120,000 Retained earnings 128.536 (This is a Group Assignment: Maximum, 4 Students per Group) depreciation 248 536 (70,000) 280.000 Total Liabilities & Stockholders' Equity $315.684 Hoho Auto Links Ltd (HALL) Total assets $315.684 2 Hoho Auto Links Ltd (HALL) manufactures a speciality part used in the steering link- ages of luxury cars. The New Maryland, NB, Canada, company prides itself in being a crucial, albeit small, part of one of the world's renowned luxury motor vehicles. HALL is in the process of preparing its 2020 fiscal year master budget and has presented you with the following information. The company has a December 31st fiscal year-end. The Accounts Receivable balance at 12/31/19 represents the remaining balances of November and December credit sales, net of any allowance for doubtful ac- counts. Sales were (would be) $70,000 and $65,000, respectively, in those two months. 3. The budgeted December 31, 2019 balance sheet for the company is shown below. HALL Budgeted Balance Sheet December 31, 2019 Estimated sales in units for January through May 2020 are shown below. January 9,000 February 13,000 March 13,000 April 12,000 May 8,000 Assets Liabilities & Stockholders' Equity Cash $ 4,480 Accounts payable Currently, each unit sells for $12. The company expects the selling price to in- crease to $13 per unit from March 1, 2020. $ HALL ... continued 4 HALL continued Accounts receivable (net) 26,500 Dividends payable O 4. The collection pattern for accounts receivable is as follows: 68% in the month of sale; 20% in the first month after the month of sale; 10% in the second month after the month of sale. The remaining 2% of credit sales are never collected. The company expects to achieve a 70-20-8 collection pattern starting with the March 2020 sales. There will be 400 units of linkage parts in finished goods inventory at the begin- ning of 2020 carried at a standard cost of $5.26 per unit: Direct Materials, $.96; Direct Labor, $3.00: Variable Overhead. $.30; and Fixed Overhead, $1.00. 7. 5. Each part has the following standard quantities and costs for direct materials and direct labor: 1.2 pounds of direct materials at $.80 per pound 15 minutes of direct labour at $12 per hour Accounts Payable relates solely to direct materials purchases. All direct material purchases are initially on account. Accounts payable are paid 60% in the month of purchase and 40% in the month after purchase. No discounts are received for prompt payment. Starting with its March 2020 purchases, the company will be making payments on accounts payable at 50% in the month of purchase and 50% in the month after purchase. 8. Any outstanding dividends payable will be paid at the end of January 2020. 9. Direct material costs and direct labor costs are expected to increase by 15% as from March 1, 2020. Variable overhead is applied to the product on a machine hour basis. It takes 12 minutes of machine time to process one unit of finished linkage part. The variable overhead rate is $1.50 per machine hour. The rate will increase to $2.25 per machine hour from March 1, 2020. Total annual fixed man- ufacturing overhead is budgeted at $120,000; it is applied to the production of the month at $1.00 per unit based on an expected annual production of 120.000 units. Budgeted fixed manufacturing overhead per year is made up of the following A new piece of equipment costing $50,000 will be purchased on March 31, 2020. Payment for 80% of the cost will be made in March and 20% in May. The equip- ment will have a ten-year useful life and no residual value. 10 The note payable has an 8% interest rate; interest is paid at the end of each month. costs: Salaries $ 72,000 Utilities 20,400 Insurance - factory 2.400 Depreciation-factory building & equipment Total $120,000 25,200 HALL ... continued HALL continued 11. Actual fixed manufacturing overhead is incurred evenly throughout the year and payments for fixed manufacturing overhead are also made monthly throughout the year, if necessary. For periodic financial statements, any under-applied overhead is added to expenses and any over-applied overhead is deducted from expenses. HALL's management has set a minimum cash balance at $6,000. Borrowing (re- payments) can be made in even $1000 amounts from (to) the Cedi Bank at an interest rate of 6% per year. Borrowing (if necessary in the month) will be at the beginning of the month while repayment (when the company is in a position to do so) will be at the end of the month. Interest on any borrowing must be paid monthly at the end of the month. 6. There is no beginning inventory of Work in Process. All work in process is com- pleted in the period in which it is started. Direct materials inventory at the begin- ning of 2020 will consist of 1,000 pounds at a standard cost of S.80 per pound. 