Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*ONLY NEED HELP WITH THE LAST PART (PART E) OF THIS QUESTION* NYU is considering two mutually exclusive investments. The projects' expected net cash flows

*ONLY NEED HELP WITH THE LAST PART (PART E) OF THIS QUESTION*

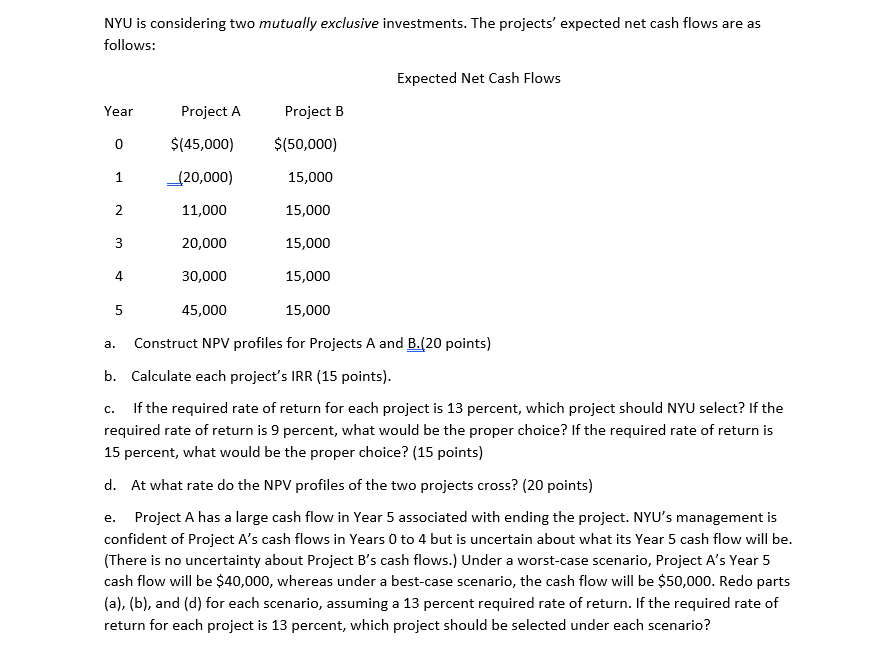

NYU is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: Expected Net Cash Flows Year Project A Project B 0 $(50,000) $(45,000) _(20,000) 1 15,000 2 11,000 15,000 3 20,000 15,000 4 30,000 15,000 5 45,000 15,000 a. C. Construct NPV profiles for Projects A and B.(20 points) b. Calculate each project's IRR (15 points). If the required rate of return for each project is 13 percent, which project should NYU select? If the required rate of return is 9 percent, what would be the proper choice? If the required rate of return is 15 percent, what would be the proper choice? (15 points) d. At what rate do the NPV profiles of the two projects cross? (20 points) e. Project A has a large cash flow in Year 5 associated with ending the project. NYU's management is confident of Project A's cash flows in Years 0 to 4 but is uncertain about what its Year 5 cash flow will be. (There is no uncertainty about Project B's cash flows.) Under a worst-case scenario, Project A's Year 5 cash flow will be $40,000, whereas under a best-case scenario, the cash flow will be $50,000. Redo parts (a), (b), and (d) for each scenario, assuming a 13 percent required rate of return. If the required rate of return for each project is 13 percent, which project should be selected under each scenarioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started