Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ONLY QUESTION !!!! Michael Wright graduated from the University College in June and has been working for about a month as a junior financial analyst

ONLY QUESTION !!!!

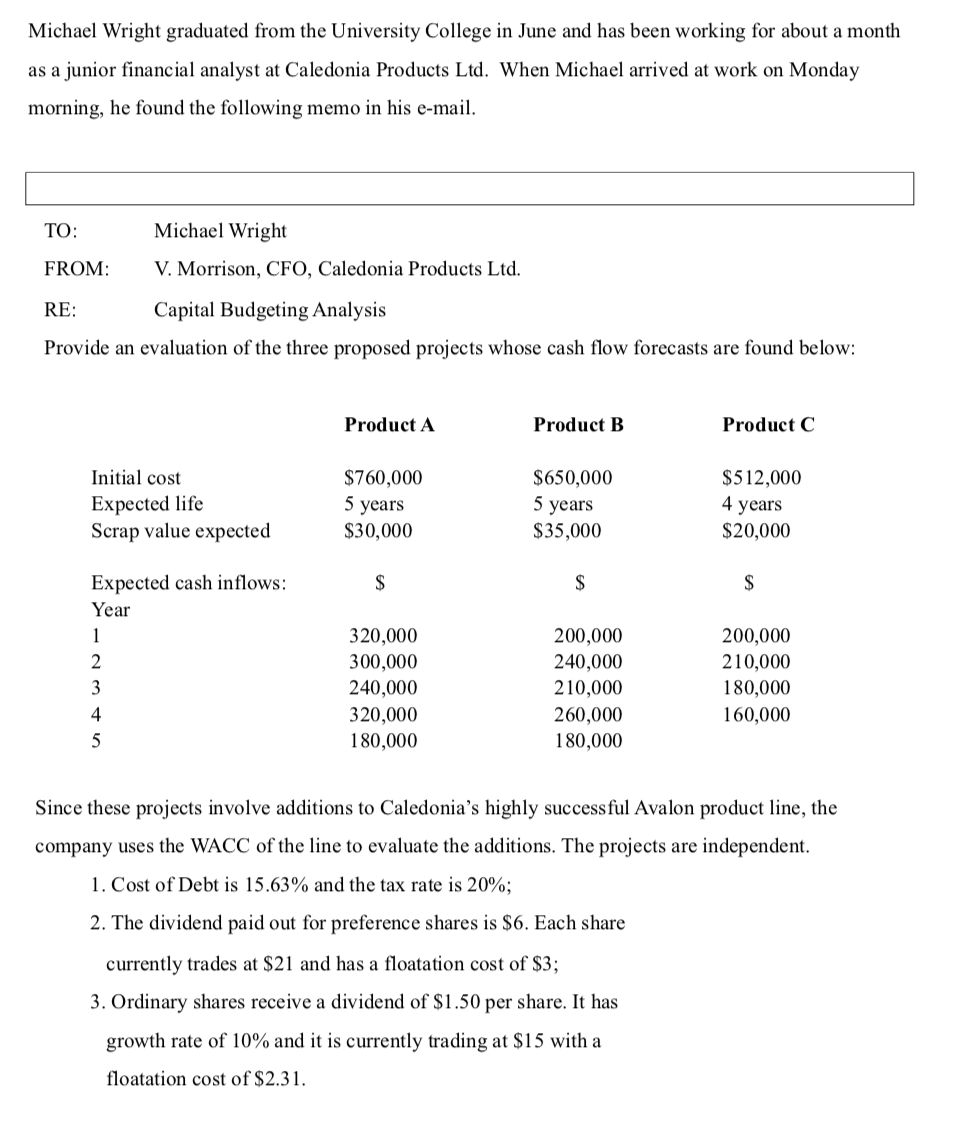

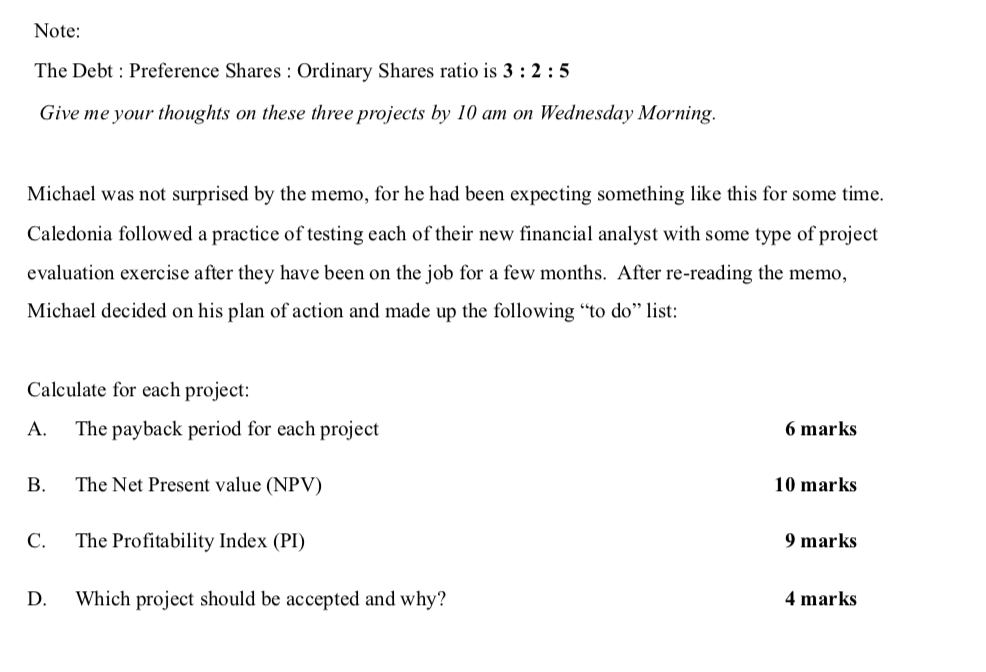

Michael Wright graduated from the University College in June and has been working for about a month as a junior financial analyst at Caledonia Products Ltd. When Michael arrived at work on Monday morning, he found the following memo in his e-mail. TO: Michael Wright V. Morrison, CFO, Caledonia Products Ltd. FROM: RE: Capital Budgeting Analysis Provide an evaluation of the three proposed projects whose cash flow forecasts are found below: Product A Product B Product C Initial cost Expected life Scrap value expected $760,000 5 years $30,000 $650,000 5 years $35,000 $512,000 4 years $20,000 Expected cash inflows: Year 320,000 300,000 240,000 320,000 180,000 200,000 240,000 210,000 260,000 180,000 200,000 210,000 180,000 160,000 Since these projects involve additions to Caledonia's highly successful Avalon product line, the company uses the WACC of the line to evaluate the additions. The projects are independent. 1. Cost of Debt is 15.63% and the tax rate is 20%; 2. The dividend paid out for preference shares is $6. Each share currently trades at $21 and has a floatation cost of $3; 3. Ordinary shares receive a dividend of $1.50 per share. It has growth rate of 10% and it is currently trading at $15 with a floatation cost of $2.31. Note: The Debt : Preference Shares : Ordinary Shares ratio is 3 : 2:5 Give me your thoughts on these three projects by 10 am on Wednesday Morning. Michael was not surprised by the memo, for he had been expecting something like this for some time. Caledonia followed a practice of testing each of their new financial analyst with some type of project evaluation exercise after they have been on the job for a few months. After re-reading the memo, Michael decided on his plan of action and made up the following to do list: Calculate for each project: A. The payback period for each project 6 marks B. The