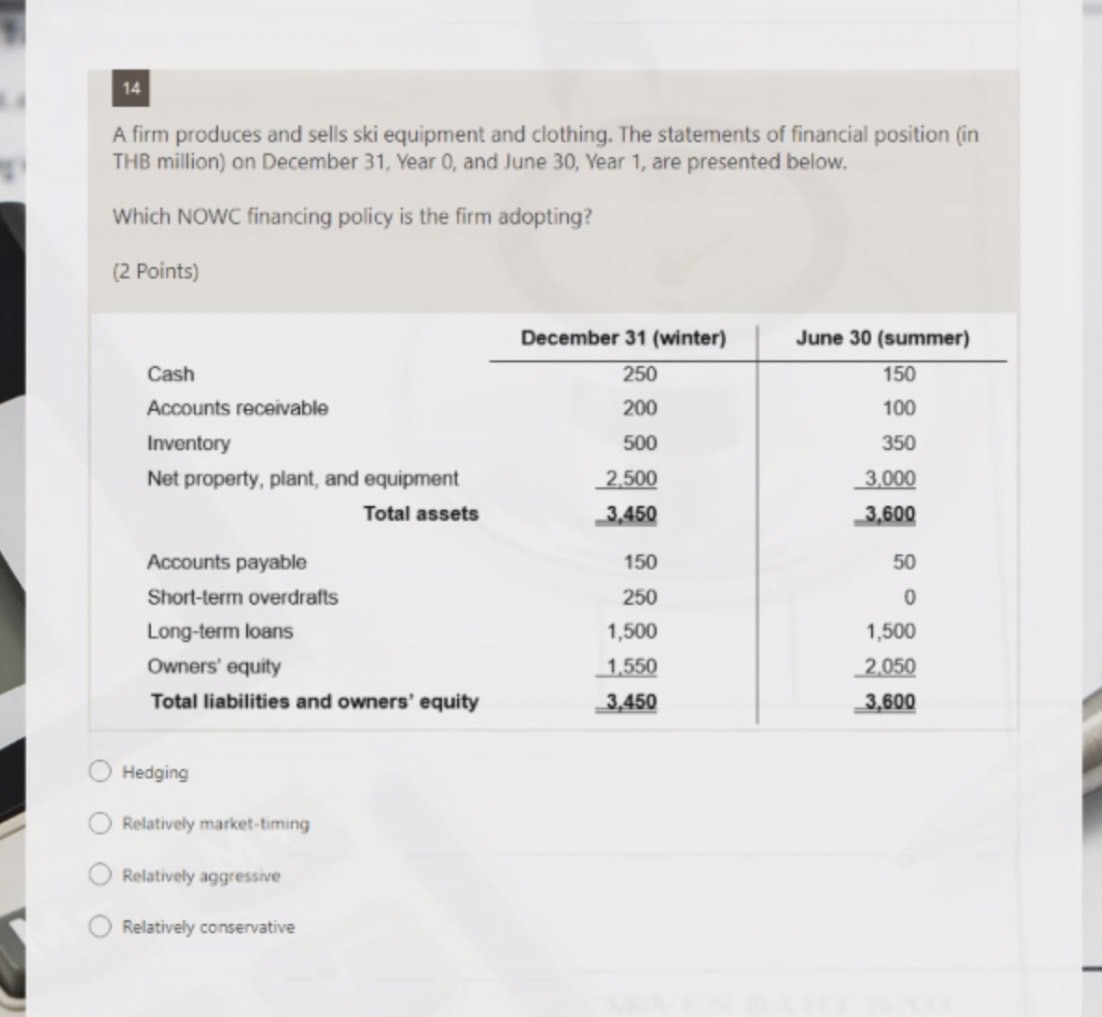

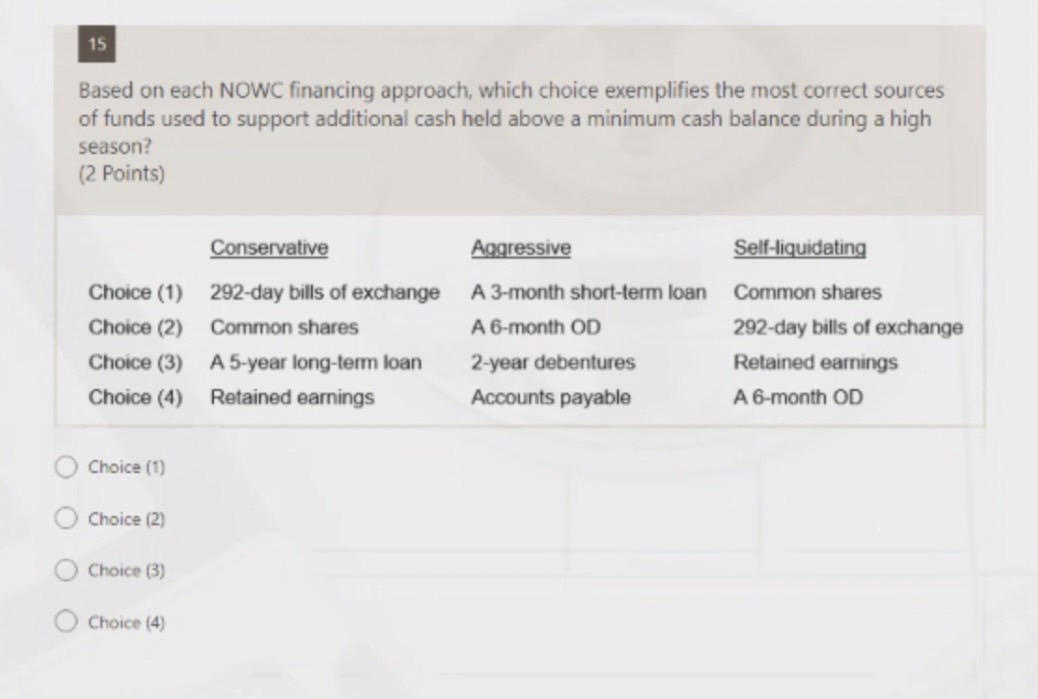

OO 14 A firm produces and sells ski equipment and clothing. The statements of financial position (in THB million) on December 31, Year 0, and June 30, Year 1, are presented below. Which NOWC financing policy is the firm adopting? (2 Points) December 31 (winter) June 30 (summer) Cash 250 150 Accounts receivable 200 100 Inventory 500 350 Net property, plant, and equipment 2,500 3,000 Total assets 3,450 3,600 Accounts payable 150 50 Short-term overdrafts 250 0 Long-term loans 1,500 1,500 Owners' equity 1,550 2,050 Total liabilities and owners' equity 3,450 3,600 Hedging Relatively market-timing Relatively aggressive Relatively conservative 15 Based on each NOWC financing approach, which choice exemplifies the most correct sources of funds used to support additional cash held above a minimum cash balance during a high season? (2 Points) Conservative Aggressive Self-liquidating A 3-month short-term loan Common shares 292-day bills of exchange Common shares A 6-month OD 2-year debentures A 5-year long-term loan Retained earnings Accounts payable Choice (1) Choice (2) Choice (3) Choice (4) Choice (1) Choice (2) Choice (3) Choice (4) 292-day bills of exchange Retained earnings A 6-month OD OO 14 A firm produces and sells ski equipment and clothing. The statements of financial position (in THB million) on December 31, Year 0, and June 30, Year 1, are presented below. Which NOWC financing policy is the firm adopting? (2 Points) December 31 (winter) June 30 (summer) Cash 250 150 Accounts receivable 200 100 Inventory 500 350 Net property, plant, and equipment 2,500 3,000 Total assets 3,450 3,600 Accounts payable 150 50 Short-term overdrafts 250 0 Long-term loans 1,500 1,500 Owners' equity 1,550 2,050 Total liabilities and owners' equity 3,450 3,600 Hedging Relatively market-timing Relatively aggressive Relatively conservative 15 Based on each NOWC financing approach, which choice exemplifies the most correct sources of funds used to support additional cash held above a minimum cash balance during a high season? (2 Points) Conservative Aggressive Self-liquidating A 3-month short-term loan Common shares 292-day bills of exchange Common shares A 6-month OD 2-year debentures A 5-year long-term loan Retained earnings Accounts payable Choice (1) Choice (2) Choice (3) Choice (4) Choice (1) Choice (2) Choice (3) Choice (4) 292-day bills of exchange Retained earnings A 6-month OD