Answered step by step

Verified Expert Solution

Question

1 Approved Answer

only operating activities!! Refer to Forten Company's financial statements and related information in Problem 16-3A. Required Prepare a complete statement of cash flows using the

only operating activities!!

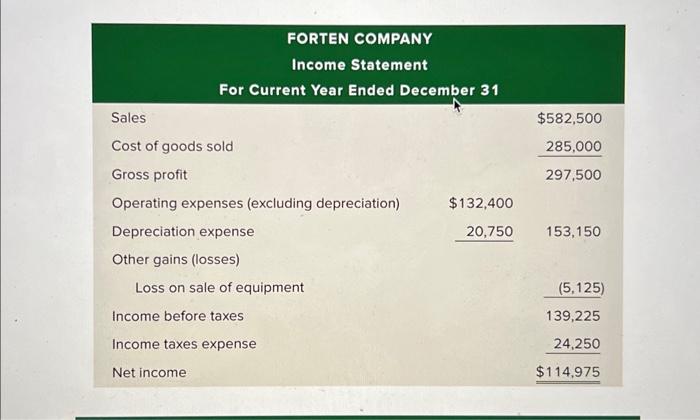

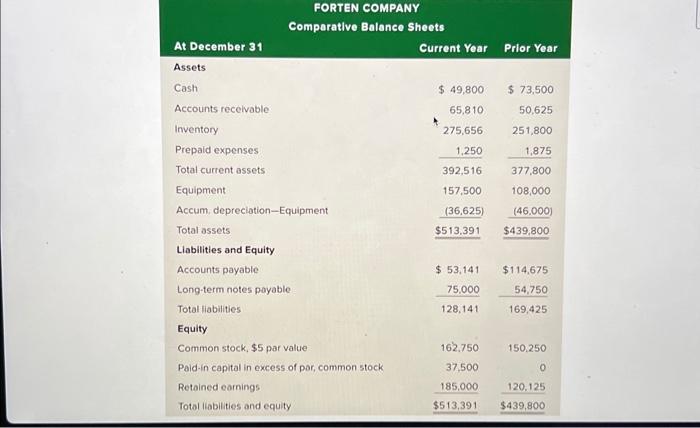

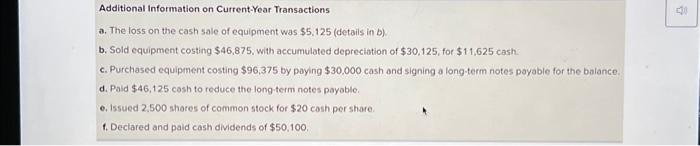

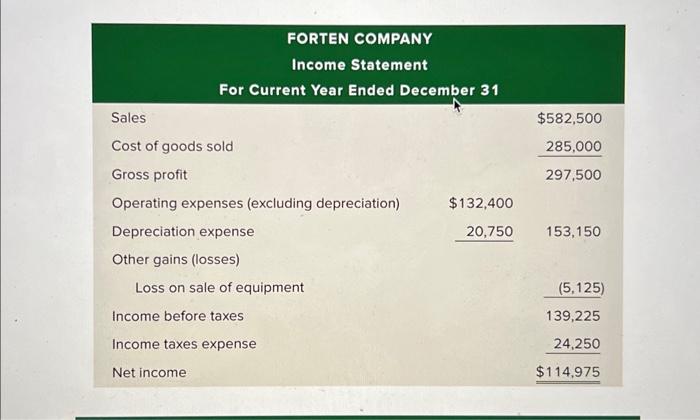

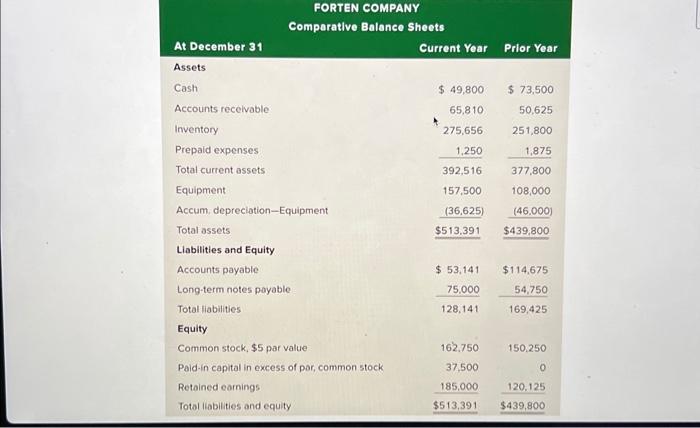

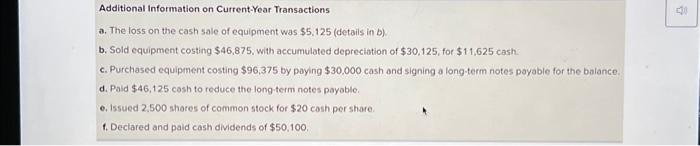

Refer to Forten Company's financial statements and related information in Problem 16-3A. Required Prepare a complete statement of cash flows using the direct method. Disclose any noncash investing and financing activities in a note. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $582,500 Cost of goods sold Gross profit 285,000 Operating expenses (excluding depreciation) 297,500 Depreciation expense $132,400 Other gains (losses) Loss on sale of equipment (5,125) Income before taxes 139,225 Income taxes expense 24,250 Net income $114,975 FORTEN COMPANY Comparative Balance Sheets At December 31 Current Year Prior Year Assets Cash Accounts recelvable Inventory $49,800$73,500 Prepaid expenses Total current assets Equipment Accum, depreciation-Equipment Total assets Liabilities and Equity Accounts payable \begin{tabular}{rr} $53,141 & $114,675 \\ 75,000 & 54,750 \\ \hline 128,141 & 169,425 \end{tabular} Equity Common stock, $5 par value 162.750150,250 Paid-in capital in excess of por, common stock 37,500 Retained earnings 185.000 0 Totol liabilities and equity $513,391$439,800 Additional Information on Current-Year Transactions a. The loss on the cash sale of equipment was $5,125 (details in b). b. Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash. c. Purchased equipment costing $96,375 by paying $30,000 cash and signing a long-term notes payable for the balance. d. Paid $46,125 cosh to reduce the long-term notes payable. e. 1ssued 2.500 shares of common stock for $20 cosh per share. f. Declared and paid cash dividends of $50,100, Refer to Forten Company's financial statements and related information in Problem 16-3A. Required Prepare a complete statement of cash flows using the direct method. Disclose any noncash investing and financing activities in a note. FORTEN COMPANY Income Statement For Current Year Ended December 31 Sales $582,500 Cost of goods sold Gross profit 285,000 Operating expenses (excluding depreciation) 297,500 Depreciation expense $132,400 Other gains (losses) Loss on sale of equipment (5,125) Income before taxes 139,225 Income taxes expense 24,250 Net income $114,975 FORTEN COMPANY Comparative Balance Sheets At December 31 Current Year Prior Year Assets Cash Accounts recelvable Inventory $49,800$73,500 Prepaid expenses Total current assets Equipment Accum, depreciation-Equipment Total assets Liabilities and Equity Accounts payable \begin{tabular}{rr} $53,141 & $114,675 \\ 75,000 & 54,750 \\ \hline 128,141 & 169,425 \end{tabular} Equity Common stock, $5 par value 162.750150,250 Paid-in capital in excess of por, common stock 37,500 Retained earnings 185.000 0 Totol liabilities and equity $513,391$439,800 Additional Information on Current-Year Transactions a. The loss on the cash sale of equipment was $5,125 (details in b). b. Sold equipment costing $46,875, with accumulated depreciation of $30,125, for $11,625 cash. c. Purchased equipment costing $96,375 by paying $30,000 cash and signing a long-term notes payable for the balance. d. Paid $46,125 cosh to reduce the long-term notes payable. e. 1ssued 2.500 shares of common stock for $20 cosh per share. f. Declared and paid cash dividends of $50,100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started