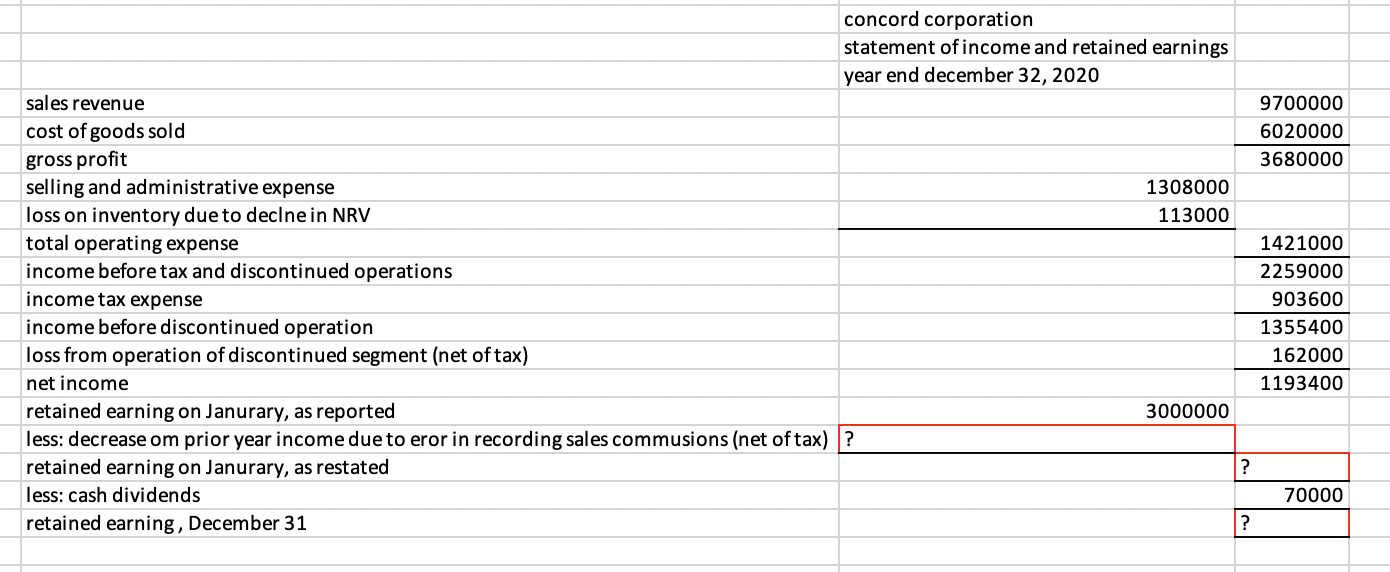

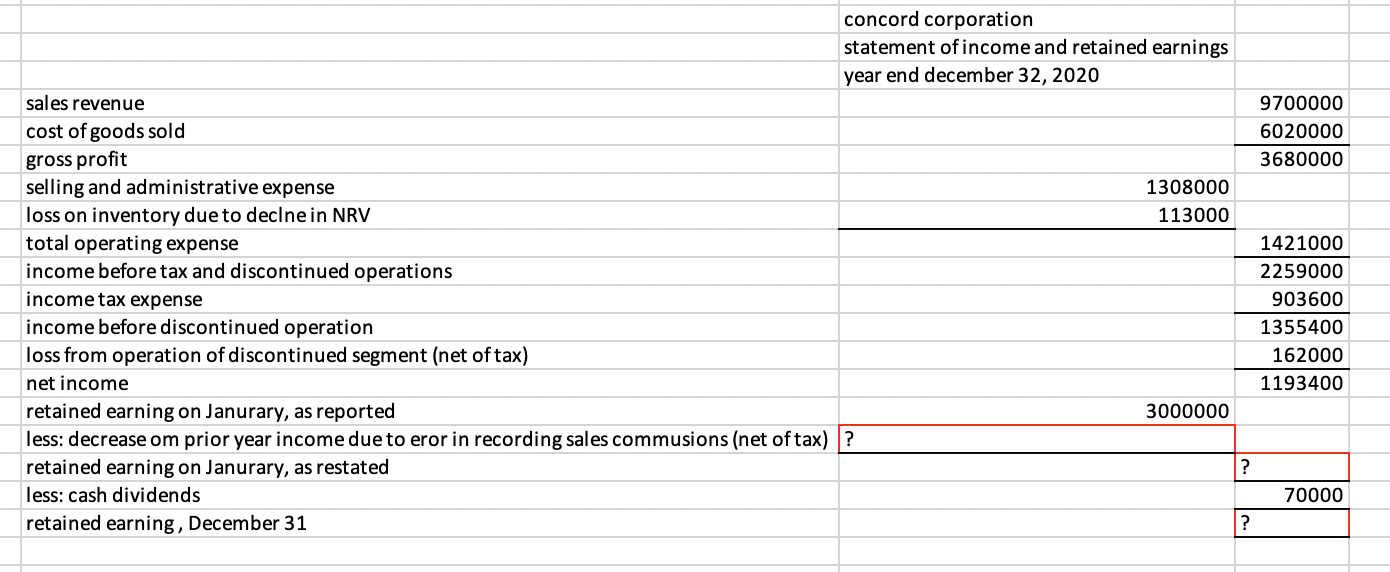

Only the blank space with a question mark, Thank you.

