Answered step by step

Verified Expert Solution

Question

1 Approved Answer

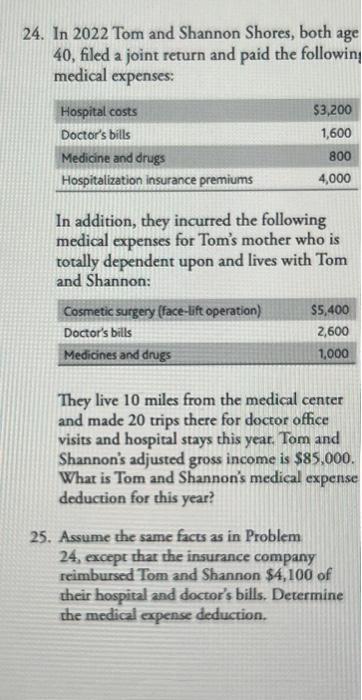

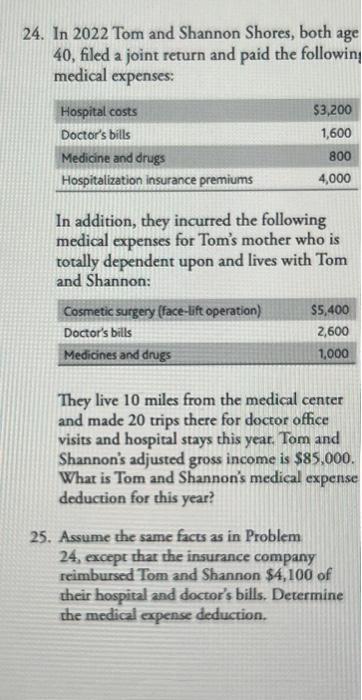

only need the answer gof number 24. but the infirmation is on nimbet 24. due now 24. In 2022 Tom and Shannon Shores, both age

only need the answer gof number 24. but the infirmation is on nimbet 24. due now

24. In 2022 Tom and Shannon Shores, both age 40 , fled a joint return and paid the followin medical expenses: In addition, they incurred the following medical expenses for Tom's mother who is totally dependent upon and lives with Tom and Shannon: They live 10 miles from the medical center and made 20 trips there for doctor office visits and hospital stays this year. Tom and Shannon's adjusted gross income is $85,000. What is Tom and Shannon's medical expense deduction for this year? 25. Assume the same facts as in Problem 24, except that the insurance company reimbursed Tom and Shannon $4,100 of their hospital and doctor's bills. Determine the medical expense deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started