12 The ending inventory of finished goods should be 10% of the next month's sales File Tools View HALL Master Budget Assignment (Summer 2020) - Compatibility Mode - Saved to this PC- e. f. HALL ... continued HALL continued g h. i. 1. k. Manufacturing Overhead budget Cost of Goods manufactured budget Finished goods budget Cost of goods sold budget Selling and administrative expenses budget Budgeted Income Statement Cash budget 11. HALL's management has set a minimum cash balance at $6,000. Borrowing (re- payments) can be made in even $1000 amounts from (to) the Cedi Bank at an interest rate of 6% per year. Borrowing (if necessary in the month) will be at the beginning of the month while repayment (when the company is in a position to do so) will be at the end of the month. Interest on any borrowing must be paid monthly at the end of the month. Also to be provided is a Budgeted Balance Sheet. Unlike the other requirements above, the Budgeted Balance Sheet submitted should be ONLY the one at the end of the first quarter of the 2020 fiscal year. 12. The ending inventory of finished goods should be 10% of the next month's sales requirements. The ending inventory of raw materials should be 10% of the raw materials required for the next month's production. These requirements may not be met on January 1, 2020, but must be met during the budgeting period. Each group (or individual) should submit on HARD COPY of the group's work as required above. All hand-in materials must be computer generated (spread- sheets for your budgets and word processors for other write-ups). Please also sub- mit by email to me at abekah@unb.ca a copy of your excel spreadsheet. 13. Fixed selling and administrative expenses per month are as follows: salaries, $17,000: rent. $6,000: and utilities. $2,500. These costs are paid in cash in the month in which they are incurred. End of document Required: Prepare an appropriate report to HALL's management detailing the company's budgeted activities for the first quarter of 2020. Budgeted information should be provided for each month, and the quarter as a whole, in columnar form. The fol- lowing component budgets must be included (and submitted): Sales budget b. Production budget Direct materials purchases budget d. Direct labor budget a. C. Screens 5-6 of 6 D Focus 10 100% O Type here to search g AD ) ** ENG 3:59 PM 2020-08-08 n O 800 35,000 Notes payable (Due Feb. 28, 2020) UNIVERSITY OF NEW BRUNSWICK Faculty of Business Administration ADM 2223 Joe Abekah Managerial Accounting Summer 2020 Master Budget Due Date: Friday August 7, 2020 Raw materials inventory 30.000 Finished goods inventory Prepaid insurance 2.104 1,800 $350,000 Factory Building & Equipment Accumulated Total liabilities $ 67,148 Common stock $120,000 Retained earnings 128.536 (This is a Group Assignment: Maximum, 4 Students per Group) depreciation 248 536 (70,000) 280.000 Total Liabilities & Stockholders' Equity $315.684 Hoho Auto Links Ltd (HALL) Total assets $315.684 2 Hoho Auto Links Ltd (HALL) manufactures a speciality part used in the steering link- ages of luxury cars. The New Maryland, NB, Canada, company prides itself in being a crucial, albeit small, part of one of the world's renowned luxury motor vehicles. HALL is in the process of preparing its 2020 fiscal year master budget and has presented you with the following information. The company has a December 31st fiscal year-end. The Accounts Receivable balance at 12/31/19 represents the remaining balances of November and December credit sales, net of any allowance for doubtful ac- counts. Sales were (would be) $70,000 and $65,000, respectively, in those two months. 3. The budgeted December 31, 2019 balance sheet for the company is shown below. HALL Budgeted Balance Sheet December 31, 2019 Estimated sales in units for January through May 2020 are shown below. January 9,000 February 13,000 March 13,000 April 12,000 May 8,000 Assets Liabilities & Stockholders' Equity Cash $ 4,480 Accounts payable Currently, each unit sells for $12. The company expects the selling price to in- crease to $13 per unit from March 1, 2020. $ HALL ... continued 4 HALL continued Accounts receivable (net) 26,500 Dividends payable O 4. The collection pattern for accounts receivable is as follows: 68% in the month of sale; 20% in the first month after the month of sale; 10% in the second month after the month of sale. The remaining 2% of credit sales are never collected. The company expects to achieve a 70-20-8 collection pattern starting with the March 2020 sales. There will be 400 units of linkage parts in finished goods inventory at the begin- ning of 2020 carried at a standard cost of $5.26 per unit: Direct Materials, $.96; Direct Labor, $3.00: Variable Overhead. $.30; and Fixed Overhead, $1.00. 7. 