ONLY PART B

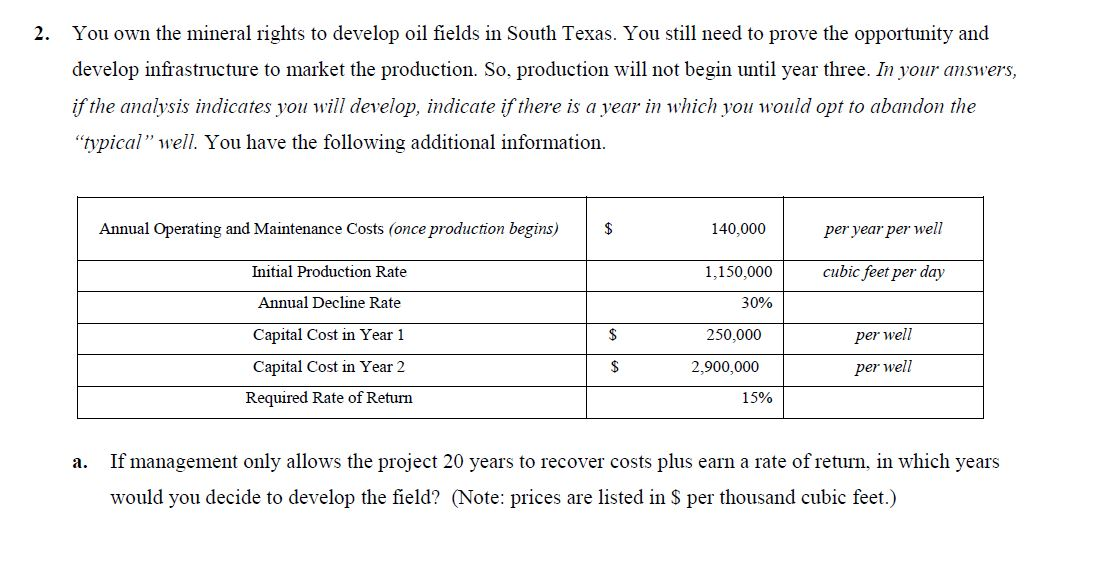

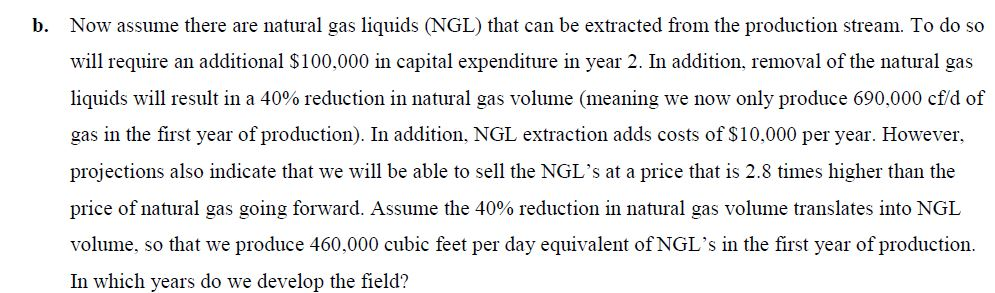

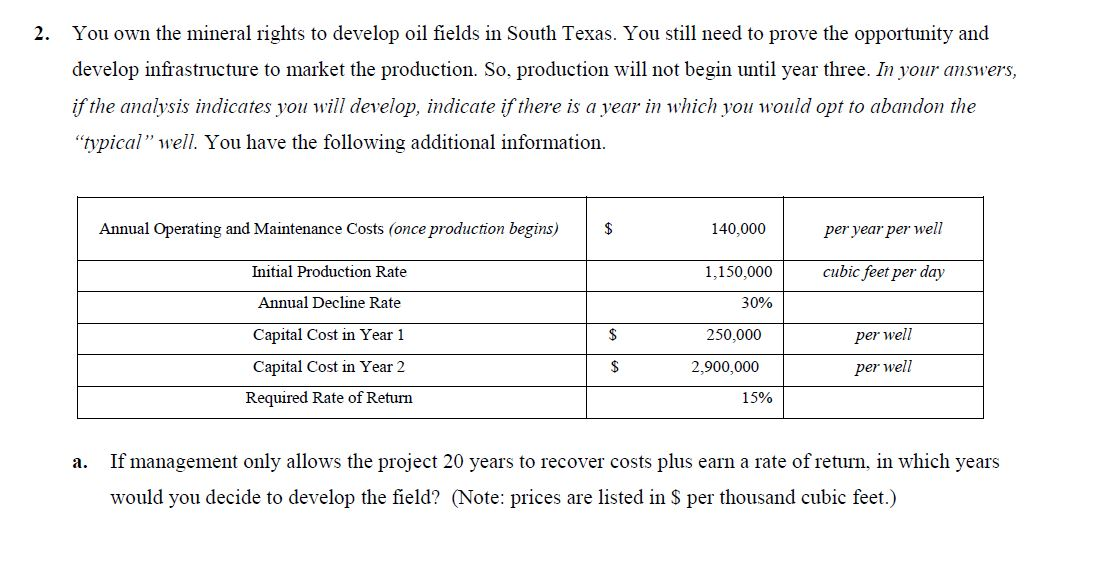

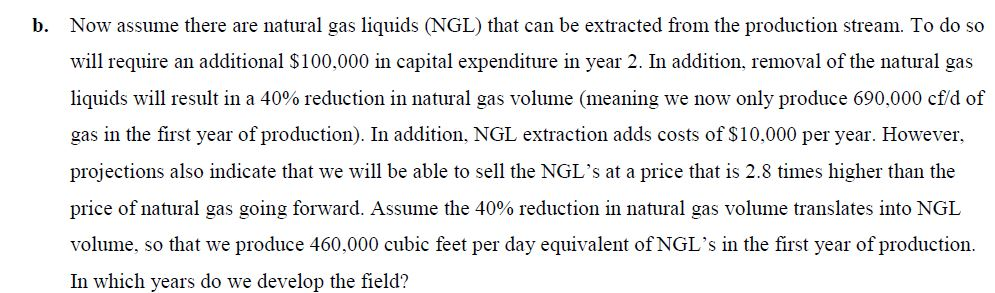

b. Now assume there are natural gas liquids (NGL) that can be extracted from the production stream. To do so will require an additional $100,000 in capital expenditure in year 2. In addition, removal of the natural gas liquids will result in a 40% reduction in natural gas volume (meaning we now only produce 690,000 cf/d of gas in the first year of production). In addition. NGL extraction adds costs of $10.000 per year. However. projections also indicate that we will be able to sell the at a price that is 2.8 times higher than the price of natural gas going forward. Assume the 40% reduction in natural gas volume translates into NGL volume, so that we produce 460,000 cubic feet per day equivalent of NGL?s in the first year of production. In which years do we develop the field? 2. You own the mineral rights to develop oil fields in South Texas. You still need to prove the opportunity and develop infrastructure to market the production. So. production will not begin until year three. In your answers, if the analysis indicates you will develop, indicate if there is a year in which you would opt to abandon the ^''typical^'' well. You have the following additional information. a. If management oily allows the project 20 years to recover costs plus earn a rate of return. in which years would you decide to develop the field? (Note: prices are listed in $ per thousand cubic feet.) b. Now assume there are natural gas liquids (NGL) that can be extracted from the production stream. To do so will require an additional $100,000 in capital expenditure in year 2. In addition, removal of the natural gas liquids will result in a 40% reduction in natural gas volume (meaning we now only produce 690,000 cf/d of gas in the first year of production). In addition. NGL extraction adds costs of $10.000 per year. However. projections also indicate that we will be able to sell the at a price that is 2.8 times higher than the price of natural gas going forward. Assume the 40% reduction in natural gas volume translates into NGL volume, so that we produce 460,000 cubic feet per day equivalent of NGL?s in the first year of production. In which years do we develop the field? 2. You own the mineral rights to develop oil fields in South Texas. You still need to prove the opportunity and develop infrastructure to market the production. So. production will not begin until year three. In your answers, if the analysis indicates you will develop, indicate if there is a year in which you would opt to abandon the ^''typical^'' well. You have the following additional information. a. If management oily allows the project 20 years to recover costs plus earn a rate of return. in which years would you decide to develop the field? (Note: prices are listed in $ per thousand cubic feet.)