only part 2 please my exam it will finsh

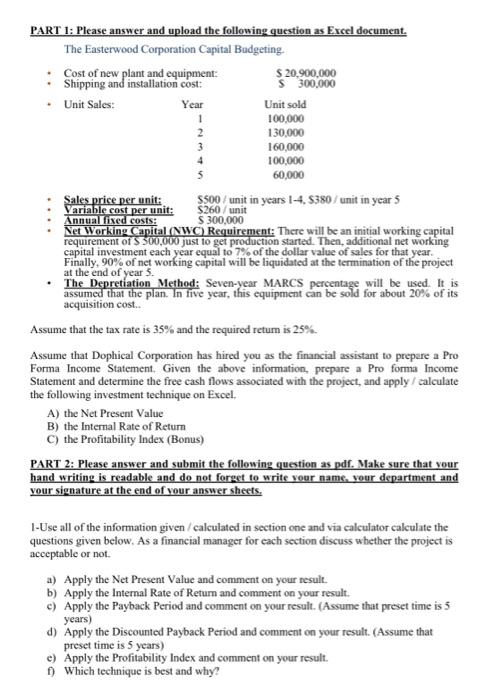

PART 1: Please answer and upload the following question as Excel document. The Easterwood Corporation Capital Budgeting. Cost of new plant and equipment: $ 20,900,000 Shipping and installation cost: S 300,000 Unit Sales: Year Unit sold 1 100,000 2 130,000 3 160,000 100,000 60,000 Sales price per unit: S500/unit in years 1-4, 8380/unit in years Variable cost per unit: S260/unit Annual fixed costs: $ 300,000 Net Working Capital (NW) Requirement: There will be an initial working capital requirement of $ 500.000 just to get production started. Then, additional networking capital investment each year equal to 7% of the dollar value of sales for that year. Finally, 90% of net working capital will be liquidated at the termination of the project The Depretiation Method: Seven-year MARCS percentage will be used. It is assumed that the plan. In five year, this equipment can be sold for about 20% of its acquisition cost.. Assume that the tax rate is 35% and the required retum is 25%. Assume that Dophical Corporation has hired you as the financial assistant to prepare a Pro Forma Income Statement. Given the above information, prepare a Pro forma Income Statement and determine the free cash flows associated with the project, and apply / calculate the following investment technique on Excel. A) the Net Present Value B) the Internal Rate of Return C) the Profitability Index (Bonus) PART 2: Please answer and submit the following question as pdf. Make sure that your hand writing is readable and do not forget to write your name your department and your signature at the end of your answer sheets. . 1-Use all of the information given calculated in section one and via calculator calculate the questions given below. As a financial manager for each section discuss whether the project is acceptable or not a) Apply the Net Present Value and comment on your result. b) Apply the Internal Rate of Return and comment on your result. c) Apply the Payback Period and comment on your result. (Assume that preset time is 5 years) d) Apply the Discounted Payback period and comment on your result. (Assume that preset time is 5 years) e) Apply the Profitability Index and comment on your result. 1) Which technique is best and why? PART 1: Please answer and upload the following question as Excel document. The Easterwood Corporation Capital Budgeting. Cost of new plant and equipment: $ 20,900,000 Shipping and installation cost: S 300,000 Unit Sales: Year Unit sold 1 100,000 2 130,000 3 160,000 100,000 60,000 Sales price per unit: S500/unit in years 1-4, 8380/unit in years Variable cost per unit: S260/unit Annual fixed costs: $ 300,000 Net Working Capital (NW) Requirement: There will be an initial working capital requirement of $ 500.000 just to get production started. Then, additional networking capital investment each year equal to 7% of the dollar value of sales for that year. Finally, 90% of net working capital will be liquidated at the termination of the project The Depretiation Method: Seven-year MARCS percentage will be used. It is assumed that the plan. In five year, this equipment can be sold for about 20% of its acquisition cost.. Assume that the tax rate is 35% and the required retum is 25%. Assume that Dophical Corporation has hired you as the financial assistant to prepare a Pro Forma Income Statement. Given the above information, prepare a Pro forma Income Statement and determine the free cash flows associated with the project, and apply / calculate the following investment technique on Excel. A) the Net Present Value B) the Internal Rate of Return C) the Profitability Index (Bonus) PART 2: Please answer and submit the following question as pdf. Make sure that your hand writing is readable and do not forget to write your name your department and your signature at the end of your answer sheets. . 1-Use all of the information given calculated in section one and via calculator calculate the questions given below. As a financial manager for each section discuss whether the project is acceptable or not a) Apply the Net Present Value and comment on your result. b) Apply the Internal Rate of Return and comment on your result. c) Apply the Payback Period and comment on your result. (Assume that preset time is 5 years) d) Apply the Discounted Payback period and comment on your result. (Assume that preset time is 5 years) e) Apply the Profitability Index and comment on your result. 1) Which technique is best and why