5. Each part has the following standard quantities and costs for direct materials and direct labor: 1.2 pounds of direct materials at $.80 per pound 15 minutes of direct labour at $12 per hour Accounts Payable relates solely to direct materials purchases. All direct material purchases are initially on account. Accounts payable are paid 60% in the month of purchase and 40% in the month after purchase. No discounts are received for prompt payment. Starting with its March 2020 purchases, the company will be making payments on accounts payable at 50% in the month of purchase and 50% in the month after purchase. 8. Any outstanding dividends payable will be paid at the end of January 2020. 9. Direct material costs and direct labor costs are expected to increase by 15% as from March 1, 2020. Variable overhead is applied to the product on a machine hour basis. It takes 12 minutes of machine time to process one unit of finished linkage part. The variable overhead rate is $1.50 per machine hour. The rate will increase to $2.25 per machine hour from March 1, 2020. Total annual fixed man- ufacturing overhead is budgeted at $120,000; it is applied to the production of the month at $1.00 per unit based on an expected annual production of 120.000 units. Budgeted fixed manufacturing overhead per year is made up of the following A new piece of equipment costing $50,000 will be purchased on March 31, 2020. Payment for 80% of the cost will be made in March and 20% in May. The equip- ment will have a ten-year useful life and no residual value. 10 The note payable has an 8% interest rate; interest is paid at the end of each month. costs: Salaries $ 72,000 Utilities 20,400 Insurance - factory 2.400 Depreciation-factory building & equipment Total $120,000 25,200 HALL ... continued HALL continued 11. Actual fixed manufacturing overhead is incurred evenly throughout the year and payments for fixed manufacturing overhead are also made monthly throughout the year, if necessary. For periodic financial statements, any under-applied overhead is added to expenses and any over-applied overhead is deducted from expenses. HALL's management has set a minimum cash balance at $6,000. Borrowing (re- payments) can be made in even $1000 amounts from (to) the Cedi Bank at an interest rate of 6% per year. Borrowing (if necessary in the month) will be at the beginning of the month while repayment (when the company is in a position to do so) will be at the end of the month. Interest on any borrowing must be paid monthly at the end of the month. 6. There is no beginning inventory of Work in Process. All work in process is com- pleted in the period in which it is started. Direct materials inventory at the begin- ning of 2020 will consist of 1,000 pounds at a standard cost of S.80 per pound. 12 The ending inventory of finished goods should be 10% of the next month's sales File Tools View HALL Master Budget Assignment (Summer 2020) - Compatibility Mode - Saved to this PC- e. f. HALL ... continued HALL continued g h. i. 1. k. Manufacturing Overhead budget Cost of Goods manufactured budget Finished goods budget Cost of goods sold budget Selling and administrative expenses budget Budgeted Income Statement Cash budget 11. HALL's management has set a minimum cash balance at $6,000. Borrowing (re- payments) can be made in even $1000 amounts from (to) the Cedi Bank at an interest rate of 6% per year. Borrowing (if necessary in the month) will be at the beginning of the month while repayment (when the company is in a position to do so) will be at the end of the month. Interest on any borrowing must be paid monthly at the end of the month. Also to be provided is a Budgeted Balance Sheet. Unlike the other requirements above, the Budgeted Balance Sheet submitted should be ONLY the one at the end of the first quarter of the 2020 fiscal year. 12. The ending inventory of finished goods should be 10% of the next month's sales requirements. The ending inventory of raw materials should be 10% of the raw materials required for the next month's production. These requirements may not be met on January 1, 2020, but must be met during the budgeting period. Each group (or individual) should submit on HARD COPY of the group's work as required above. All hand-in materials must be computer generated (spread- sheets for your budgets and word processors for other write-ups). Please also sub- mit by email to me at abekah@unb.ca a copy of your excel spreadsheet. 13. Fixed selling and administrative expenses per month are as follows: salaries, $17,000: rent. $6,000: and utilities. $2,500. These costs are paid in cash in the month in which they are incurred. End of document Required: Prepare an appropriate report to HALL's management detailing the company's budgeted activities for the first quarter of 2020. Budgeted information should be provided for each month, and the quarter as a whole, in columnar form. The fol- lowing component budgets must be included (and submitted): Sales budget b. Production budget Direct materials purchases budget d. Direct labor budget a. C. Screens 5-6 of 6 D Focus 10 100% O Type here to search g AD ) ** ENG 3:59 PM 2020-08-08 n

Only need E-K

Only need E-K