for the 'less: decrease om prior year income due to error in recording sales commission (net of tax)' , I've tried 20,000 and 121,875, but they were all wrong.

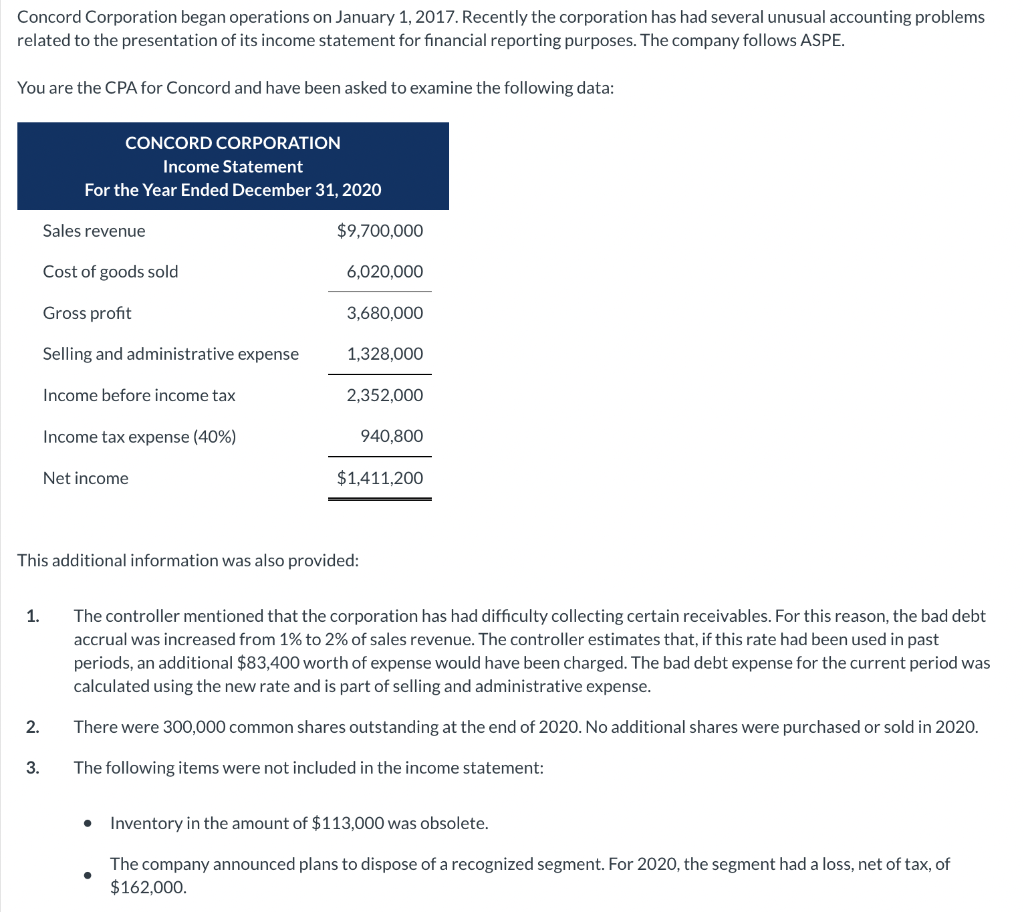

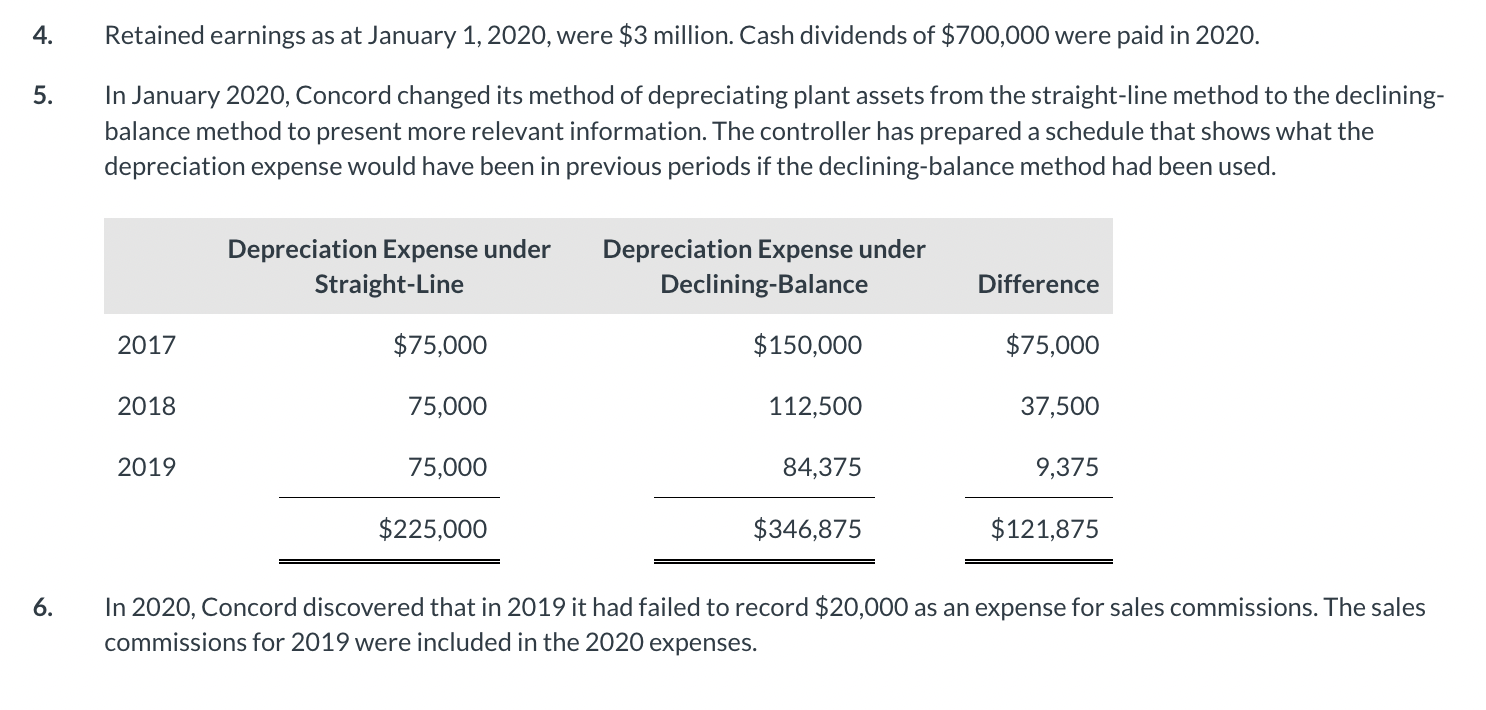

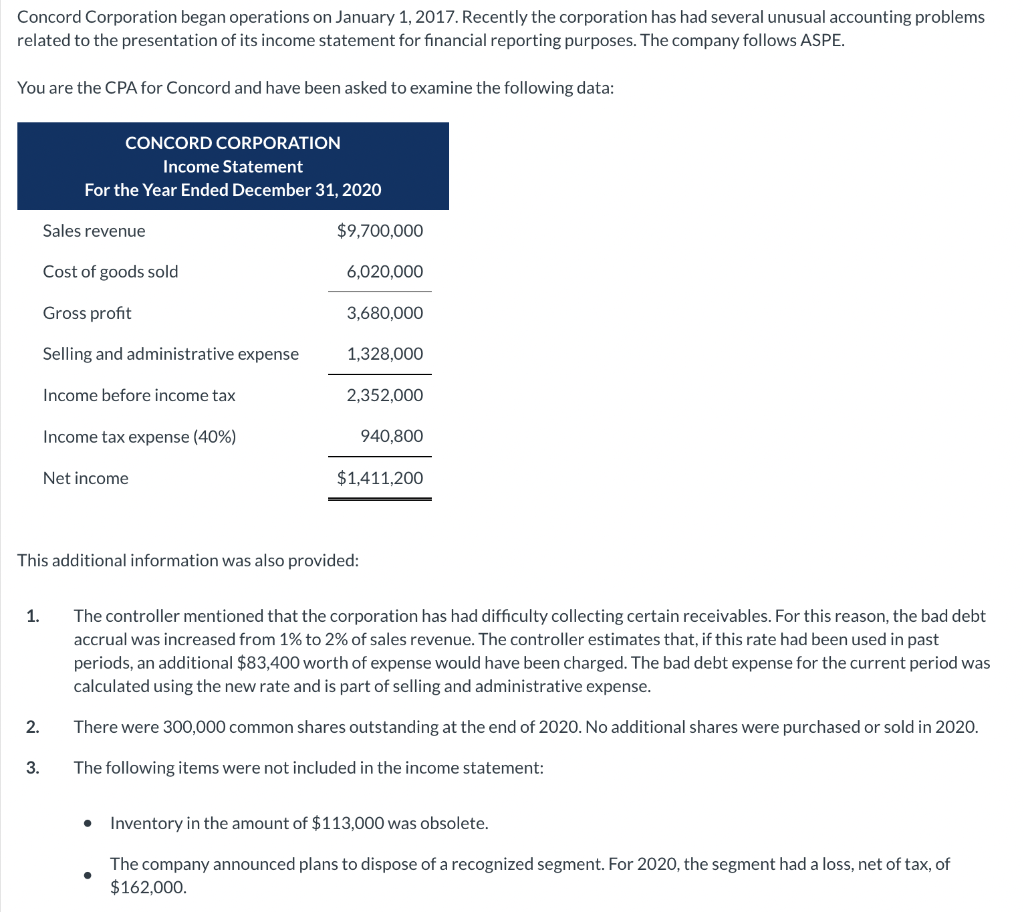

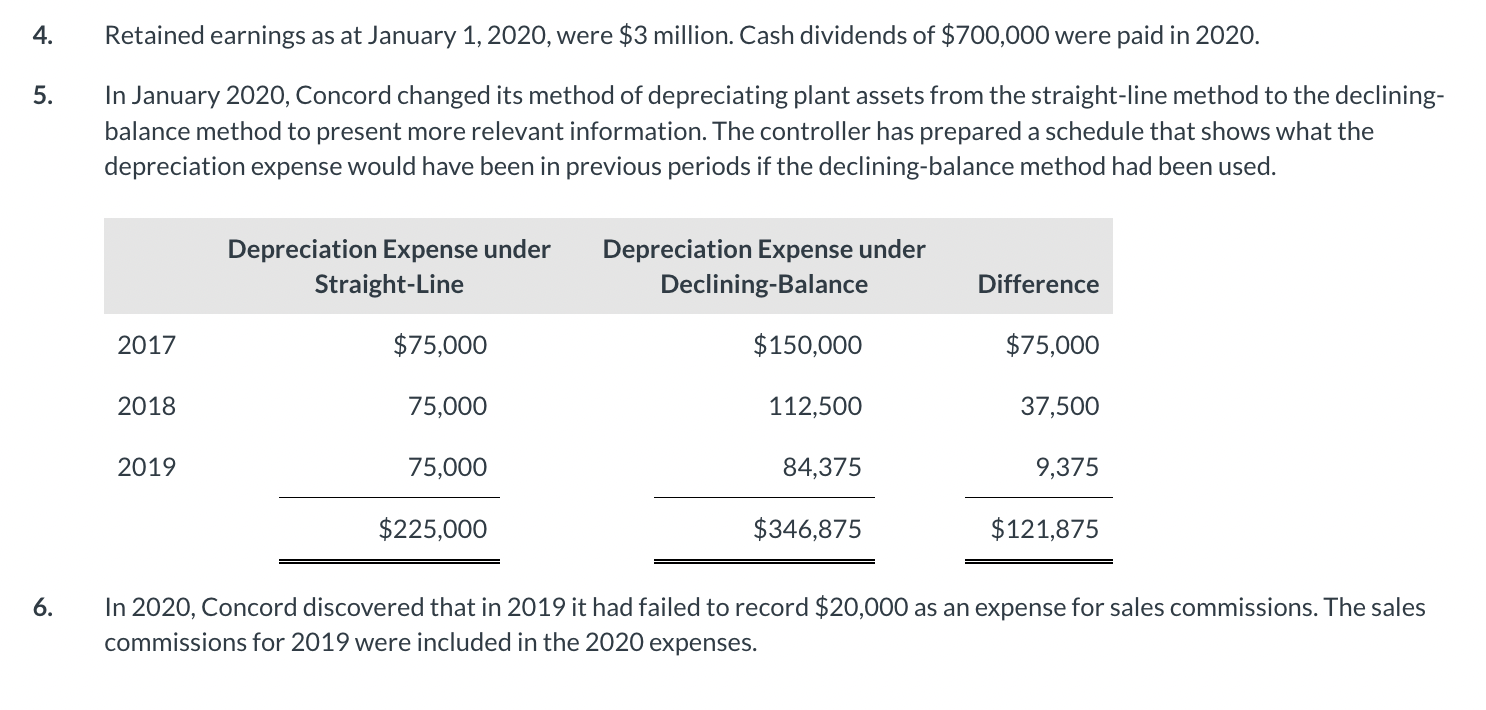

Concord Corporation began operations on January 1, 2017. Recently the corporation has had several unusual accounting problems related to the presentation of its income statement for financial reporting purposes. The company follows ASPE. You are the CPA for Concord and have been asked to examine the following data: CONCORD CORPORATION Income Statement For the Year Ended December 31, 2020 Sales revenue $9,700,000 Cost of goods sold 6,020,000 Gross profit 3,680,000 Selling and administrative expense 1,328,000 