Net Present value (NPV) 10 marks C. The Profitability Index (PI) 9 marks D. Which project should be accepted and why? 4 marks Michael Wright graduated from the University College in June and has been working for about a month as a junior financial analyst at Caledonia Products Ltd. When Michael arrived at work on Monday morning, he found the following memo in his e-mail. TO: Michael Wright V. Morrison, CFO, Caledonia Products Ltd. FROM: RE: Capital Budgeting Analysis Provide an evaluation of the three proposed projects whose cash flow forecasts are found below: Product A Product B Product C Initial cost Expected life Scrap value expected $760,000 5 years $30,000 $650,000 5 years $35,000 $512,000 4 years $20,000 Expected cash inflows: Year 320,000 300,000 240,000 320,000 180,000 200,000 240,000 210,000 260,000 180,000 200,000 210,000 180,000 160,000 Since these projects involve additions to Caledonia's highly successful Avalon product line, the company uses the WACC of the line to evaluate the additions. The projects are independent. 1. Cost of Debt is 15.63% and the tax rate is 20%; 2. The dividend paid out for preference shares is $6. Each share currently trades at $21 and has a floatation cost of $3; 3. Ordinary shares receive a dividend of $1.50 per share. It has growth rate of 10% and it is currently trading at $15 with a floatation cost of $2.31. Note: The Debt : Preference Shares : Ordinary Shares ratio is 3 : 2:5 Give me your thoughts on these three projects by 10 am on Wednesday Morning. Michael was not surprised by the memo, for he had been expecting something like this for some time. Caledonia followed a practice of testing each of their new financial analyst with some type of project evaluation exercise after they have been on the job for a few months. After re-reading the memo, Michael decided on his plan of action and made up the following to do list: Calculate for each project: A. The payback period for each project 6 marks B. The Net Present value (NPV) 10 marks C. The Profitability Index (PI) 9 marks D. Which project should be accepted and why? 4 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started