Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ONLY PART C. please provide the calculations and explain how you got the numbers in the eliminations section. Thank you Workpaper Entries and Consolidated Financial

ONLY PART C.

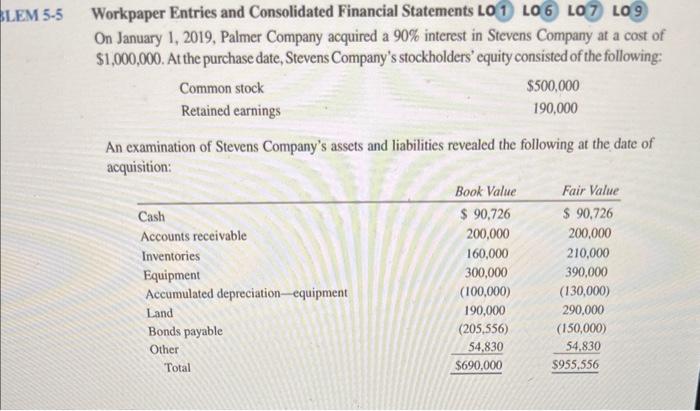

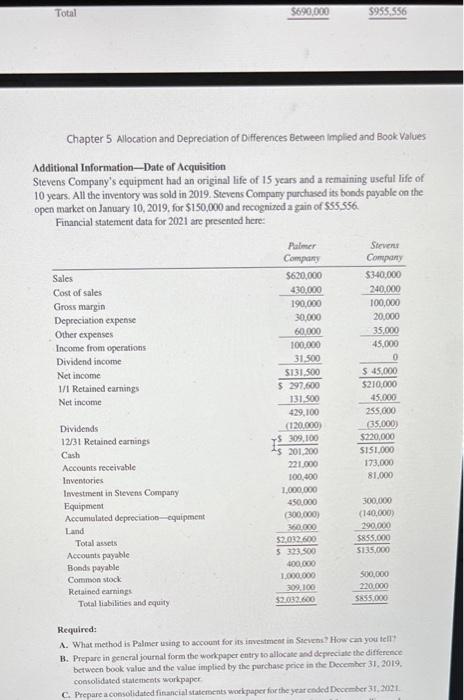

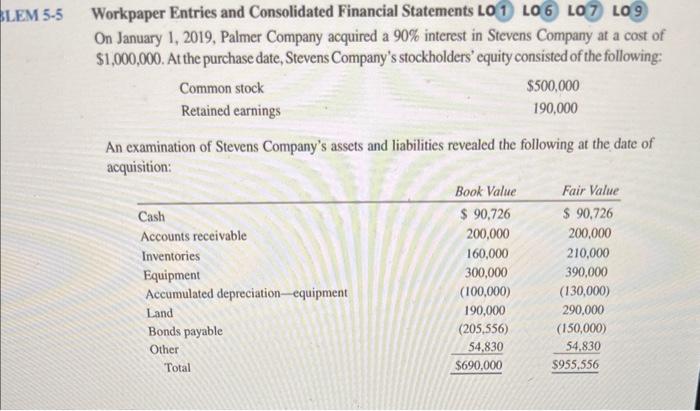

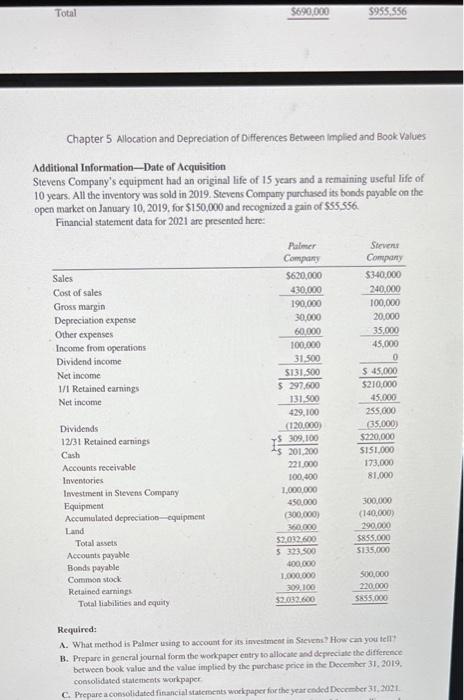

Workpaper Entries and Consolidated Financial Statements LO 1 LO 6LO7)L99 On January 1, 2019, Palmer Company acquired a 90% interest in Stevens Company at a cost of $1,000,000. At the purchase date, Stevens Company's stockholders' equity consisted of the following: An examination of Stevens Company's assets and liabilities revealed the following at the date of acquisition: Chapter 5 Allocation and Depreciation of Differences Between implied and Book Values Additional Information-Date of Acquisition Stevens Company's equipment had an original life of 15 years and a remaining useful life of 10 years. All the inventory was sold in 2019. Stevens Company purchased its bonds payable on the open market on January 10, 2019, for $150,000 and recognized a gain of $55,556. Financial statement data for 2021 are presented here: Fequired A. What method is Palmer using to account for its imvesiment in Stevens? How cme you tell? B. Prepare in general journal form the workpaper entry to allocate asd depreciate the difference between book value and the value implied by the purchase peice in the Decemher 31, 2019. copsolidated statemcets warkpaper C. Prepare a conselidatod fintanciel statcroents worigaper for the yrar coded December 31, 2o?l please provide the calculations and explain how you got the numbers in the eliminations section. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started