Income before income tax 2,352,000 Income tax expense (40%) 940,800 Net income $1,411,200 This additional information was also provided: 1. The controller mentioned that the corporation has had difficulty collecting certain receivables. For this reason, the bad debt accrual was increased from 1% to 2% of sales revenue. The controller estimates that, if this rate had been used in past periods, an additional $83,400 worth of expense would have been charged. The bad debt expense for the current period was calculated using the new rate and is part of selling and administrative expense. 2. There were 300,000 common shares outstanding at the end of 2020. No additional shares were purchased or sold in 2020. 3. The following items were not included in the income statement: Inventory in the amount of $113,000 was obsolete. The company announced plans to dispose of a recognized segment. For 2020, the segment had a loss, net of tax, of $162,000. 4. Retained earnings as at January 1, 2020, were $3 million. Cash dividends of $700,000 were paid in 2020. 5. In January 2020, Concord changed its method of depreciating plant assets from the straight-line method to the declining- balance method to present more relevant information. The controller has prepared a schedule that shows what the depreciation expense would have been in previous periods if the declining-balance method had been used. Depreciation Expense under Depreciation Expense under Straight-Line Declining-Balance Difference 2017 $75,000 $150,000 $75,000 2018 75,000 112,500 37,500 2019 75,000 84,375 9,375 $225,000 $346,875 $121,875 6. In 2020, Concord discovered that in 2019 it had failed to record $20,000 as an expense for sales commissions. The sales commissions for 2019 were included in the 2020 expenses. concord corporation statement of income and retained earnings year end december 32, 2020 1308000 113000 3000000 sales revenue cost of goods sold gross profit selling and administrative expense loss on inventory due to decine in NRV total operating expense income before tax and discontinued operations income tax expense income before discontinued operation loss from operation of discontinued segment (net of tax) net income retained earning on Janurary, as reported less: decrease om prior year income due to eror in recording sales commusions (net of tax) ? retained earning on Janurary, as restated less: cash dividends retained earning, December 31 ? [] 9700000 6020000 3680000 1421000 2259000 903600 1355400 162000 1193400 ? 70000